Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

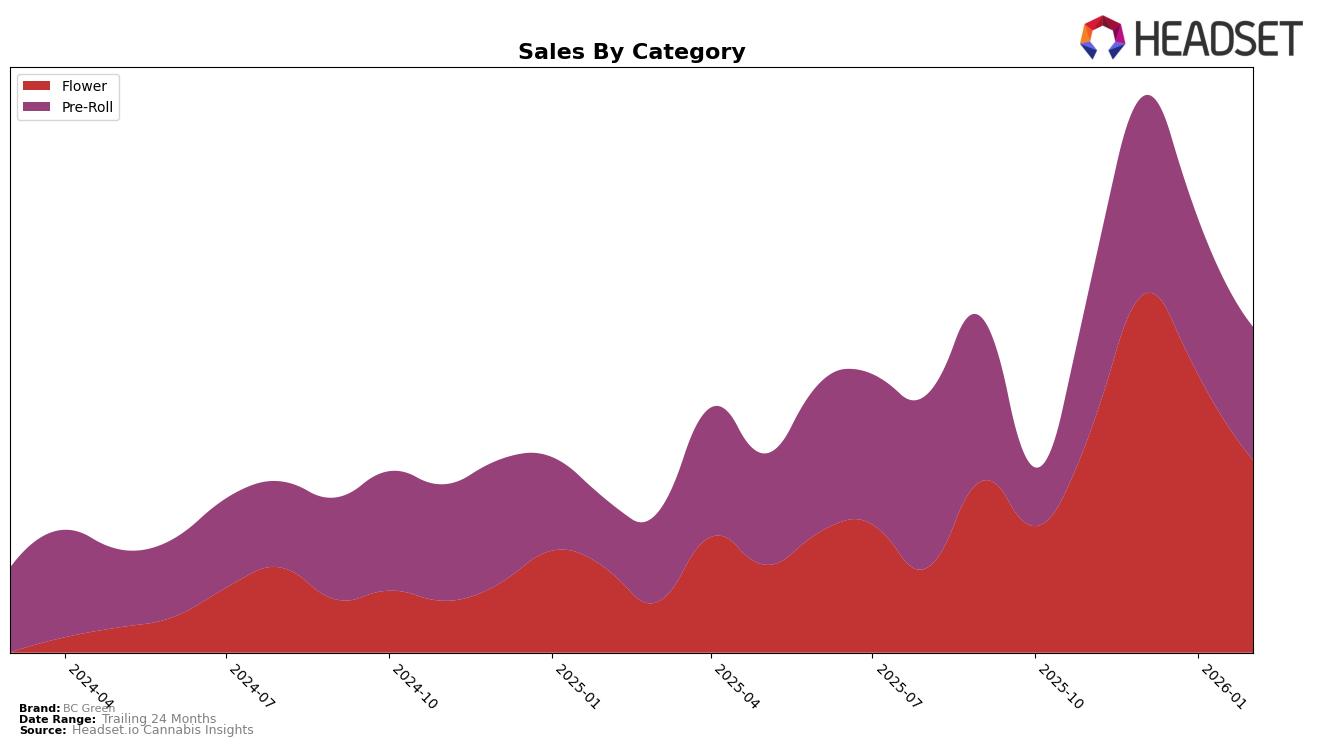

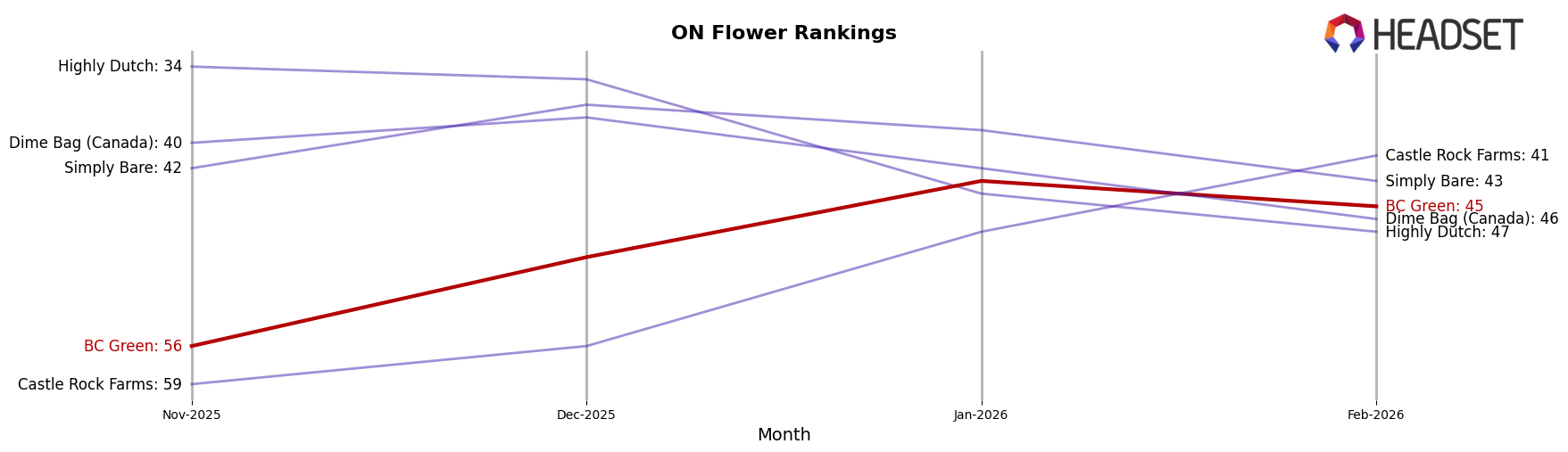

BC Green has shown varied performance across different provinces in Canada, particularly in the Flower category. In Alberta, the brand made a significant leap from 40th to 22nd place between November and December 2025, although it did experience a slight decline to 29th by February 2026. This suggests a strong but fluctuating presence in the market. In contrast, British Columbia saw BC Green's Flower category ranking drop from 32nd in November 2025 to 59th by February 2026, indicating a potential challenge in maintaining its market position. Interestingly, in Ontario, BC Green's rank in the Flower category improved from 56th to 43rd by January 2026, before settling at 45th in February, which could point to a more stable growing interest in this region.

In the Pre-Roll category, BC Green's performance in British Columbia showed a minor decline from 34th in November 2025 to 36th in February 2026, suggesting a relatively stable position. However, the brand's entry into the Pre-Roll category in Ontario is noteworthy, as it was not in the top 30 until January 2026, when it entered at 95th and improved to 79th by February. This indicates a growing footprint in the Ontario Pre-Roll market. While the specific sales figures are not detailed here, the directional trends suggest BC Green is experiencing both challenges and opportunities across different provinces and product categories.

Competitive Landscape

In the competitive landscape of the Flower category in Ontario, BC Green has shown a notable upward trend in rankings over the past few months, moving from 56th in November 2025 to a peak of 43rd in January 2026, before slightly declining to 45th in February 2026. This positive trajectory indicates a strengthening market presence, despite not being in the top 20. In comparison, Simply Bare and Dime Bag (Canada) have maintained relatively stable positions, consistently ranking higher than BC Green, though both experienced a dip in February 2026. Meanwhile, Highly Dutch and Castle Rock Farms have seen more volatility, with Highly Dutch dropping significantly in rank by February 2026. These dynamics suggest that while BC Green is gaining ground, it still faces stiff competition from established brands, and its sales trajectory, which saw a peak in January 2026, needs to maintain momentum to continue climbing the ranks.

Notable Products

In February 2026, the top-performing product for BC Green was Frosted Gumbo (14g) in the Flower category, climbing to the number one spot with sales of $2,548. Pick Me Up Pre-Roll 10-Pack (5g) followed closely at the second position, maintaining its presence in the top three from previous months. Goofiez Pre-Roll 3-Pack (1.5g) secured the third rank, descending from its first-place position in January. Watermelon Gushers Pre-Roll 3-Pack (1.5g) improved its standing to fourth place, showing a positive trend from prior months. Frosted Gumbo (28g) rounded out the top five, indicating a decline in its ranking compared to earlier months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.