Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

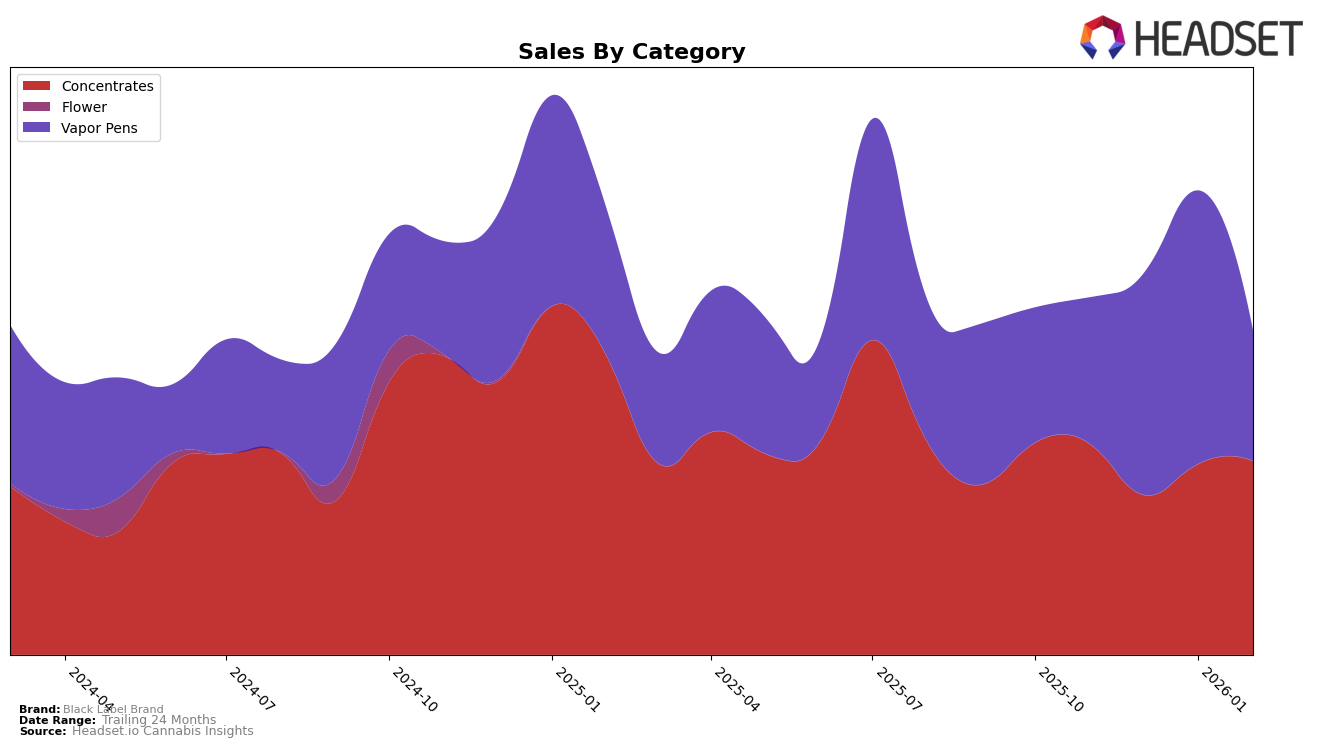

Black Label Brand has shown varying performance across different states and product categories. In the Massachusetts market, their presence in the Vapor Pens category was not strong enough to place them in the top 30 rankings until February 2026, when they barely made it to the 78th position. This indicates a struggle in gaining traction in this category within the state. Conversely, in Maryland, Black Label Brand maintained a consistent presence in the Vapor Pens category, although their rankings fluctuated slightly between 41st and 46th positions from November 2025 to February 2026. Despite the ups and downs, they appear to have a steadier foothold in Maryland compared to Massachusetts.

In the New Jersey market, Black Label Brand has demonstrated significant strength in the Concentrates category, consistently ranking within the top 10. They achieved a high of 2nd place in both November 2025 and February 2026, showcasing their strong market presence in this sector. However, their performance in the Vapor Pens category in New Jersey has been less consistent, with rankings ranging from 23rd to 43rd over the four-month period. This indicates a more volatile performance in this category, suggesting potential areas for strategic improvement or market focus.

Competitive Landscape

In the New Jersey concentrates category, Black Label Brand experienced notable fluctuations in its market position from November 2025 to February 2026. Initially ranked 2nd in November 2025, Black Label Brand saw a significant drop to 7th place in December, before recovering to 3rd in January and regaining the 2nd position by February 2026. This volatility contrasts with the more stable performance of competitors such as 710 Labs, which maintained a consistent top-three presence, and Bullet Train Extracts, which held steady in the 4th position from December through February. Despite the temporary dip in December, Black Label Brand's ability to rebound suggests resilience and a strong market presence, potentially driven by strategic adjustments or consumer loyalty. These dynamics highlight the competitive landscape in New Jersey's concentrates market, where maintaining rank requires agility and a keen understanding of market trends.

Notable Products

In February 2026, the top-performing product for Black Label Brand was Strawberry Mango Haze Crumble (1g) in the Concentrates category, securing the first rank with sales of 794 units. Local Skunk RSO Syringe (1g) followed closely in second place, while Local Skunk Crumble (1g) held the third position. Blue Dream Cured Resin Crumble (1g) was ranked fourth, showing a strong performance in the Concentrates category. White Widow Sugar (1g), which was ranked third in January, dropped to fifth place in February. This shift in rankings indicates a competitive landscape within the Concentrates category for Black Label Brand.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.