Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

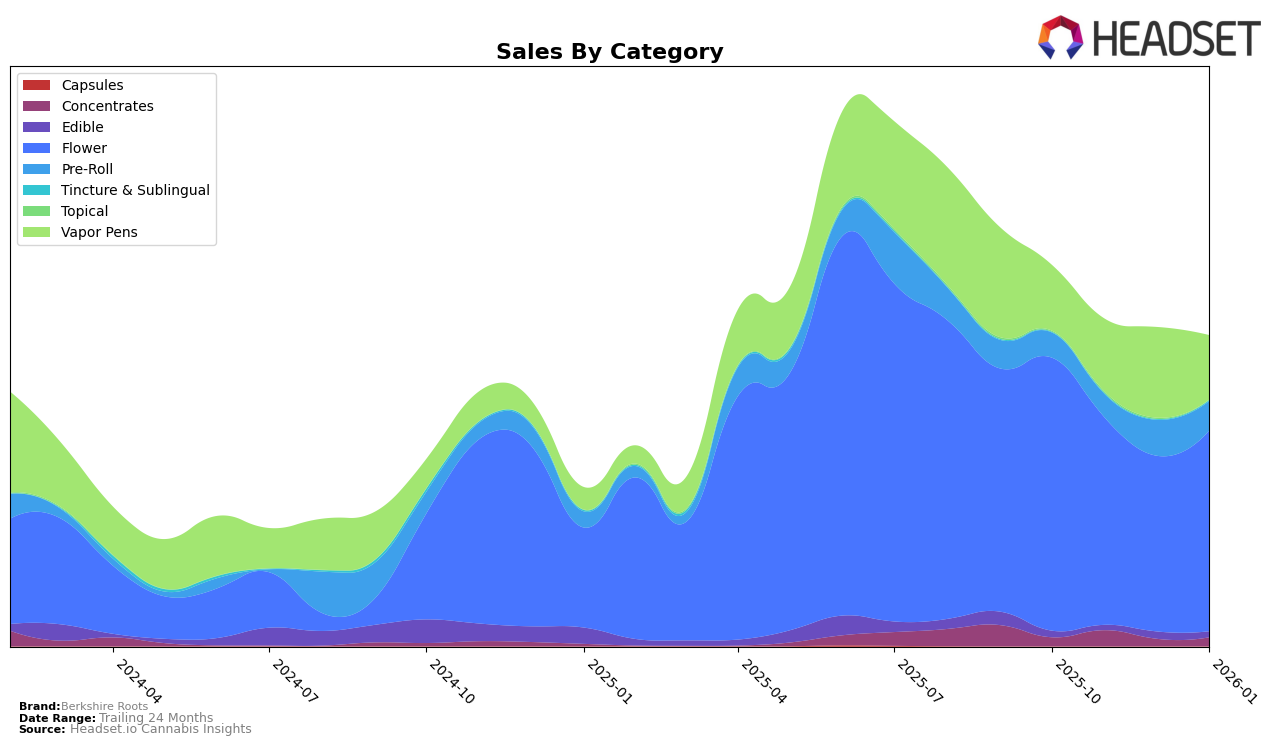

In the Massachusetts market, Berkshire Roots has demonstrated varied performance across different cannabis categories. Notably, the brand's presence in the Concentrates category has been absent from the top 30 rankings for several months, indicating a potential area for improvement or strategic focus. In contrast, the Flower category shows a gradual decline in ranking from 59th in October 2025 to 76th in December 2025, before rebounding slightly to 69th in January 2026. This fluctuation suggests a dynamic market environment, where Berkshire Roots might need to adapt its strategies to regain and maintain a stronger foothold.

The Vapor Pens category presents a slightly more optimistic scenario for Berkshire Roots. Starting at 75th place in October 2025, the brand improved its ranking to 66th by December 2025, maintaining this position into January 2026. This upward trend, despite a minor setback in sales during January, indicates a growing acceptance or preference for Berkshire Roots' products within this category. Such trends could be pivotal for the brand as it navigates the competitive landscape in Massachusetts, offering insights into consumer preferences and potential areas for marketing or product development focus.

Competitive Landscape

In the Massachusetts flower category, Berkshire Roots experienced fluctuating rankings from October 2025 to January 2026, reflecting a competitive landscape. Despite a drop from 59th to 76th in December, Berkshire Roots managed to recover slightly to 69th by January. This volatility contrasts with competitors like Cloud Cover (C3) and Theory Wellness, who also faced ranking shifts but showed stronger sales recovery. Notably, Theory Wellness improved its rank from 85th in November to 61st in January, suggesting a robust sales strategy that Berkshire Roots might analyze for insights. Meanwhile, Bountiful Farms maintained a relatively stable position, indicating consistent performance. The absence of Fathom Cannabis from the top 20 in October, followed by a gradual climb, highlights potential market entry strategies that Berkshire Roots could consider to enhance its competitive edge.

Notable Products

In January 2026, Hella Jelly (3.5g) emerged as the top-performing product for Berkshire Roots, securing the number one rank with sales of 1836 units. Orange Chemeleon Pre-Roll (1g) followed closely in second place, having improved from its debut in December 2025. Orange Chameleon (3.5g), which held the top spot in October and November 2025, slipped to third place in January 2026, indicating a decline in sales momentum. Trop Cherry (3.5g) entered the rankings at the fourth position, showing strong initial performance. Signature - Granddaddy Purple (3.5g) rounded out the top five, having previously been ranked second in October 2025 but experiencing a steady decline since then.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.