Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

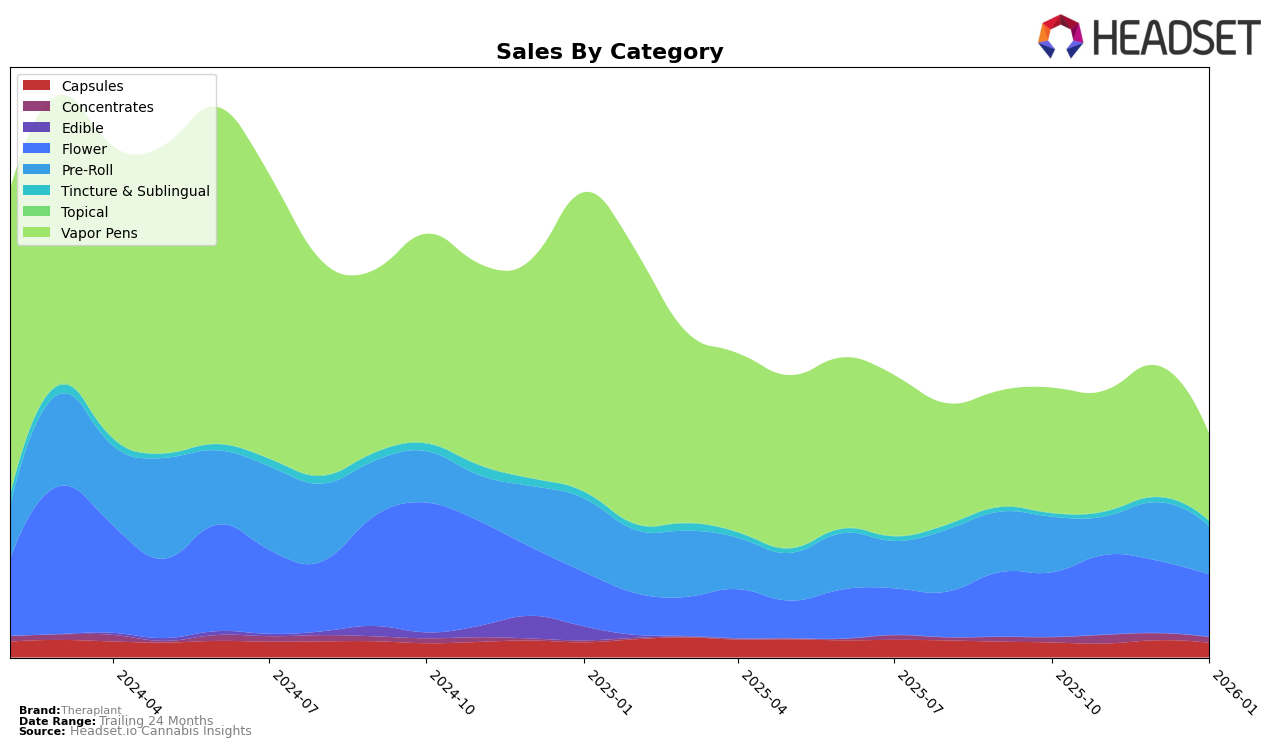

Theraplant has shown a strong and consistent performance in the Connecticut cannabis market, particularly in the Capsules and Vapor Pens categories, where it has maintained a steady first-place ranking from October 2025 to January 2026. This dominance is underscored by its robust sales figures, notably in the Vapor Pens category, where sales peaked in December 2025. However, the Concentrates category presents a more nuanced picture; while Theraplant reached the top spot in November 2025, it slipped to second place in December and maintained that position through January 2026. This shift indicates a competitive landscape in the Concentrates category, suggesting that while Theraplant is a strong player, it faces significant competition.

In the Flower category, Theraplant's performance has been relatively stable, consistently ranking within the top five brands in Connecticut. Despite fluctuations in sales, the brand managed to secure the third spot in November 2025, demonstrating its ability to capitalize on market opportunities. Conversely, the Pre-Roll category has seen Theraplant holding onto the second position consistently, suggesting a solid foothold but also highlighting potential areas for growth to capture the top rank. The absence of a top 30 ranking in the Concentrates category in October 2025, before quickly climbing to the first position in November, indicates a significant strategic shift or market entry that could be worth exploring further for stakeholders interested in Theraplant's market strategies and adaptability.

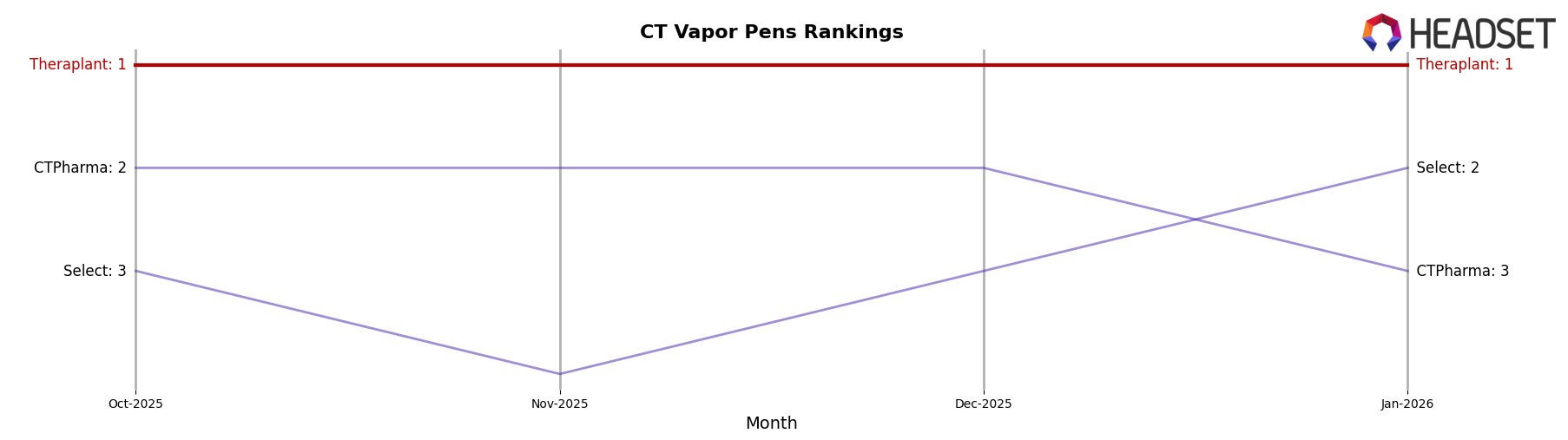

Competitive Landscape

In the Connecticut vapor pens category, Theraplant has consistently maintained its position as the top-ranked brand from October 2025 through January 2026. Despite a noticeable decline in sales from December 2025 to January 2026, Theraplant continues to outperform its competitors. CTPharma, which held the second position from October to December 2025, experienced a drop to the third position in January 2026, indicating a potential shift in consumer preference or market dynamics. Meanwhile, Select showed a positive trajectory, moving from the fourth position in November 2025 to the second position by January 2026, suggesting a growing competitive pressure on Theraplant. These changes highlight the dynamic nature of the Connecticut vapor pen market and underscore the importance for Theraplant to innovate and adapt to maintain its leading position.

Notable Products

In January 2026, the top-performing product for Theraplant was the LemonBerry Pure Co2 Cartridge (1g) in the Vapor Pens category, achieving the number one rank with sales of 2662 units. The Black Cherry Marker Pure Co2 Cartridge (1g) followed closely in second place, also within the Vapor Pens category. The Fat Boy - Black Cherry Marker Infused Pre-Roll (2g), categorized under Pre-Roll, secured the third rank, indicating a strong preference for infused pre-rolls. Wedding Cruiser Pure Co2 Cartridge (1g) and Black Ch GMO (7g) rounded out the top five, with the former in the Vapor Pens category and the latter in Flower. Notably, these products were not ranked in the previous months, suggesting a significant shift in consumer preference or a successful new product launch.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.