Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

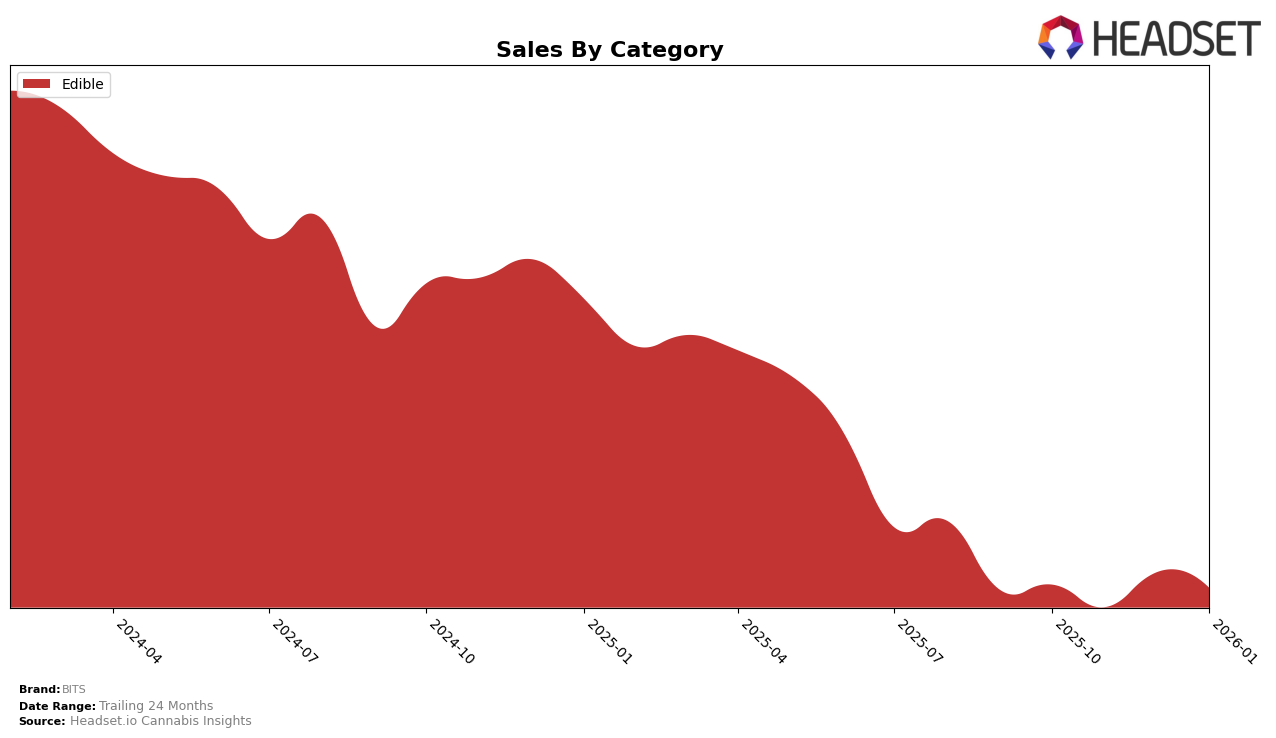

In the competitive landscape of cannabis edibles, BITS has shown varied performance across different states. In Arizona, the brand has maintained a consistent position at rank 22 from October 2025 through January 2026, with a noteworthy upward trend in sales each month, culminating in over 93,000 in January. This stability in ranking, coupled with increasing sales, suggests a steady consumer base and growing popularity. Meanwhile, in Illinois, BITS has been struggling to break into the top 30, hovering just outside at ranks 38 and 39. The downward trajectory in sales during this period could indicate challenges in market penetration or increased competition.

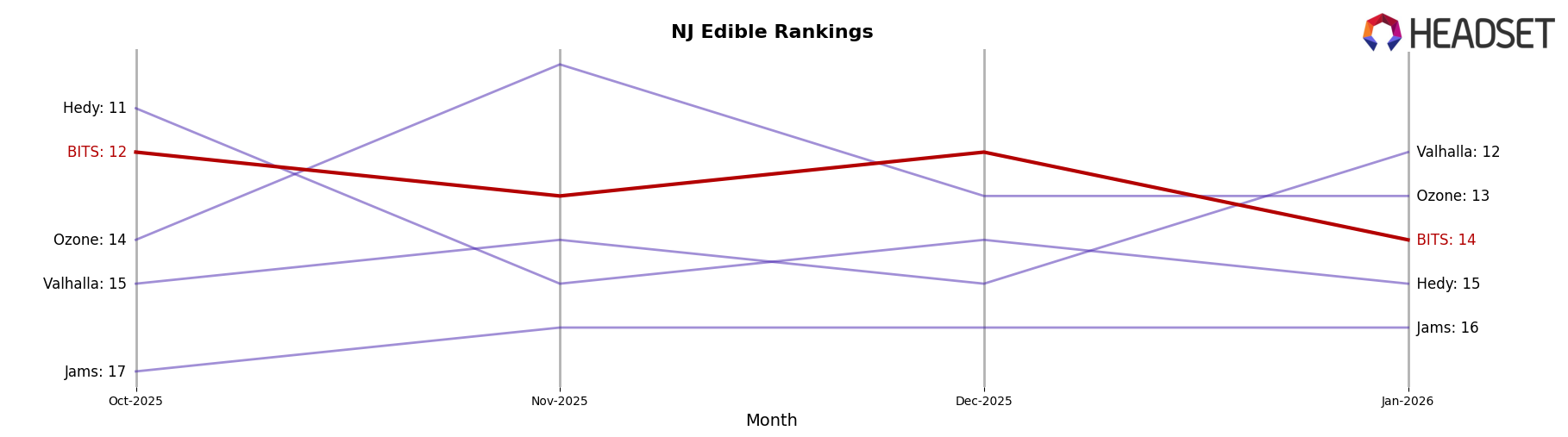

In Maryland, BITS experienced fluctuations in its rankings, dropping from 18 in October to 23 in December before improving slightly to 21 in January. Despite these shifts, sales figures suggest a recovery towards the end of the period, indicating potential for stabilization. New Jersey presents a different story, where BITS consistently ranked within the top 15, peaking at rank 12 in October and December. However, the sales saw a significant spike in December, followed by a decline in January, which might point to seasonal variations or promotional impacts. Notably, in Nevada, BITS was absent from the top 30 in October but made a remarkable entry at rank 32 in November, climbing to 24 by January, suggesting a successful market entry strategy. Meanwhile, Ohio showed a slight decline in ranking from 15 to 18, although sales remained relatively strong, hinting at a resilient market presence despite increased competition.

Competitive Landscape

In the competitive landscape of the New Jersey edible market, BITS has experienced fluctuating rankings over the past few months, indicating a dynamic competitive environment. In October 2025, BITS held the 12th position, but by January 2026, it had slipped to 14th. This change is notable as it contrasts with the performance of competitors like Ozone, which maintained a relatively stable position, peaking at 10th in November before settling at 13th in January. Meanwhile, Valhalla showed a significant upward trend, climbing from 15th in October to 12th in January, suggesting an increase in consumer preference or effective marketing strategies. Despite these shifts, BITS achieved its highest sales in December, indicating strong consumer demand during the holiday season, even as its rank remained consistent at 12th. This suggests that while BITS faces stiff competition, particularly from brands like Hedy and Jams, there is still a robust market presence that could be leveraged with strategic marketing efforts to regain higher rankings.

Notable Products

In January 2026, the CBC/THC 1:1 Dragonfruit LOL Gummies 20-Pack (100mg CBC, 100mg THC) emerged as the top-performing product for BITS, reclaiming the number one spot with sales figures reaching 6439 units. The CBD/THC 1:1 Elderberry Wellness Gummies 20-Pack, which had held the top rank in the previous two months, fell to second place, demonstrating a slight decline in sales. The CBN/THC 1:1 Pomegranate R&R Gummies 20-Pack maintained a steady presence, climbing to third place after a brief dip in November. Acai Affection Gummies 20-Pack consistently held the fourth position, showing stable performance across the months. Guava Go Gummies 20-Pack experienced a notable drop from third to fifth place, indicating a significant decrease in demand compared to previous months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.