Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

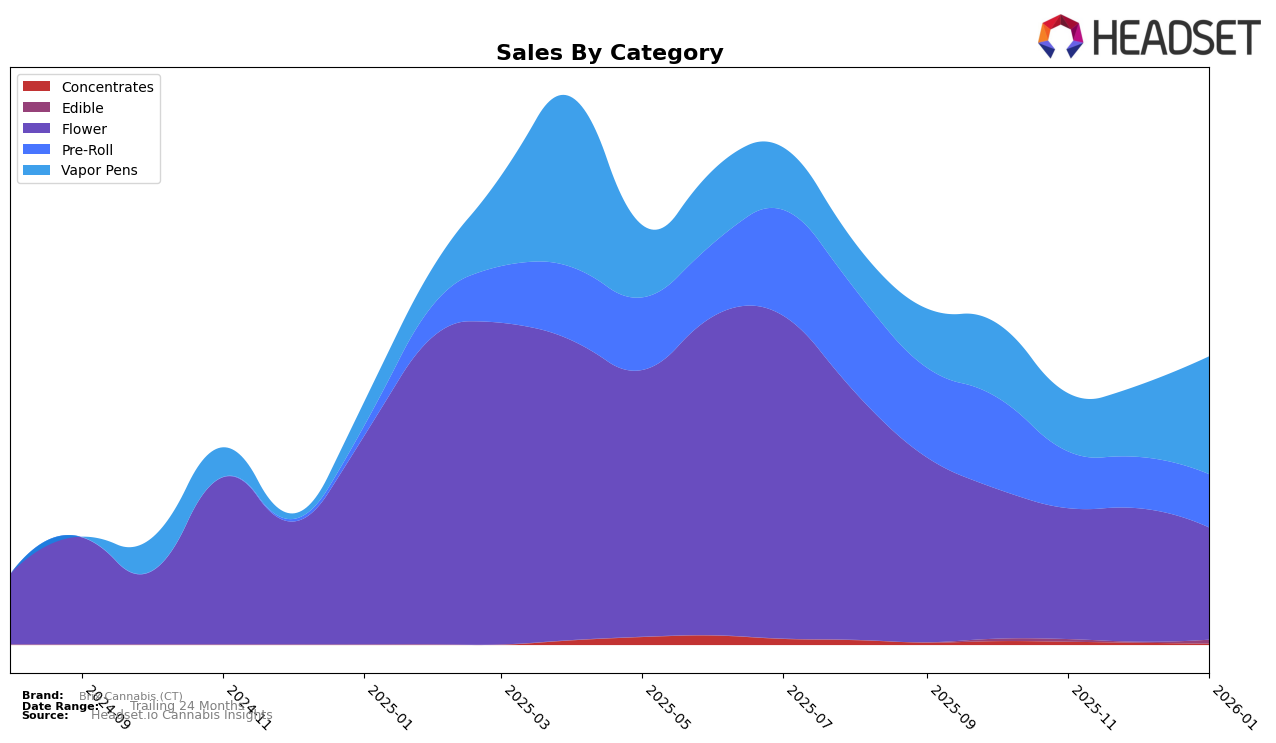

Brix Cannabis (CT) has shown a dynamic performance across different categories in Connecticut, with notable shifts in their rankings over recent months. In the Flower category, Brix Cannabis (CT) experienced a gradual decline, moving from the 7th position in October 2025 to the 10th position by January 2026. This downward trend could indicate increased competition or changing consumer preferences within the state. Meanwhile, in the Pre-Roll category, the brand initially dropped from 4th to 8th place in November 2025 but managed to climb back to 6th by January 2026, suggesting a potential recovery or strategic adjustments that resonated with the market.

The Vapor Pens category presents a contrasting narrative for Brix Cannabis (CT), where the brand displayed resilience and growth. Initially ranked 8th in October 2025, the brand briefly fell to 11th in November but quickly rebounded to 8th in December and further improved to 7th by January 2026. This positive trajectory is underscored by a significant increase in sales, particularly noticeable in January 2026. The fluctuations in rankings across these categories highlight Brix Cannabis (CT)'s ability to adapt and respond to market dynamics, although not consistently maintaining top positions across all categories. Such movements are crucial for stakeholders to monitor as they reflect the brand's competitive stance and operational strategies within Connecticut.

Competitive Landscape

In the competitive landscape of vapor pens in Connecticut, Brix Cannabis (CT) has experienced notable fluctuations in its market position from October 2025 to January 2026. Initially ranked 8th in October, Brix Cannabis (CT) saw a dip to 11th in November, before rebounding to 8th in December and climbing to 7th in January. This upward trend in the latter months indicates a recovery in sales performance, culminating in a significant increase by January. In contrast, competitors like Savvy and Rodeo Cannabis Co. maintained relatively stable rankings, with Savvy consistently in the top 10 and Rodeo Cannabis Co. improving to 6th by January. Meanwhile, Soundview showed variability, peaking at 8th in November but ending at 9th in January. Amigos (CT) consistently held the 5th position throughout this period, indicating strong market presence. These dynamics suggest that while Brix Cannabis (CT) is improving its competitive stance, it faces strong competition from established brands that have maintained or improved their rankings over the same period.

Notable Products

In January 2026, Purple Milk Pre-Roll (1g) emerged as the top-performing product for Brix Cannabis (CT), achieving the number one rank with sales of 2922 units. Jungle Cake (3.5g) maintained its second position from December 2025, showing consistent popularity. GG4 Pre-Roll (1g) secured the third spot, reflecting strong demand in the pre-roll category. Cap Junk (3.5g) improved its ranking from fifth in December to fourth in January, indicating a positive sales trend. Iced Out Live Resin Disposable (1g) entered the top five with notable sales, highlighting the growing interest in vapor pens.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.