Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

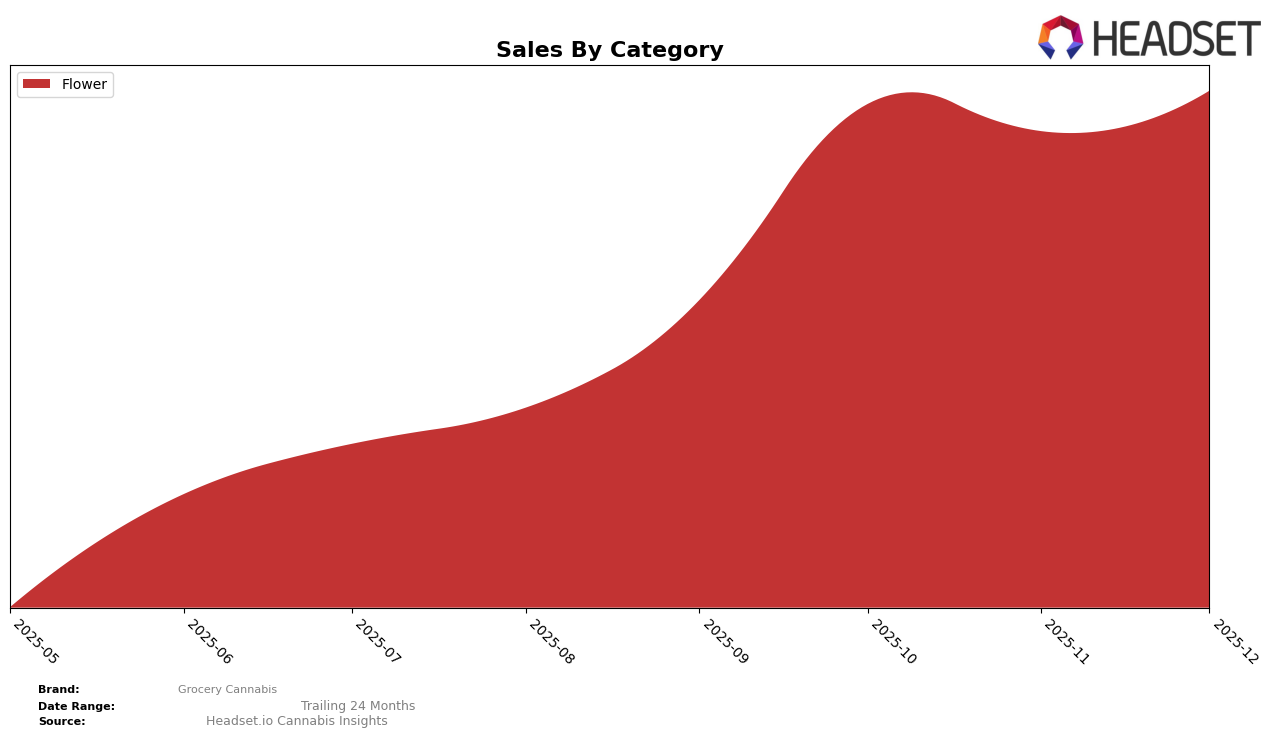

Grocery Cannabis has shown a notable upward trajectory in the New York market, particularly within the Flower category. Over the last few months of 2025, the brand has climbed from the 12th position in September to a steady 7th place by December. This advancement indicates a growing consumer preference and strong market penetration. Notably, the brand's sales in New York increased significantly from October to December, suggesting that their strategies in this state are resonating well with consumers. However, the absence of ranking data in other states or provinces could imply that Grocery Cannabis has yet to make a significant impact outside of New York, or they are focusing their efforts specifically within this market.

In terms of category performance, Grocery Cannabis's consistent ranking in the top 10 for Flower in New York suggests a solid foothold, but the lack of rankings in other categories raises questions about their diversification strategy. It is possible that the brand is concentrating on dominating the Flower category before expanding into others. This focused approach might be beneficial in strengthening their brand identity and consumer loyalty within a specific niche. However, the absence from the top 30 in other categories could also be seen as a missed opportunity for broader market capture. Observing how Grocery Cannabis evolves its category strategy in the upcoming months will be crucial for understanding its long-term growth potential.

Competitive Landscape

In the competitive landscape of the New York flower category, Grocery Cannabis has shown a steady improvement in its market position, climbing from 12th place in September 2025 to 7th place by November and maintaining this rank in December. This upward trend in rank is indicative of a positive sales trajectory, with December sales reaching a notable high. However, Grocery Cannabis faces stiff competition from brands like Find., which consistently held a top 5 position, and Revert Cannabis New York, which, despite a drop to 6th place in December, has maintained strong sales figures. Meanwhile, Back Home Cannabis Co. has seen fluctuations, dropping to 8th place in November and December, which may present an opportunity for Grocery Cannabis to further solidify its standing. The Botanist, another competitor, has shown a significant rise from 17th to 9th place over the same period, indicating a dynamic market environment where Grocery Cannabis must continue to innovate and adapt to maintain its competitive edge.

Notable Products

In December 2025, Grocery Cannabis saw Citrus Tartz 28g leading the sales as the top-performing product, maintaining its first rank with notable sales figures of 946 units. Gush Mintz 28g followed closely, securing the second position with strong performance. Space Candy 28g held the third rank, demonstrating consistent demand. Lemon Cherry Zaza 28g experienced a drop from its previous top position in November to fourth place in December, indicating a shift in consumer preference. Durban Poison 28g rounded out the top five, showing stable entry into the rankings, suggesting emerging popularity.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.