Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

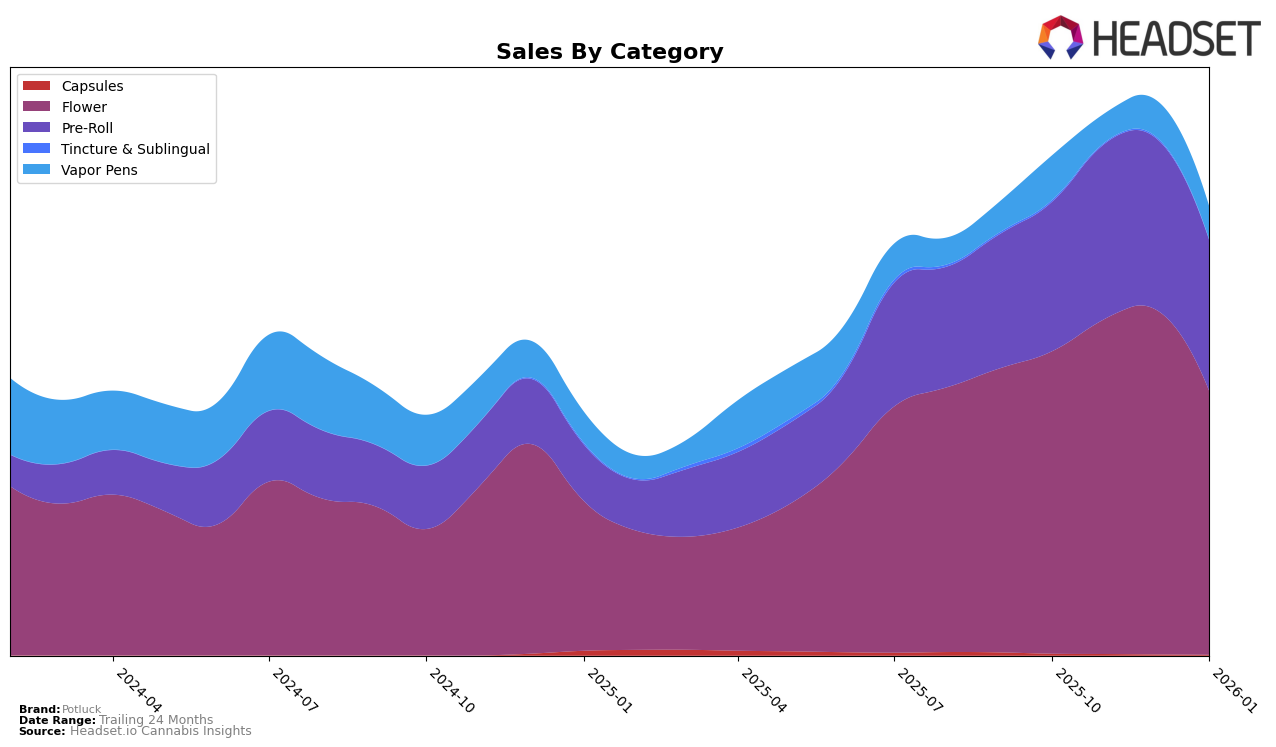

Market Insights Snapshot

In the Alberta market, Potluck has shown fluctuating performance across different categories. In the Flower category, Potluck experienced a significant rise in rankings from 23rd in October 2025 to 13th in November 2025, before dropping to 33rd by January 2026, indicating a potential challenge in maintaining consistent market presence. The Pre-Roll category in Alberta tells a more stable story, with Potluck maintaining a presence within the top 30, albeit at the lower end, ranking 27th in both November 2025 and January 2026. This highlights a steadier demand or competitive positioning in this category compared to Flower.

In Ontario, Potluck's performance in the Flower category has been relatively strong, consistently holding a ranking around the 17th position, though slipping slightly to 18th by January 2026. This steady ranking suggests a robust market position despite seasonal fluctuations in sales. Conversely, in the Vapor Pens category, Potluck has struggled to break into the top 30, with rankings hovering around the 50th position, indicating potential opportunities for growth or challenges in market penetration. Meanwhile, in British Columbia, the Pre-Roll category saw Potluck consistently outside the top 30, highlighting a competitive landscape or a need for strategic adjustments in this region.

Competitive Landscape

In the competitive landscape of the Flower category in Ontario, Potluck experienced a slight decline in its rankings from October 2025 to January 2026, moving from 17th to 18th place. This shift is notable as it reflects a decrease in sales from December 2025 to January 2026, where Potluck's sales dropped significantly compared to its competitors. For instance, FIGR maintained a steady 16th rank throughout the same period, showcasing consistent sales performance. Meanwhile, MTL Cannabis improved its position from 19th in November to 17th in January, indicating a positive sales trend. In contrast, LowKey remained at the 20th position, reflecting a stable but lower sales volume compared to Potluck. The data suggests that while Potluck remains competitive, it faces challenges in maintaining its rank amidst fluctuating sales and the upward momentum of brands like MTL Cannabis.

Notable Products

In January 2026, Berry Cherry Infused Pre-Roll (0.5g) continued to dominate as the top-performing product for Potluck, maintaining its number one rank with sales of 11,707 units. Beaver Tail (7g) climbed to the second position, showing a consistent improvement from fourth in November and third in December. Orange Twist Infused Pre-Roll (0.5g) held a steady position at third, despite a slight dip in sales compared to previous months. Beaver Tail Pre-Roll (0.5g) entered the rankings in December and rose to fourth place in January. The Tropical X Burst Collection Infused Pre-Roll 4-Pack (2g) experienced a decline, dropping to fifth place from its third-place rank in November.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.