Apr-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

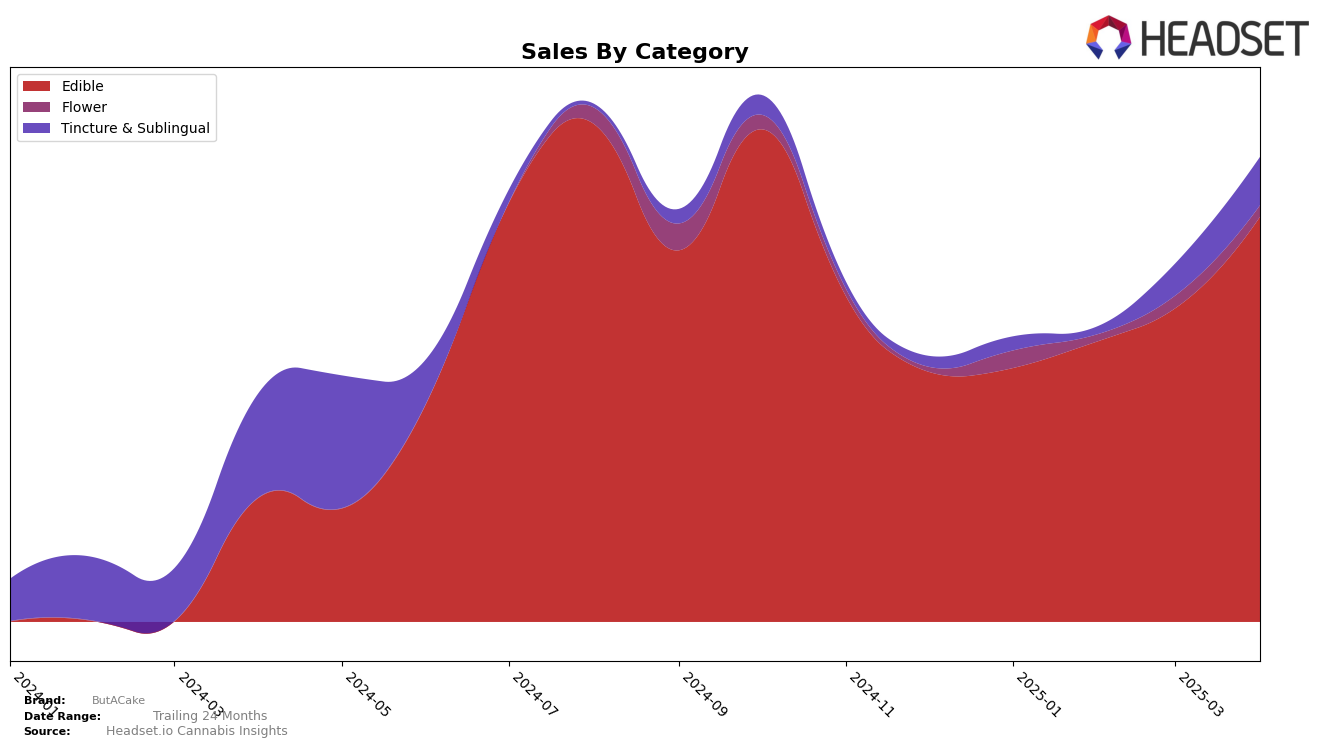

ButACake has shown a promising upward trajectory in the Edible category in New Jersey. Starting from January 2025, the brand was ranked just outside the top 30, at position 31. By April, they managed to climb to the 27th position, indicating a positive reception and increasing market penetration in the state. This climb is noteworthy given the competitive nature of the cannabis edibles market. The brand's sales figures in New Jersey have also reflected this upward movement, with a significant increase from $41,616 in January to $66,426 by April, showcasing a robust growth trend.

While ButACake's performance in New Jersey is commendable, the brand's absence from the top 30 rankings in other states or provinces suggests there is still considerable room for expansion and growth. The lack of presence in these markets could be seen as a potential area for strategic development. It will be interesting to observe whether ButACake can replicate its New Jersey success in other regions, or if its focus will remain concentrated in this particular state. The brand's ability to adapt and penetrate other markets could be pivotal for its overall growth strategy in the coming months.

Competitive Landscape

In the competitive landscape of the edible cannabis category in New Jersey, ButACake has shown a promising upward trend in its rankings from January to April 2025. Starting at rank 31 in January, ButACake improved to rank 27 by April, indicating a positive trajectory in market presence. This improvement is notable when compared to competitors such as HAZE, which fluctuated between ranks 22 and 36, and Bango Bites, which showed less consistency in its rankings. Meanwhile, The Growfather and ONYX (NJ) maintained relatively stable positions, with The Growfather slightly improving from rank 37 to 26. ButACake's sales growth trajectory, particularly the significant increase in April, suggests a strengthening brand appeal and market strategy, potentially positioning it to challenge higher-ranked competitors in the coming months.

Notable Products

In April 2025, Classic Brownie (10mg) maintained its top position from the previous month, leading ButACake's sales with a notable figure of 2916 units sold. Oatmeal Raisin Cookie (10mg) climbed to the second spot, showing a consistent upward trend from the fourth position in February and March. PBNJ Brownie (10mg) held steady in third place, while Choco Chunk Cookie (10mg) experienced a decline, dropping to fourth place despite its previous dominance in January and February. Blue Blizzard Mint Strip 2-Pack (20mg) remained in fifth position, showing steady growth since its introduction in March. Overall, Edibles continue to dominate ButACake's product lineup, with Classic Brownie leading the charge.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.