Mar-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

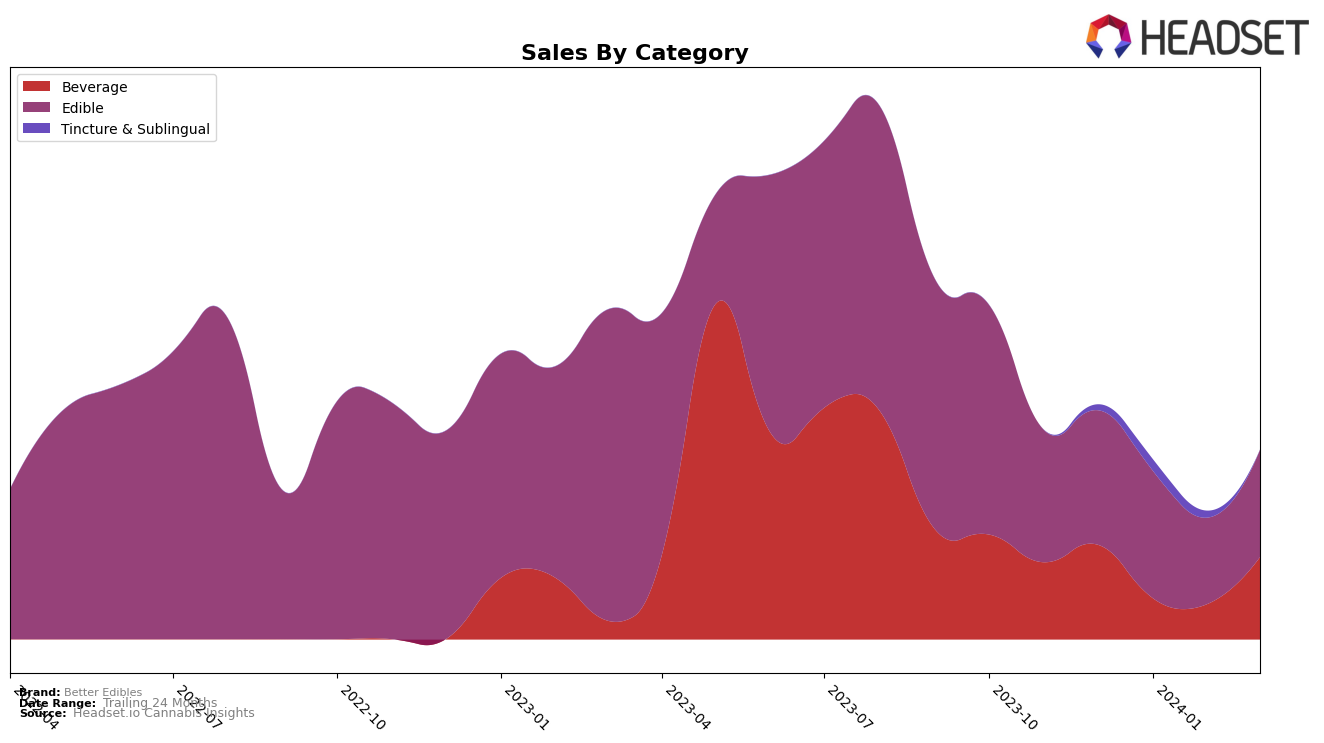

In Oregon, Better Edibles has shown a varied performance across different cannabis product categories. In the Beverage category, the brand maintained a stable presence within the top 30 brands from December 2023 to March 2024, with a slight improvement in rank from 25th in February to 21st in March. This upward movement could indicate a growing consumer preference or effective marketing strategies in this category. However, sales figures reveal a dip in January and February 2024 before a significant recovery in March, suggesting potential seasonal fluctuations or operational challenges. On the other hand, their Edible category performance indicates a struggle to break into the top 50, with rankings hovering around the high 50s to low 60s over the same period. This could reflect stiffer competition or lesser focus on this category by Better Edibles.

Interestingly, Better Edibles made a notable entry into the Tincture & Sublingual category in February 2024, ranking 30th without any prior ranking in December and January, which is a commendable achievement. This suggests a strategic expansion or a successful product launch within this category. However, the absence of subsequent ranking data for March 2024 leaves room for speculation regarding their ability to maintain or improve this position. The lack of sales data for the Tincture & Sublingual category from December 2023 to March 2024 further obscures the brand's performance trajectory in this segment. Overall, Better Edibles demonstrates a dynamic market presence in Oregon, with significant movements across different categories that may point to evolving consumer preferences or shifts in the brand's strategic focus.

Competitive Landscape

In the competitive landscape of the edible cannabis market in Oregon, Better Edibles has shown a notable trajectory in terms of rank and sales among its competitors. Despite starting at a lower rank in December 2023, Better Edibles has made significant strides, moving from 59th to 55th by March 2024. This is a remarkable improvement, especially when compared to Journeyman, which saw a drastic fall from 15th to 54th in the same period. Although Do Drops was initially trailing behind Better Edibles, it managed to slightly outpace Better Edibles by March 2024, securing the 56th position. Other competitors like High Desert Pure and Angel (OR) have also shown fluctuations in their rankings, but none have demonstrated the upward momentum of Better Edibles. This analysis suggests that Better Edibles is on a positive trajectory in a highly competitive market, indicating a potential for further growth and an opportunity for investors and stakeholders to closely monitor its performance relative to its competitors.

Notable Products

In Mar-2024, Better Edibles saw Fifty-One-Fifty Mystery Flavor Gummies (100mg) maintain its top position in sales with 172 units sold, continuing its streak from previous months. Following closely were Cookies n' Cream Crispy (100mg) and Peanut Butter & Chocolate Canna Crispy (100mg), both securing the second spot due to a tie in sales figures, showcasing their consistent popularity. Notably, the entry of CBN/THC 1:1 Day Holy Water (100mg CBN, 100mg THC) into the rankings at third place indicates a growing interest in beverage categories among consumers. Holy Water (100mg THC, 50ml) also made a significant jump to the third position, highlighting a shift in consumer preferences towards beverage options. These changes illustrate a dynamic market, with Better Edibles' product lineup experiencing shifts in consumer demand, particularly with the rise in beverage product popularity.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.