Nov-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

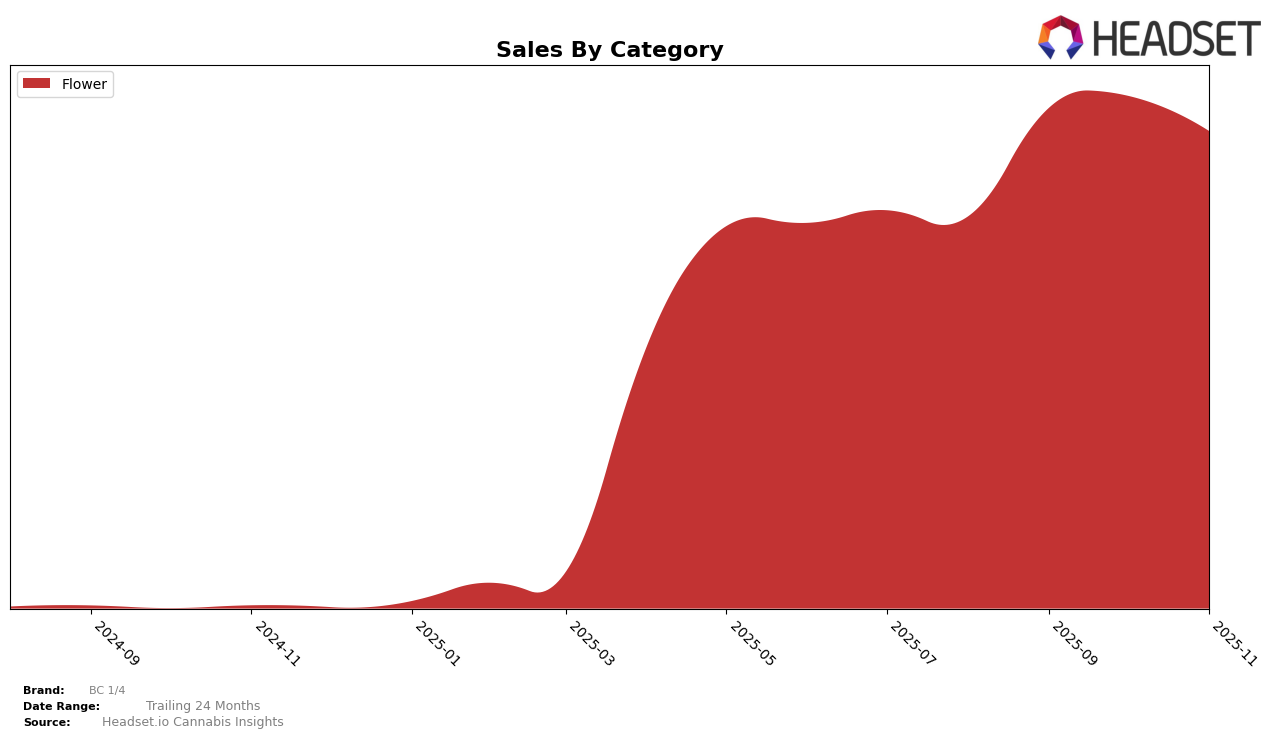

BC 1/4 has demonstrated fluctuating performance across Canadian provinces, particularly in the Flower category. In British Columbia, the brand saw a notable improvement in September 2025, jumping to the 24th position from 32nd in August. However, it slipped to 38th in October before recovering slightly to 30th in November. This volatility indicates a competitive market environment where BC 1/4 is striving to maintain its presence. The sales figures reflect this trend, with a peak in September followed by a decline in the subsequent months. In contrast, in Ontario, BC 1/4 was not ranked in the top 30 until November, where it made a modest entry at the 95th position, suggesting a gradual but positive market penetration.

Analyzing BC 1/4's performance in these provinces reveals varying dynamics. The brand's presence in British Columbia is more established, albeit with some inconsistencies in its ranking. The challenge lies in sustaining growth amidst a competitive landscape. On the other hand, Ontario presents a different picture, with BC 1/4 only recently breaking into the top 100. This indicates potential for growth in a new market, yet highlights the need for strategic efforts to enhance visibility and consumer engagement. The contrasting performances across these provinces underscore the importance of tailored strategies to address unique market conditions and consumer preferences.

Competitive Landscape

In the competitive landscape of the Flower category in British Columbia, BC 1/4 has experienced notable fluctuations in its ranking and sales performance from August to November 2025. Starting at rank 32 in August, BC 1/4 improved to 24th in September, only to drop to 38th in October before recovering slightly to 30th in November. This volatility contrasts with competitors like FIGR, which consistently hovered around the 22nd rank until November when it fell out of the top 20, and BC Green, which showed a steady climb from 47th to 34th over the same period. Meanwhile, 3Saints and Potluck demonstrated resilience with significant jumps in November, reaching 29th and 28th respectively. BC 1/4's sales peaked in September, indicating a potential for growth if the brand can stabilize its market position amidst these dynamic competitors.

Notable Products

In November 2025, Raspberry Fields (7g) emerged as the top-performing product for BC 1/4, climbing from an unranked position in October to first place, with sales reaching 1500 units. Breathalyzer (7g) secured the second spot, improving from third place in October. Lemon Cherry Gary (7g), which previously held the top position in October, fell to third place in November. Amnesia Haze (7g) entered the rankings in fourth place for the first time. Meanwhile, Lychee Dream (7g) saw a decline, dropping to fifth from its consistent fourth place in the previous two months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.