Aug-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

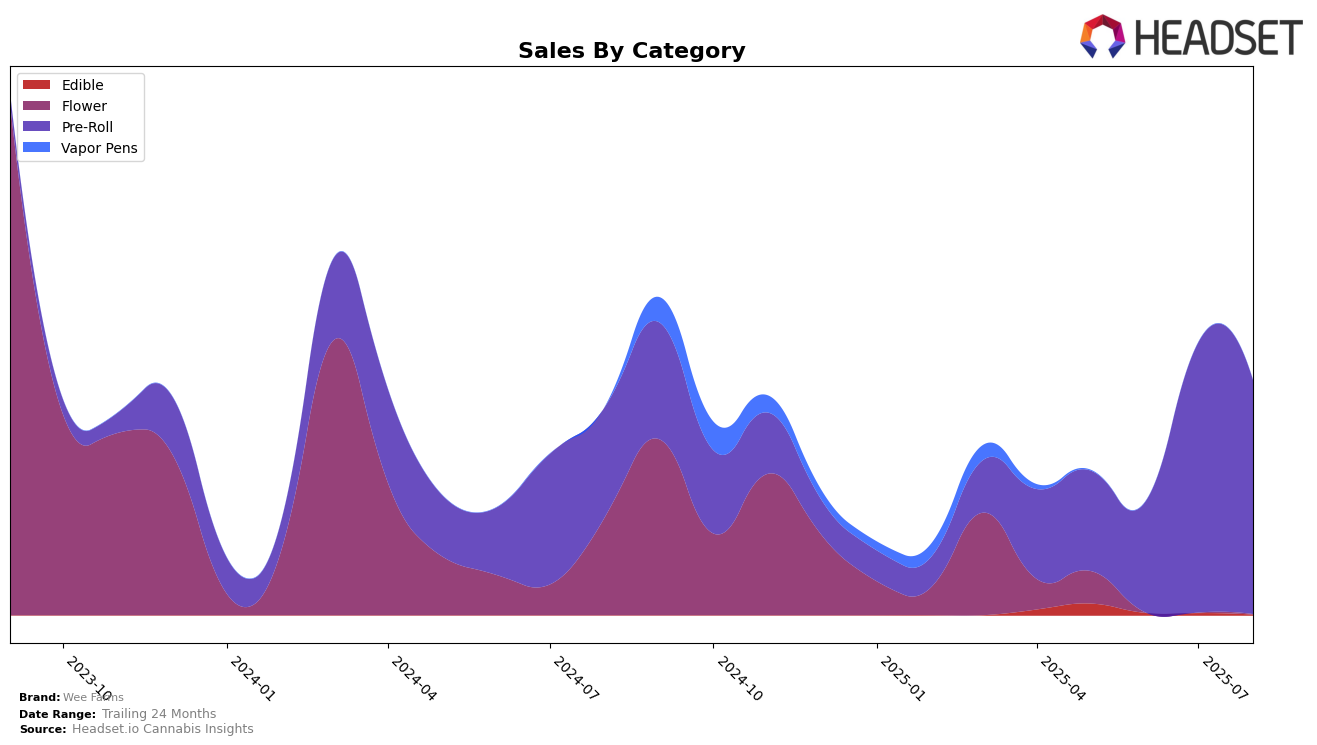

Wee Farms has demonstrated significant progress in the Pre-Roll category within Oregon. Notably, the brand improved its ranking from 51st in May 2025 to 24th by July 2025, showcasing a remarkable climb within just a few months. However, August saw a slight dip to 30th place, indicating some volatility in its market position. Despite this fluctuation, the brand's sales in Oregon grew notably from May to July, suggesting that the brand's strategy might be resonating well with consumers, although the slight drop in August could imply increased competition or shifting consumer preferences.

Wee Farms' absence from the top 30 rankings in earlier months highlights the challenges it faced in establishing itself within the competitive Pre-Roll category in Oregon. The brand's ability to break into the top 30 by July is a positive indicator of its growing market presence. However, maintaining this momentum will be crucial, especially given the slight decline in August. This dynamic underscores the importance of adaptability and continuous market analysis to sustain and improve the brand's position in the evolving cannabis market.

Competitive Landscape

In the Oregon pre-roll category, Wee Farms has demonstrated a significant upward trajectory in the competitive landscape over the summer of 2025. Starting from a rank of 51 in May, Wee Farms surged to 24 by July, indicating a notable improvement in market position. This rise can be contrasted with Dog House, which saw a decline from rank 12 in May to 32 in August, reflecting a downward trend in both rank and sales. Meanwhile, Altered Alchemy experienced fluctuations, peaking at rank 26 in July before slipping back to 29 in August. Gud Gardens showed a steady climb, improving from rank 38 in May to 33 by August, while Feel Goods maintained a relatively stable position, hovering around the mid-20s. The dynamic shifts in rankings highlight Wee Farms' ability to capitalize on market opportunities and enhance its competitive standing, suggesting a promising outlook for future sales growth.

Notable Products

In August 2025, the top-performing product from Wee Farms was the Peyote Cookies Pre-Roll 7-Pack (3.5g), securing the number 2 spot with sales figures reaching 1301 units. Following closely in the rankings, the Pina Colada Runtz Pre-Roll 7-Pack (3.5g) took the 3rd position, marking its debut in the top rankings. The Garlic Ice Cream Pre-Roll 7-Pack (3.5g) maintained its 4th place position from July, showing consistent performance. The Grape Slushie Pre-Roll 7-Pack (3.5g) entered the rankings at 5th place, indicating a growing interest in this flavor. Notably, the Garlic Cookies Pre-Roll 7-Pack (3.5g), which previously held the top rank in June, was absent from the August rankings, suggesting a shift in consumer preferences.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.