Dec-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

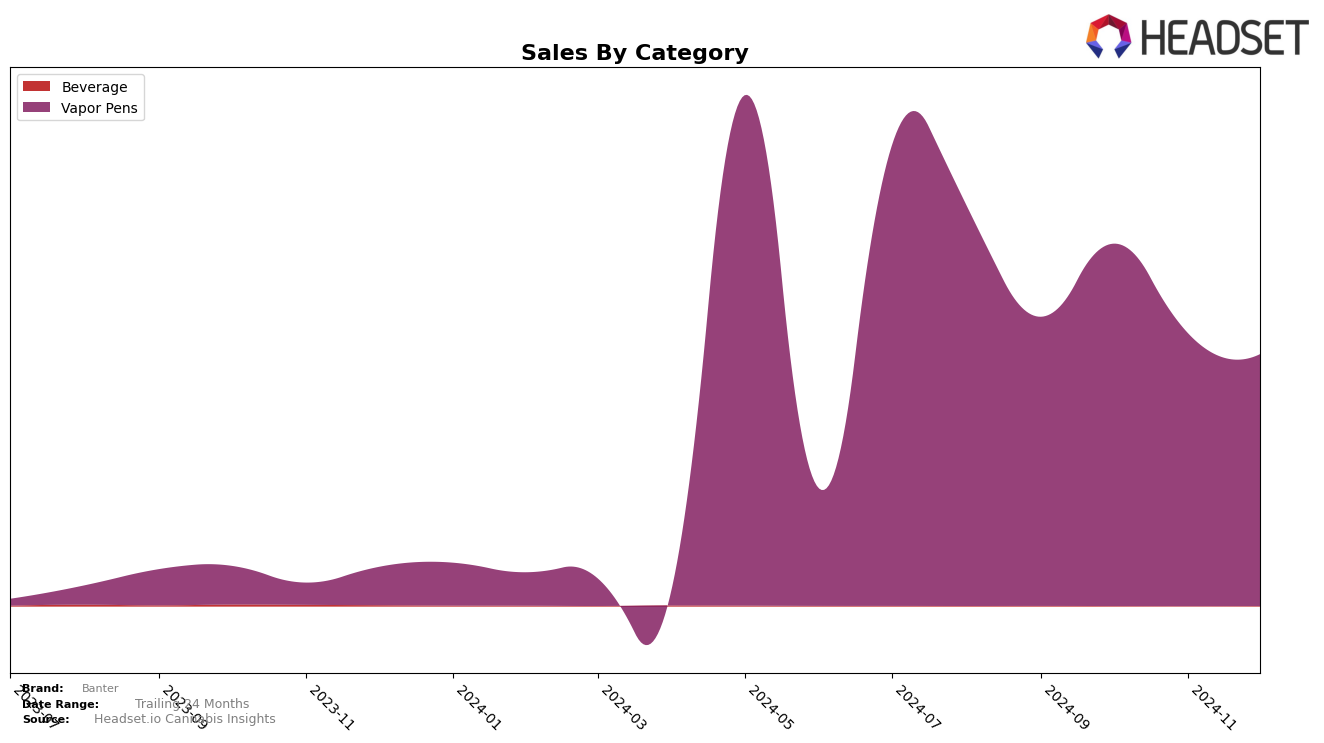

In the Alberta market, Banter has shown a consistent presence in the Vapor Pens category, maintaining its position within the top 30 brands throughout the last quarter of 2024. Starting at rank 27 in September, Banter climbed to 24 in October before gradually descending to 29 and 30 in the following months. This trajectory suggests a fluctuating yet stable performance in the region, with sales peaking in October at approximately $192,460. The brand's ability to stay within the top 30 indicates a resilient market presence despite the downward trend in sales towards the end of the year.

In contrast, Banter's performance in Ontario highlights a different challenge. The brand did not make it into the top 30 in September and continued to lag behind, with rankings of 65, 73, and 71 from October to December. This suggests that Banter is struggling to establish a strong foothold in Ontario's competitive Vapor Pens market. Meanwhile, in Saskatchewan, Banter saw a dramatic drop from rank 20 in September to 37 in October, after which it did not appear in the top 30 rankings. Such a decline could point to increased competition or shifting consumer preferences in the province. These variations across regions underscore the importance of localized strategies to maintain and improve Banter's market position.

Competitive Landscape

In the competitive landscape of vapor pens in Alberta, Banter has shown a dynamic performance with notable fluctuations in its rank and sales. Over the months from September to December 2024, Banter's rank improved from 27th to 24th in October, before experiencing a slight decline to 30th by December. This indicates a competitive market where Banter is striving to maintain its position. In comparison, brands like Foray and Versus have shown a more stable presence, with Foray consistently ranking higher than Banter, although it also saw a decline in sales towards the end of the year. Meanwhile, Glacial Gold and Throwbacks have experienced similar rank volatility, with Throwbacks surpassing Banter in November. Despite these challenges, Banter's sales peaked in October, suggesting a potential for growth if the brand can capitalize on its market presence and consumer interest during peak periods.

Notable Products

In December 2024, Raspberry Rush Liquid Diamonds Cartridge (1g) maintained its top position among Banter's products, despite a decline in sales to 1955 units. Watermelon Wave Liquid Diamonds Cartridge (1g) held steady at the second rank, following its previous month's performance. Blueberry Blast Liquid Diamonds Disposable (1g) consistently ranked third over the last three months. Blueberry Blast Liquid Diamonds Cartridge (1g) remained in fourth place, showing stable performance since October. Raspberry Ice Distillate Cartridge (1g) reappeared in the rankings at fifth place, although its sales figures have decreased significantly compared to earlier months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.