Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

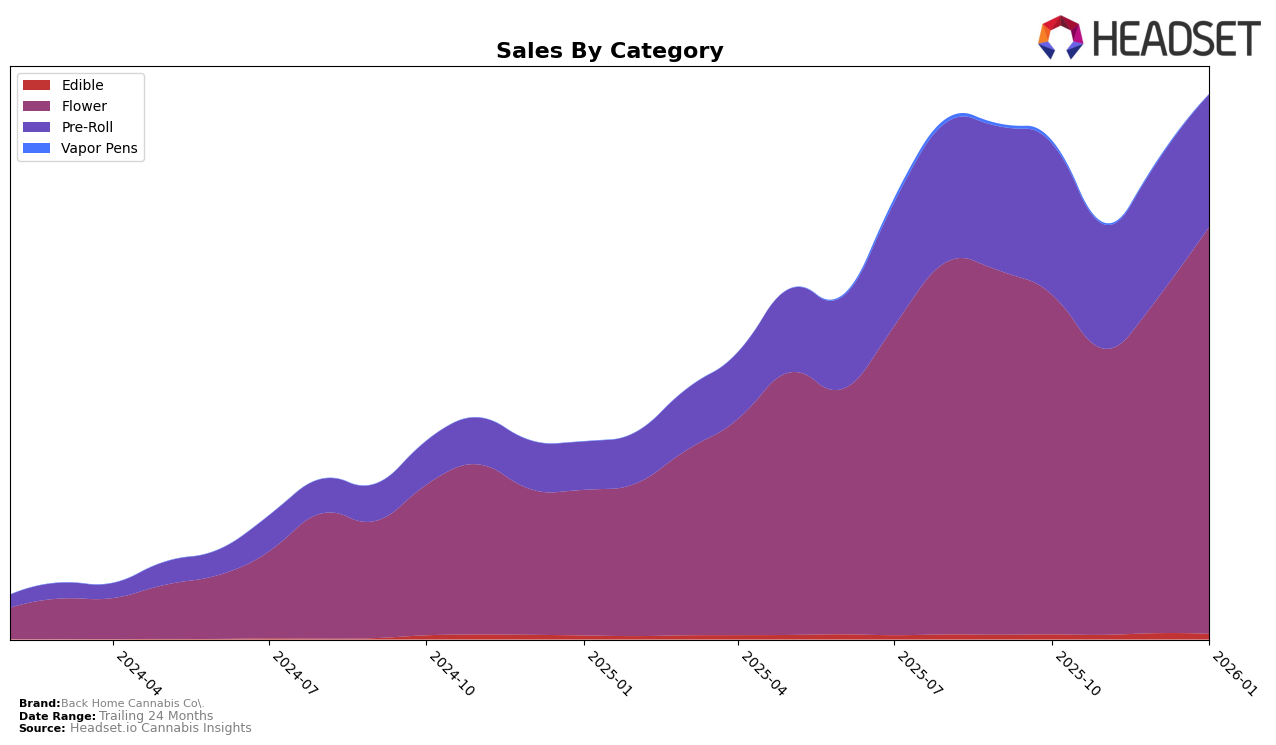

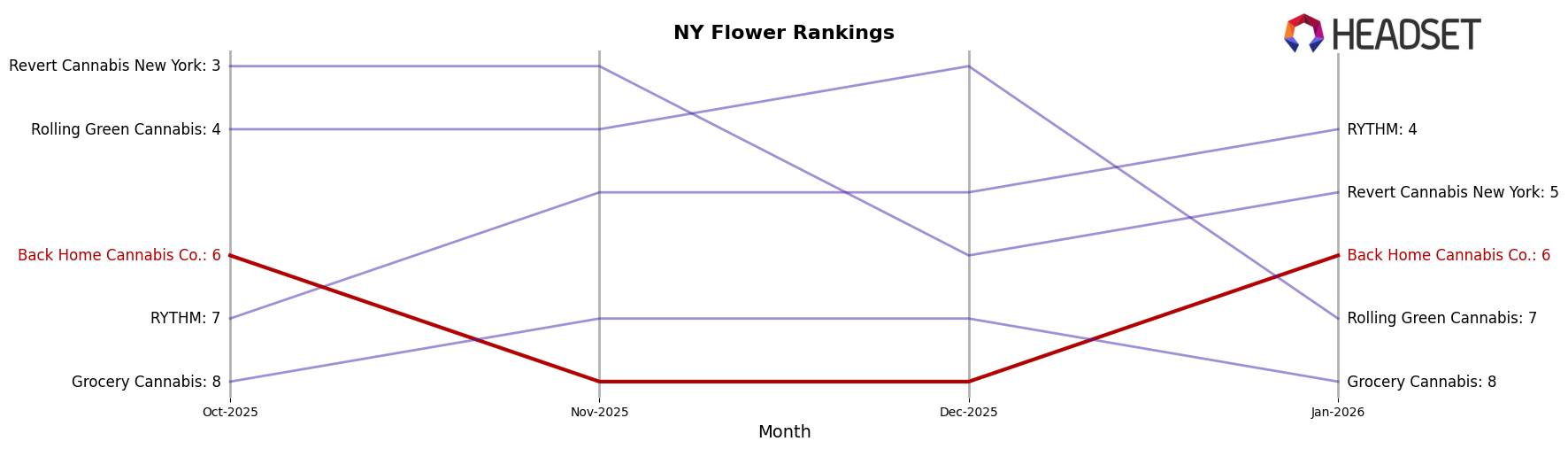

Back Home Cannabis Co. has demonstrated notable resilience and growth in the New York market, particularly within the Flower category. Over the four-month period from October 2025 to January 2026, the brand maintained a strong presence, consistently ranking within the top 10. Specifically, the Flower category saw a slight dip in rankings from 6th to 8th between October and November 2025, before regaining its 6th position by January 2026. This recovery coincided with a significant increase in sales, indicating effective strategies in place to boost market share during the competitive holiday season. The ability to rebound quickly in rankings suggests a strong brand loyalty and effective market penetration strategies.

In contrast, the Pre-Roll category for Back Home Cannabis Co. in New York experienced a more challenging period, with rankings fluctuating slightly more than in the Flower category. Starting at 9th in October 2025, the brand slipped to 11th by December 2025, before improving slightly to 10th in January 2026. Although the sales figures for Pre-Rolls did not show the same upward trajectory as Flower, the brand's ability to maintain a presence in the top 15 indicates a stable consumer base. The fluctuations in rankings suggest potential areas for improvement in competitive positioning or product offerings within this category, which could be pivotal for future growth. The absence from the top 30 in any other state or province highlights a potential area for expansion beyond their current stronghold in New York.

Competitive Landscape

In the competitive landscape of the New York flower category, Back Home Cannabis Co. has experienced notable fluctuations in its market position from October 2025 to January 2026. Initially ranked 6th in October, the brand saw a dip to 8th place in both November and December, before recovering to 6th in January. This recovery coincides with a significant increase in sales, suggesting a successful strategy adjustment. In contrast, RYTHM has shown a consistent upward trajectory, climbing from 7th to 4th place, potentially indicating a growing consumer preference for their products. Meanwhile, Revert Cannabis New York and Rolling Green Cannabis have experienced mixed results, with Revert dropping from 3rd to 5th and Rolling Green falling from 3rd to 7th by January. These shifts highlight a dynamic market where Back Home Cannabis Co.'s ability to regain its rank amidst strong competition could be a positive sign for its future performance.

Notable Products

In January 2026, Northern Lights (3.5g) reclaimed its top position as the best-selling product for Back Home Cannabis Co., with sales reaching 7303 units. Acapulco Gold (3.5g) dropped to the second position, despite maintaining strong sales figures throughout the previous months. Maui Wowie (3.5g) consistently held its third position from December 2025 to January 2026, indicating steady demand. White Widow (3.5g) improved its rank to fourth place, showing an increase in popularity compared to previous months. Notably, Super Lemon Haze (3.5g) emerged as a new entry in fifth place, highlighting a growing interest in this product.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.