Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

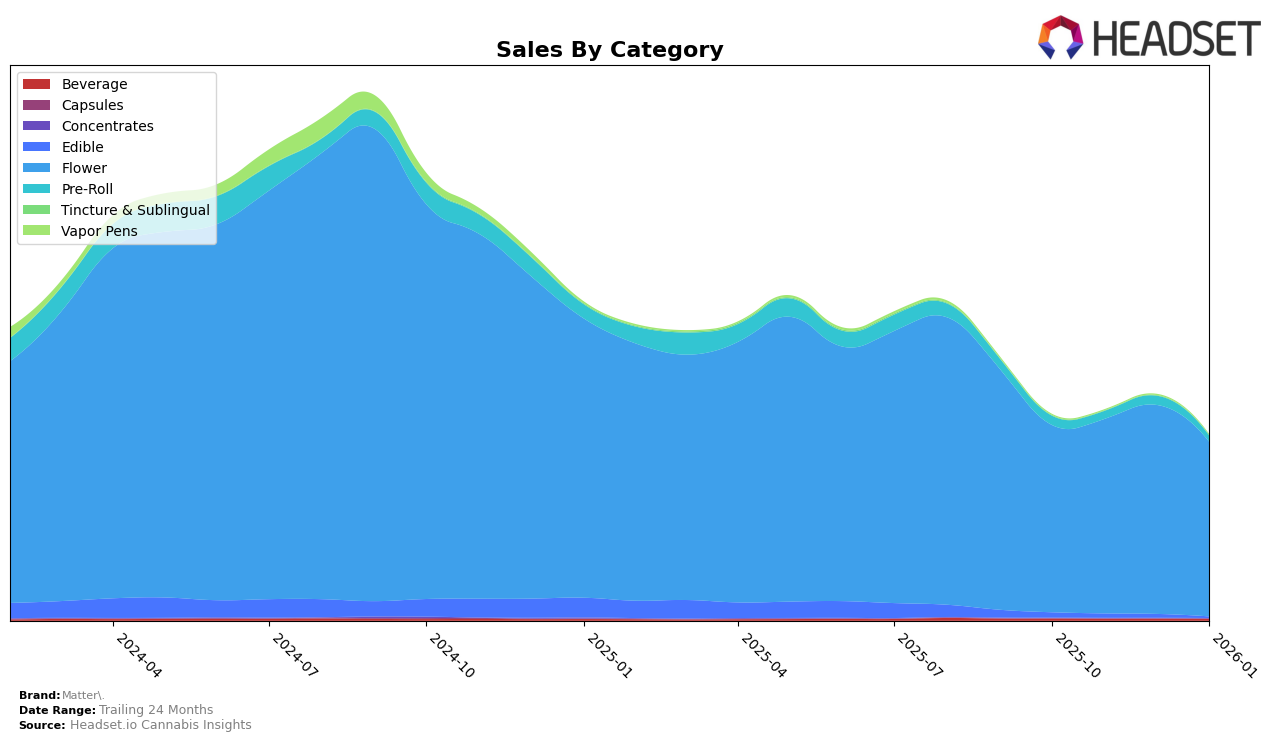

In the state of Illinois, Matter. has shown fluctuating performance in the Flower category. Starting at rank 60 in October 2025, the brand slightly improved its position to rank 57 by November, only to climb further to 51 by December. However, January 2026 saw a significant drop to rank 63, indicating a potential challenge in maintaining consistent growth. This volatility might suggest competitive pressures or shifting consumer preferences within the Illinois market. Despite these changes, the brand's sales figures demonstrate a notable peak in December, hinting at a strong holiday season performance before the subsequent decline.

In contrast, Maryland presents a more positive trend for Matter. in the Flower category. The brand improved its ranking from 38 in October 2025 to 28 by January 2026, reflecting a steady upward trajectory. This consistent improvement suggests successful market strategies or favorable consumer reception in Maryland. Meanwhile, in New York, Matter. has maintained a strong presence in the Flower category, consistently ranking within the top 15, though it slipped slightly from 10 to 14 by January 2026. The absence of Matter. in the top 30 for Edibles after October 2025 and the lack of ranking for Pre-Rolls in January might indicate areas where the brand could focus on strengthening its market share.

Competitive Landscape

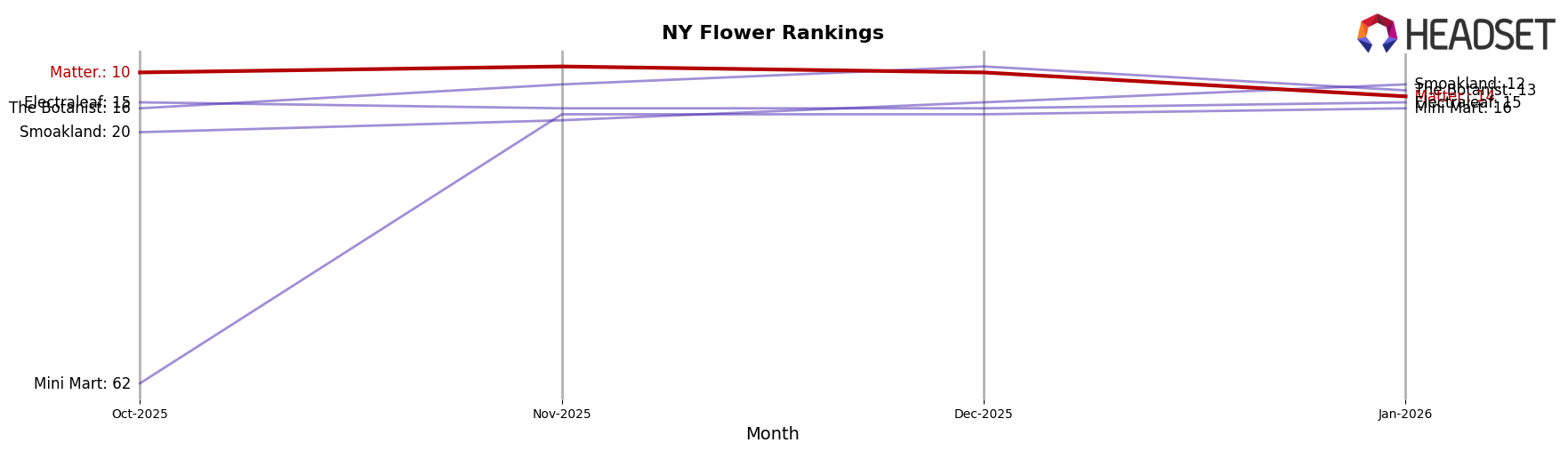

In the competitive landscape of the Flower category in New York, Matter. has experienced notable fluctuations in its market position from October 2025 to January 2026. Initially ranked 10th in October 2025, Matter. saw a slight improvement to 9th in November, but then slipped to 10th in December and further down to 14th by January 2026. This decline in rank is significant when compared to competitors such as The Botanist, which improved from 16th in October to 9th in December before dropping to 13th in January. Meanwhile, Smoakland showed a consistent upward trend, climbing from 20th to 12th over the same period. Despite Matter.'s higher sales figures compared to many competitors, the brand's ranking decline suggests increasing competition and potential challenges in maintaining market share. Brands like Mini Mart also demonstrated a significant leap from 62nd to 16th, indicating a dynamic and rapidly evolving market environment that Matter. must navigate strategically.

Notable Products

In January 2026, Scotties Cake (3.5g) emerged as the top-performing product for Matter., climbing from its previous rank of fourth place in December 2025 to first place, with sales reaching 1951 units. Grape Gas (3.5g) maintained a strong position, ranking second, although its sales decreased compared to December. Garlicane (3.5g) improved its standing to third place, despite a consistent decline in sales over the past months. Orange Cookies (3.5g) experienced a notable drop from the top spot in December to fourth in January. Additionally, Grape Gas (28g) entered the rankings at fifth place, showcasing its presence in the market.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.