Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

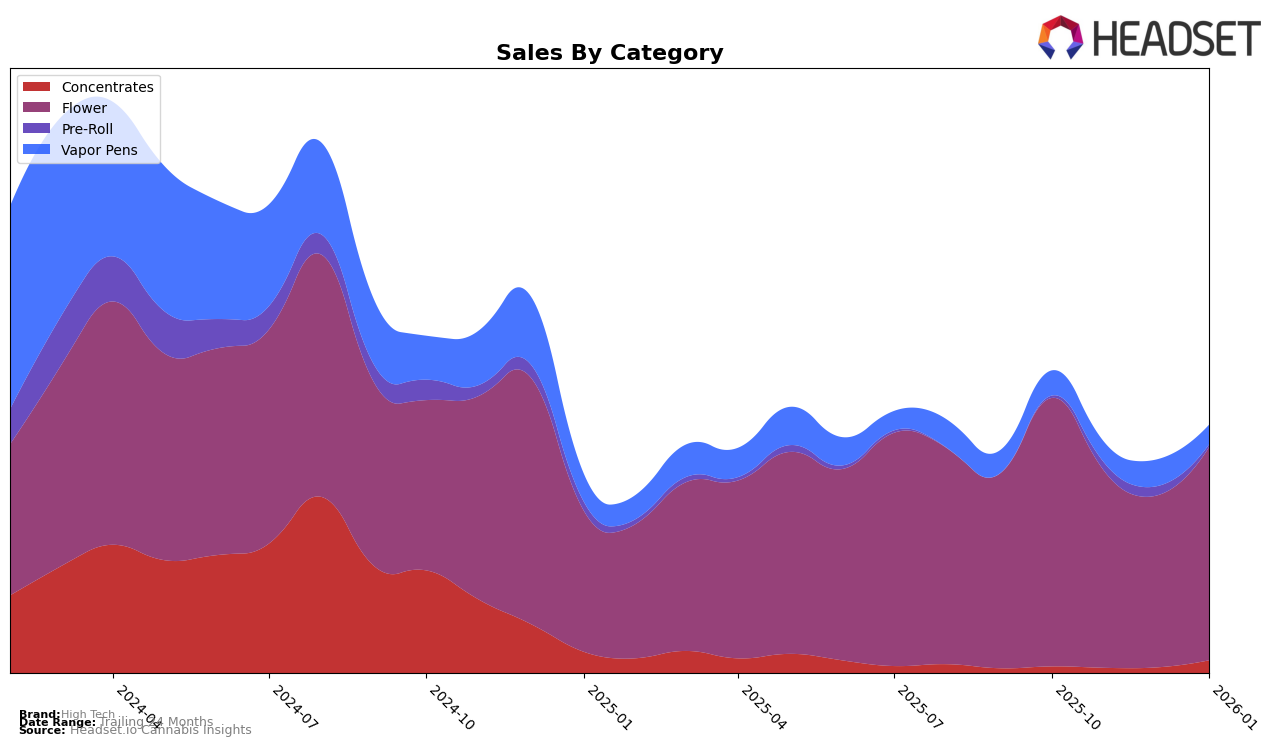

High Tech's performance in Oregon shows a varied trajectory across different product categories. In the Concentrates category, they have made significant progress, moving from a rank of 68 in December 2025 to 51 in January 2026, reflecting a notable improvement in their market position. However, their sales figures in this category reveal a fluctuating pattern, with a significant increase in January 2026 compared to previous months. In the Flower category, High Tech has maintained a relatively strong presence, consistently ranking within the top 10. Despite a dip in December, they rebounded to a rank of 7 in January, indicating resilience in this competitive segment.

In the Pre-Roll category, High Tech's absence from the top 30 in October 2025 suggests challenges in gaining a foothold in this segment. However, by November, they entered the rankings at 74 and improved to 67 by December, hinting at potential growth opportunities. The Vapor Pens category presents a mixed picture; while High Tech's ranking remained relatively stable, hovering around the 50s, sales figures did not show a consistent upward trend, with a drop observed in January 2026. This indicates potential challenges in sustaining consumer interest or competition pressures. The overall landscape for High Tech in Oregon is one of both promising growth in certain categories and areas needing strategic focus to improve market share.

Competitive Landscape

In the competitive landscape of the Oregon flower market, High Tech has experienced notable fluctuations in its ranking and sales performance over the past few months. Initially ranked 4th in October 2025, High Tech saw a decline to 9th place by December 2025, before recovering slightly to 7th in January 2026. This volatility is contrasted by the steady performance of Urban Canna, which maintained a top 5 position throughout the same period. Meanwhile, Meraki Gardens demonstrated a strong comeback, climbing from 10th in November 2025 to 3rd in December 2025, indicating a potential shift in consumer preferences. High Tech's sales mirrored its rank changes, with a significant drop from October to November, followed by a recovery in January, suggesting that while the brand remains competitive, it faces challenges from dynamic competitors like Otis Garden, which saw a remarkable rise to 4th place in November 2025. These insights highlight the need for High Tech to strategize effectively to regain and maintain its competitive edge in the Oregon flower market.

Notable Products

In January 2026, the top-performing product from High Tech was Chem Cookies (Bulk) in the Flower category, maintaining its number 1 rank from December 2025 with sales of 3511 units. Jokerz Candy (Bulk), another Flower product, secured the second position, marking its debut in the rankings. Queen of the South (3.5g) followed closely in third place, also making its first appearance in the top ranks. Sol Sonic (3.5g) took the fourth spot, rounding out the top new entries for the month. Vanilla Bean (3.5g) experienced a slight drop, moving from second place in November 2025 to fifth in January 2026, indicating a shift in consumer preferences or competition within the Flower category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.