Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

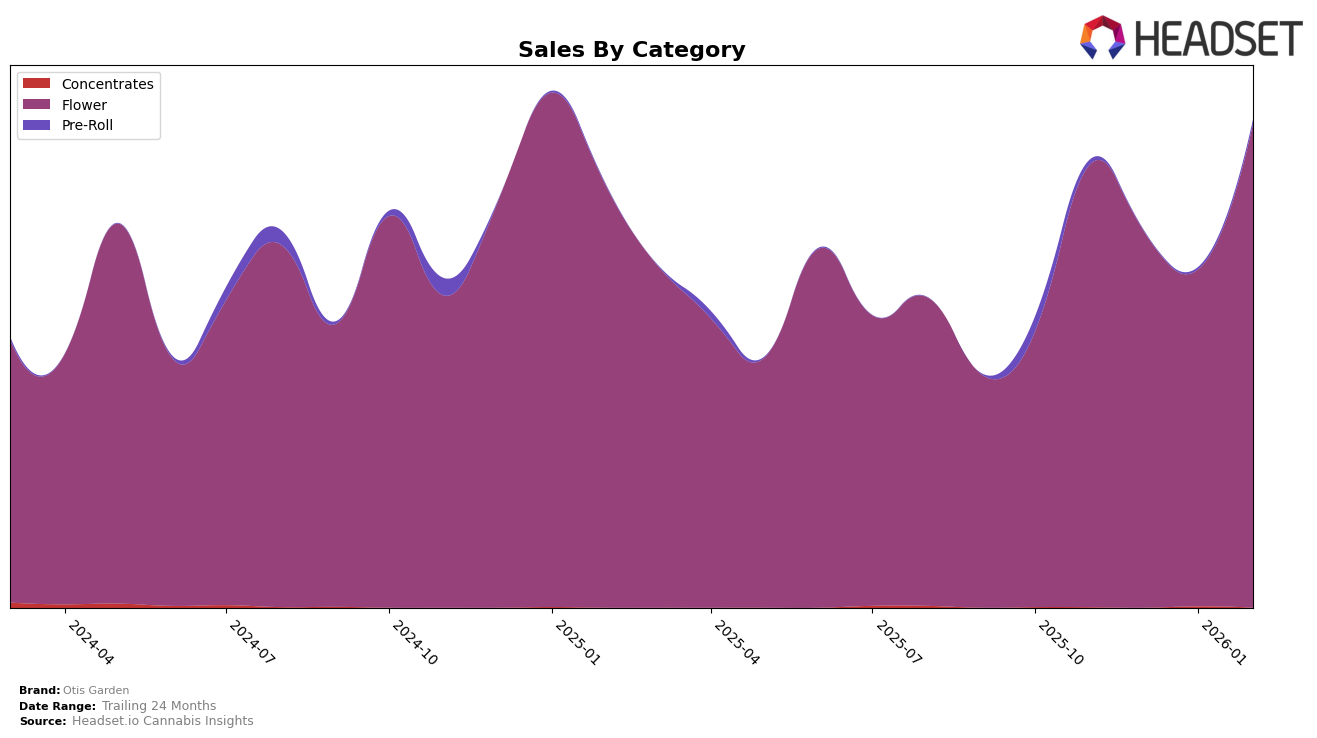

Otis Garden has shown a fluctuating performance in the Oregon market, particularly in the Flower category. In November 2025, they held a strong position at rank 4, but experienced a slight decline to rank 5 in December and further to rank 8 in January 2026. However, they made a notable recovery by February 2026, climbing back to the 5th position. This pattern indicates a resilience in their market strategy, as they managed to bounce back after a dip. The Flower category appears to be quite competitive in Oregon, and maintaining a top 10 position is indicative of Otis Garden's solid market presence.

It's important to note that Otis Garden's absence from the top 30 in any additional states or categories suggests areas where the brand could potentially expand or strengthen its market share. The sales figures from November 2025 to February 2026 reflect some variability, with a notable increase in February, suggesting effective promotional strategies or market conditions favoring their product during that period. While the specifics of their performance in other states or categories are not detailed here, such data could provide further insights into their overall market strategy and areas for potential growth.

Competitive Landscape

In the competitive landscape of the Oregon flower market, Otis Garden has experienced notable fluctuations in its rank and sales performance over the past few months. While Otis Garden started strong in November 2025, holding the 4th position, it saw a decline to 8th place by January 2026, before recovering slightly to 5th in February 2026. This fluctuation is significant when compared to competitors like Oregrown, which made a remarkable leap from 12th to 3rd place between December 2025 and January 2026, and Urban Canna, which maintained a more stable ranking, hovering around 4th to 6th place during the same period. Meanwhile, Bald Peak consistently outperformed Otis Garden, maintaining a top 4 position and even securing the 2nd spot for several months. These dynamics suggest that while Otis Garden remains a strong player, it faces stiff competition from brands that are either gaining momentum or maintaining consistent sales, indicating the need for strategic adjustments to regain and sustain higher rankings in the market.

Notable Products

In February 2026, Cap'n Jack (Bulk) maintained its top position from January, leading the sales for Otis Garden with an impressive figure of 4,342 units sold. Ocean Air (Bulk) made a notable entry at the second position, while Velvet Montage (3.5g) secured the third spot. Coconut Cloud (Bulk) followed closely at fourth, demonstrating strong performance in the Flower category. Blueberry Muffins (1g), previously ranked first in November 2025, slipped to fifth place in February 2026, indicating a shift in consumer preference. The rankings highlight a dynamic movement within the product lineup, with Cap'n Jack (Bulk) consistently outperforming others over the recent months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.