Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

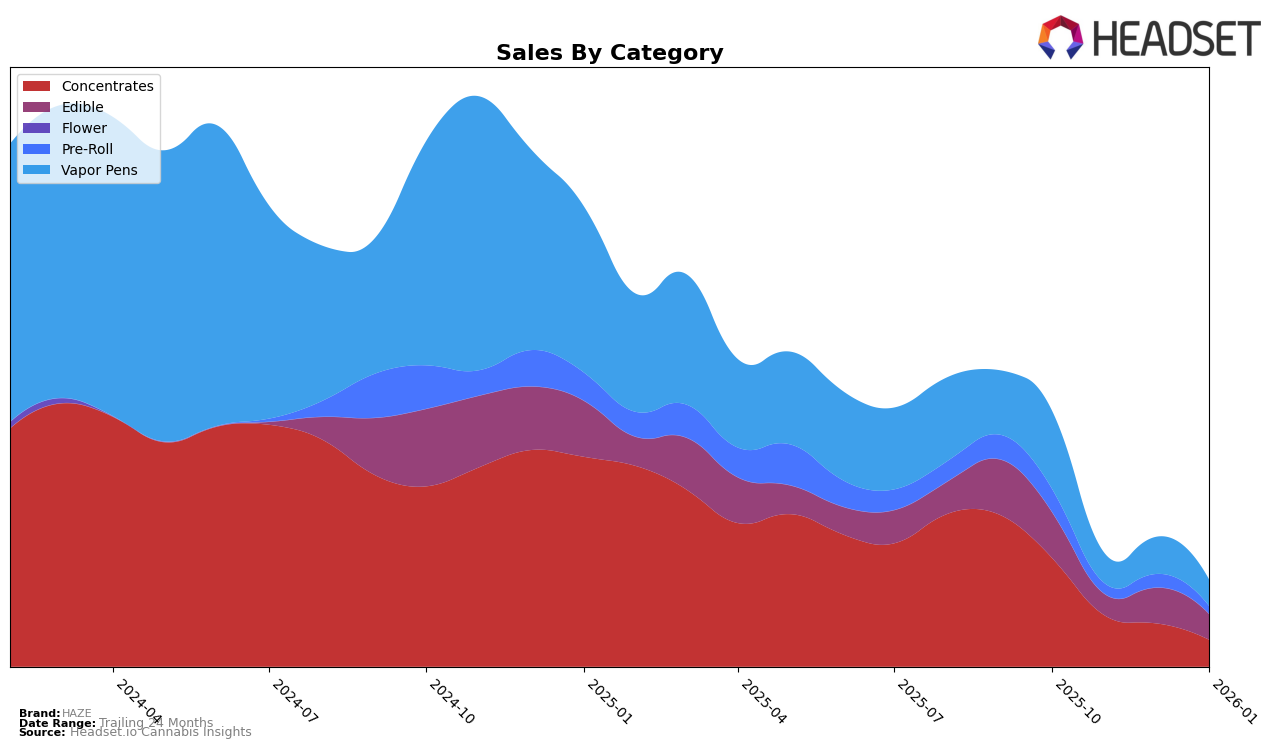

HAZE's performance in the Massachusetts market has shown a notable decline, particularly in the Concentrates category. Starting from an 11th place ranking in October 2025, HAZE saw a drop to 28th by November, and further slipped out of the top 30 by December, ending January 2026 at 49th. This downward trajectory is mirrored by a stark decrease in sales, which plummeted from October's figures. In the Edible category, HAZE never managed to break into the top 30, with rankings consistently outside this range, indicating a challenging competitive landscape in Massachusetts.

In contrast, HAZE's performance in New Jersey presents a more mixed picture. The brand maintained a consistent presence in the top 30 for Concentrates, although it did experience a slight decline from 18th to 29th over the observed months. While the Edible category saw fluctuating rankings, HAZE managed to stay within the top 60, showing resilience despite the competitive pressures. Notably, their Vapor Pens category did not manage to break into the top 30, indicating potential areas for strategic improvement. The Pre-Roll category, although not in the top 30, showed some movement, suggesting there might be niche opportunities within this segment.

Competitive Landscape

In the competitive landscape of vapor pens in New Jersey, HAZE has experienced a notable decline in rank from October 2025 to January 2026, dropping from 36th to 67th. This shift is significant as it indicates a decrease in market presence, potentially impacting sales momentum. During the same period, competitors like Rosin King of Jersey maintained a stronger position, consistently ranking in the mid-50s, which suggests a more stable market performance. Additionally, GRUV showed resilience by improving its rank from 66th in October to 60th by January, coupled with a steady increase in sales. Meanwhile, On The Rocks and New Earth remained outside the top 60, indicating that HAZE still holds a competitive edge over these brands despite its recent challenges. These dynamics highlight the importance for HAZE to strategize effectively to regain its footing in the New Jersey vapor pen market.

Notable Products

In January 2026, Haze's top-performing product was the Haze x Mudd Brother - Mandarin Dreamz Live Resin Gummies 10-Pack, which claimed the number one spot in the rankings. Tangie Twist Live Resin Gummies followed closely in second place, showing a strong debut. The Haze x Mudd Bros - Black Razz Live Resin Gummies, which had previously held first place in November and December 2025, slipped to third place. Raspberry Lime Live Resin Gummies, consistently ranked second in the previous months, dropped to fourth place. Notably, sales for the Haze x Mudd Brother - Mandarin Dreamz Live Resin Gummies reached 217 units, highlighting its popularity surge.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.