Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

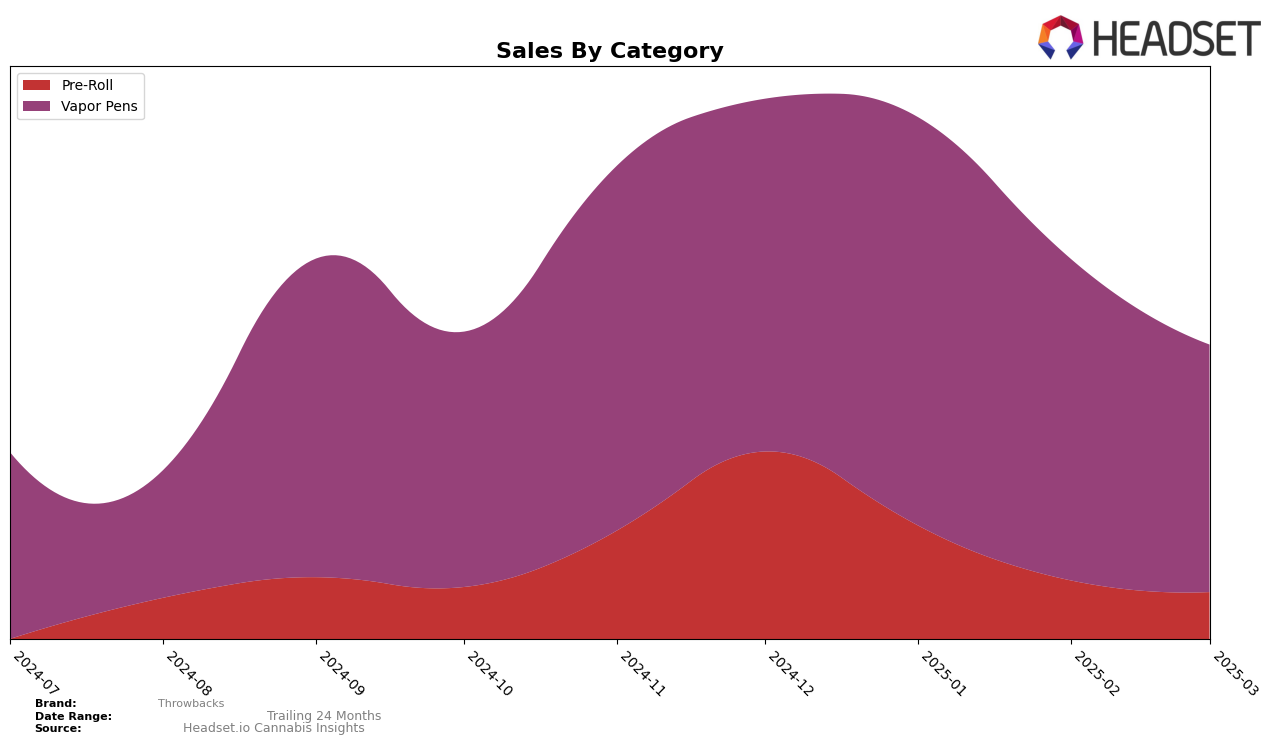

Throwbacks has shown a varied performance across different categories and regions. In Alberta, the brand's presence in the Pre-Roll category was not strong enough to break into the top 30 rankings from February 2025 onwards, indicating a potential area for improvement. Conversely, their performance in the Vapor Pens category has been relatively stable, maintaining a presence within the top 30 throughout the first quarter of 2025. This stability suggests a consistent consumer base and potential growth opportunities in this category for Throwbacks.

Despite the challenges in the Pre-Roll category in Alberta, Throwbacks has managed to keep its ranking in the Vapor Pens category relatively consistent, with a slight dip in March 2025. This could indicate competitive pressures or market saturation, but the brand's ability to remain in the top 30 suggests resilience. The fluctuations in sales figures across the months also highlight the dynamic nature of the market, where strategic adjustments could further enhance Throwbacks' positioning. The brand's overall performance underscores the importance of category-specific strategies to leverage opportunities and address challenges effectively.

Competitive Landscape

In the competitive landscape of Vapor Pens in Alberta, Throwbacks has experienced fluctuating rankings from December 2024 to March 2025, indicating a dynamic market presence. In December 2024, Throwbacks was ranked 29th, improving to 26th in January 2025, before slipping to 28th in February and further to 30th in March. This fluctuation suggests a competitive pressure from brands like Fuego Cannabis (Canada), which, despite a decline in sales, maintained a higher rank, moving from 16th to 28th over the same period. Meanwhile, Foray demonstrated a steady climb from 33rd to 29th, potentially capturing market share with consistent sales growth. In contrast, Ness and Glacial Gold showed more volatility in their rankings, indicating potential opportunities for Throwbacks to capitalize on their inconsistencies. Overall, Throwbacks' sales trajectory suggests a need for strategic adjustments to regain and sustain higher rankings amidst strong competition.

Notable Products

In March 2025, the top-performing product from Throwbacks was the Orange Creamsicle Distillate Cartridge (1g) in the Vapor Pens category, achieving the number one rank with sales of 1770 units. This product improved from its second-place rank in February 2025. The Cream Soda Distillate Cartridge (1g) followed closely, dropping one spot to second place after leading in January and February. The Gives You Wings Distillate Cartridge (1g) maintained its position in third place for March, despite a significant drop in sales from December 2024. The Root Beer Float Infused Pre-Roll 3-Pack (1.5g) remained steady in fourth place, while the Gives You Wings Kief Infused Pre-Roll 3-Pack (1.5g) re-entered the rankings at fifth place after being unranked in February.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.