Apr-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

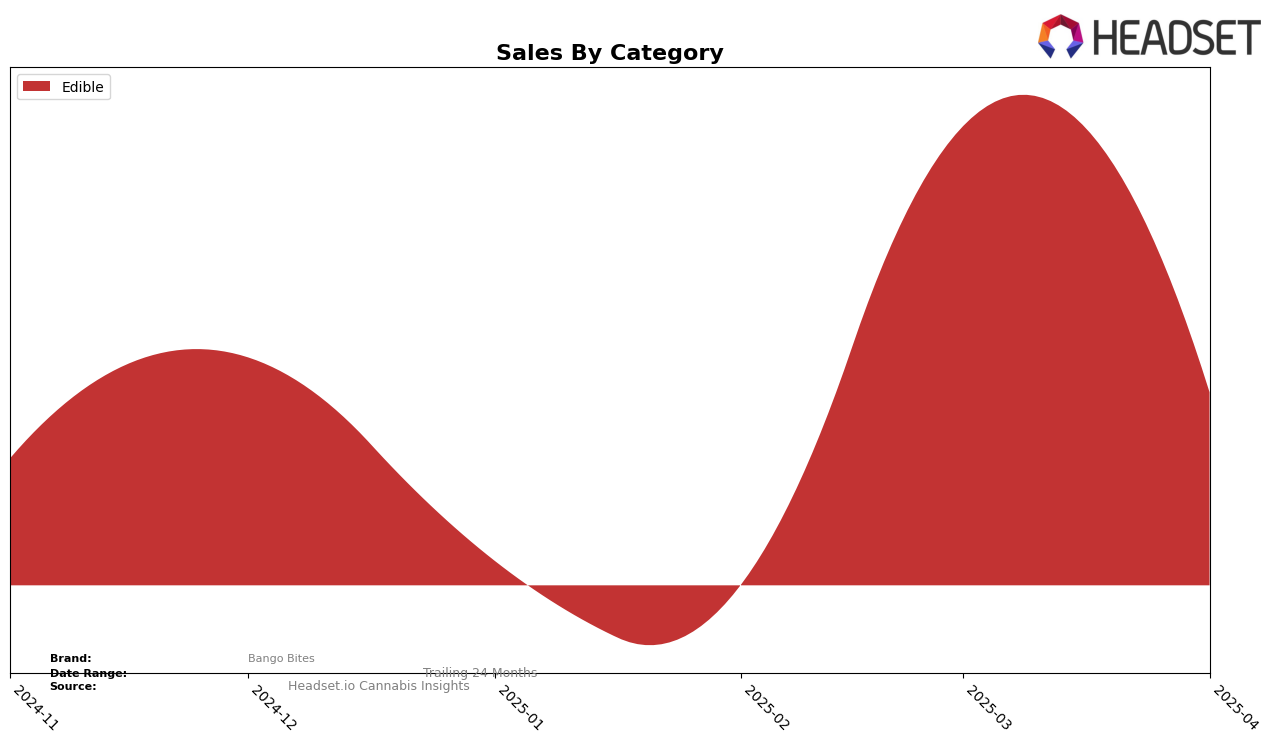

Bango Bites has shown some interesting movements in the edible category, particularly in New Jersey. Although the brand started the year outside the top 30, ranking 34th in both January and February, it made a notable leap to the 28th position in March. This improvement suggests a successful strategy or product launch that resonated with consumers during that period. However, in April, Bango Bites experienced a slight drop to the 29th position, indicating a need to maintain momentum to stay competitive in the market. The brand's sales figures reflect these ranking changes, with March seeing a significant spike in sales, more than doubling from the previous month. This fluctuation highlights the competitive nature of the edible market in New Jersey.

Across other states and categories, Bango Bites' presence appears limited, as they did not break into the top 30 in any other markets or categories during the same period. This absence from the top tier in other regions could indicate either a focused strategy on New Jersey or challenges in expanding their market reach. The brand's performance in the edible category in New Jersey suggests potential for growth if similar strategies are applied elsewhere. However, the data also points to the importance of consistency and adaptation to maintain and improve their market position, as evidenced by the slight ranking decline in April. The insights from New Jersey could serve as a valuable learning point for Bango Bites as they consider broader market expansion.

Competitive Landscape

In the competitive landscape of the edible cannabis market in New Jersey, Bango Bites has shown a dynamic performance over the first four months of 2025. Starting the year at rank 34, Bango Bites saw an improvement in March, climbing to rank 28, before slightly declining to rank 29 in April. This fluctuation in rank is notable when compared to competitors like HAZE, which consistently hovered around the lower 20s but never broke into the top 20, and Zoobies, which maintained a relatively stable position in the high 20s to low 30s. Meanwhile, ButACake showed a steady climb, reaching rank 27 by April, potentially posing a challenge to Bango Bites' market share. Despite these shifts, Bango Bites' sales performance in March was particularly strong, surpassing competitors like Zoobies and Full Tilt Labs, indicating potential for future growth if the brand can maintain its upward trajectory in sales.

Notable Products

In April 2025, Watermelon Sugar Gummies 10-Pack (100mg) from Bango Bites maintained its position as the top-performing product, leading the sales chart in the Edible category with notable sales of 1427 units. Bango Mango Gummies 10-Pack (100mg) followed closely, securing the second spot, showing a slight decrease in sales compared to March. Strawberry Fields Gummies 10-Pack (100mg) dropped to third place, experiencing a significant decline from its previous second place in March. This shift in rankings highlights Watermelon Sugar Gummies' consistent performance over the months, while Bango Mango Gummies and Strawberry Fields Gummies have seen fluctuations. Overall, the top three products have demonstrated strong sales figures, with Watermelon Sugar Gummies consistently outperforming its peers.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.