Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

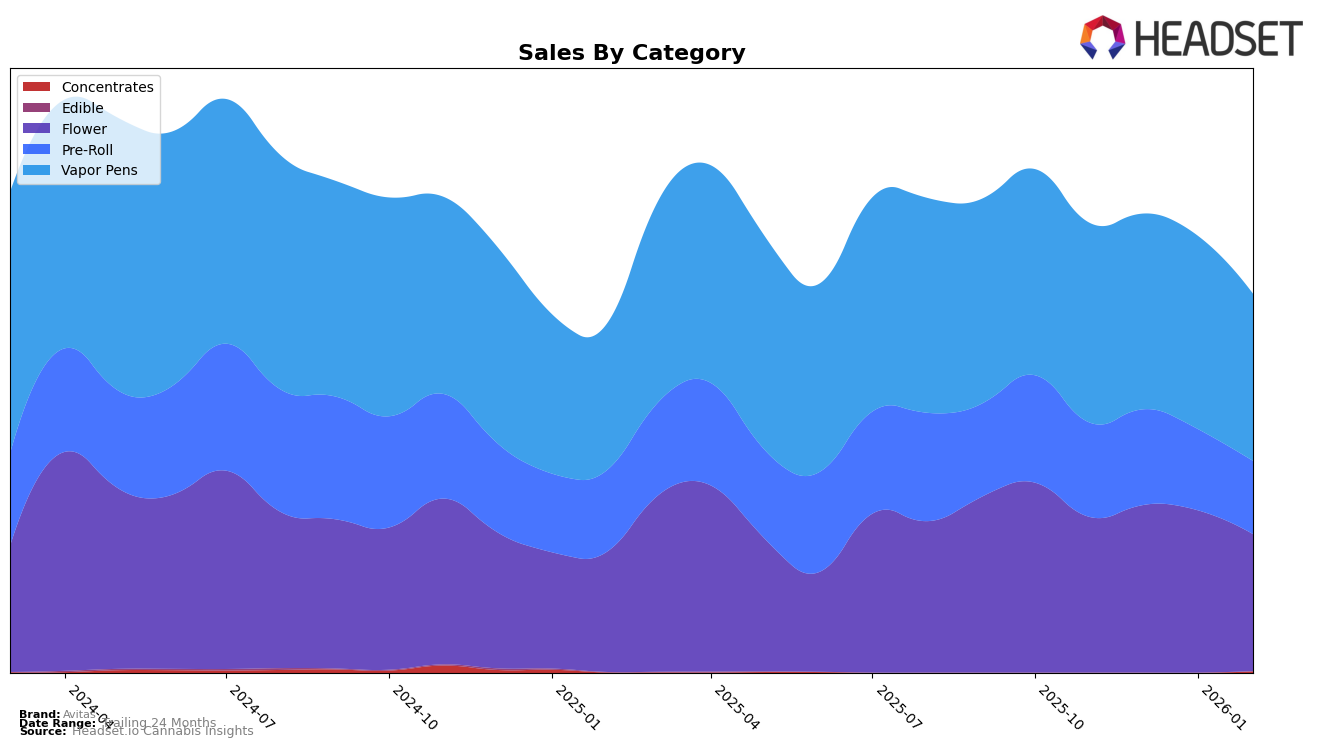

Avitas has shown varied performance across different categories and states, with notable movements in rankings and sales figures. In Oregon, the brand has experienced an upward trend in the Flower category, moving from 48th in November 2025 to 37th by February 2026. This positive momentum contrasts with their performance in the Pre-Roll category, where they slipped from 40th to 46th over the same period. Meanwhile, in the Vapor Pens category, Avitas maintained a relatively stable ranking, hovering around 30th position. This consistency in the Vapor Pens category might indicate a steady consumer base, despite the overall sales dip in February 2026.

In Washington, Avitas's performance in the Vapor Pens category has been less impressive. The brand ranked 77th in November 2025 and dropped to 83rd by February 2026, highlighting a challenging market position. This downward trend in rankings is accompanied by a decline in sales, suggesting a potential need for strategic adjustments to regain market share. The lack of presence in the top 30 across other categories in Washington could be seen as a significant opportunity for Avitas to explore and expand its footprint in the state. This varied performance across states and categories underscores the importance of targeted strategies to address market-specific challenges and opportunities.

Competitive Landscape

In the competitive landscape of vapor pens in Oregon, Avitas has maintained a relatively stable position, hovering around the 30th rank from November 2025 to February 2026. Despite a slight dip in sales in February 2026, Avitas has shown resilience in a competitive market. Notably, Orchid Essentials has been a significant competitor, consistently ranking close to Avitas and even surpassing it in February 2026, indicating a potential threat to Avitas's market share. Meanwhile, Eugreen Farms has demonstrated a positive trajectory, climbing from the 48th to the 34th rank, suggesting a growing presence that could challenge Avitas if the trend continues. Additionally, PRUF Cultivar made a notable entry into the top 20 in January 2026, indicating a strong market entry that Avitas should monitor closely. Lastly, Fire Dept. Cannabis has remained a consistent competitor, ranking just behind Avitas, which suggests that Avitas needs to strategize to maintain its edge in this dynamic and evolving market.

Notable Products

In February 2026, Rainbow Guava (7g) emerged as the top-performing product for Avitas, climbing from third place in January to secure the number one spot with sales of 942 units. Kimbo Kush (Bulk), although previously holding the top rank in January, slipped to second place. The Tropicalez Punch Juicy Stickz Infused Pre-Roll (0.75g) also saw a notable rise, moving up from fifth to third position. Grape Fritter (1g) made its debut in the rankings, securing fourth place, while Alien Mints (Bulk) entered the rankings at fifth. This shift in rankings indicates a dynamic change in consumer preferences, with Rainbow Guava (7g) gaining significant traction in the market.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.