Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

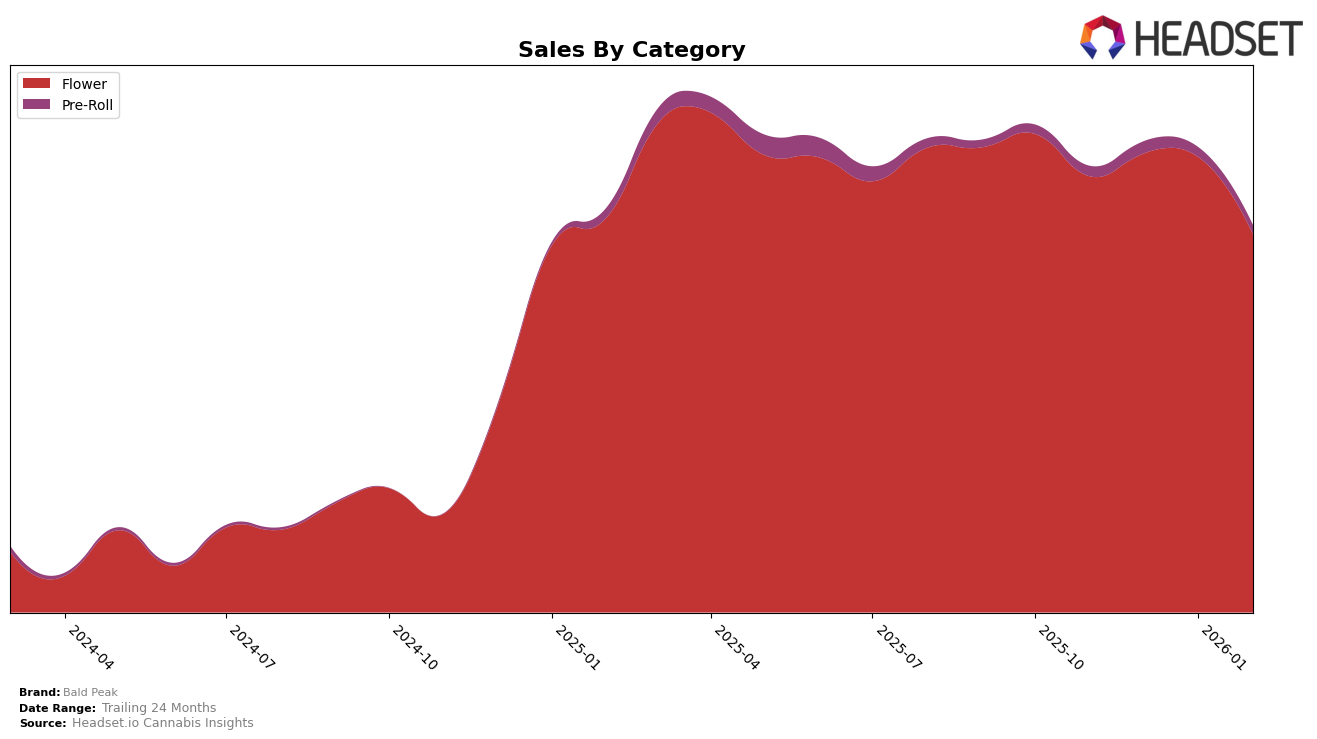

Bald Peak has shown a strong performance in the Flower category within the state of Oregon. For three consecutive months, from November 2025 to January 2026, the brand maintained a solid position at rank 2. However, in February 2026, there was a slight dip to rank 4. Despite this drop, the brand's sales figures in this category have been robust, with a noticeable peak in December 2025. This movement indicates a strong foothold in the Oregon Flower market, though the recent decline suggests potential challenges or increased competition in the category.

In contrast, Bald Peak's performance in the Pre-Roll category in Oregon has not been as impressive. The brand did not make it into the top 30 rankings for any of the months from November 2025 to February 2026, indicating a weaker presence in this category. While there was a slight improvement in sales from November to December 2025, the subsequent months saw a decline, suggesting that Bald Peak may need to strategize differently to capture a larger share of the Pre-Roll market. This disparity between the Flower and Pre-Roll categories highlights the brand's strengths and potential areas for growth within the cannabis market.

Competitive Landscape

In the competitive landscape of the Oregon flower category, Bald Peak has maintained a strong presence, consistently ranking in the top tier. Despite a slight dip from 2nd to 4th place in February 2026, Bald Peak's sales remain robust, indicating a resilient market position. This shift in rank is notable as competitors like Grown Rogue experienced a rise from 4th to 2nd place during the same period, suggesting a competitive push that Bald Peak must contend with. Meanwhile, Oregrown surged dramatically from 13th in November 2025 to 3rd by January 2026, maintaining this rank in February, which underscores a significant competitive threat. Otis Garden and Urban Canna have also shown fluctuations in rank, but neither has surpassed Bald Peak's sales figures, indicating that while the competition is fierce, Bald Peak's market share remains substantial. This dynamic environment highlights the importance for Bald Peak to innovate and strategize to reclaim its higher ranking and sustain its sales momentum.

Notable Products

In February 2026, the top-performing product for Bald Peak was Maui Melon Bubblegum (1g) in the Flower category, maintaining its first-place rank from January with sales of 1853 units. Hawaiian Durban Pie (1g) rose to the second position, showing a significant improvement from its absence in the January rankings. Birthday Cake (1g) emerged as the third-ranked product, marking its debut in the rankings for the year. Bruce Banner (1g) secured the fourth spot, while Mandarin Grape Gelato (1g) maintained its fifth position from January, despite a slight decline in sales. Overall, February showcased a mix of consistency and new entries in the top five, indicating dynamic shifts in consumer preferences.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.