Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

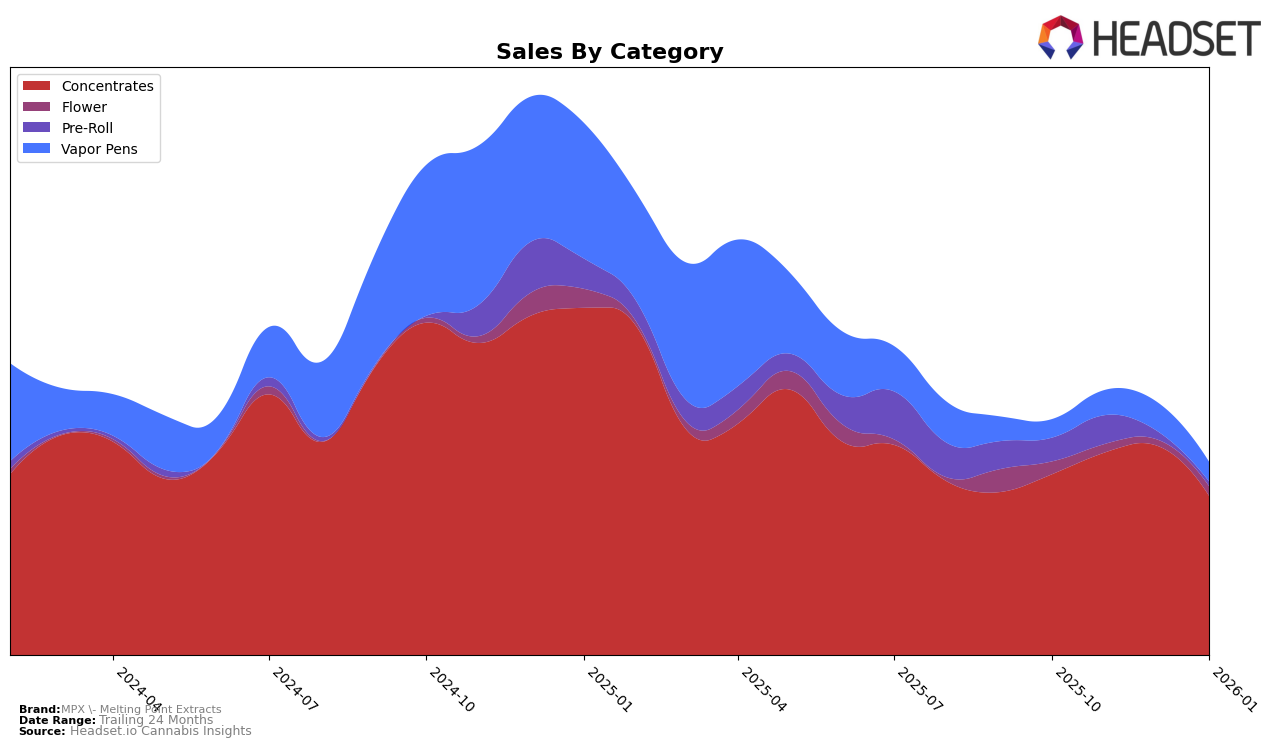

MPX - Melting Point Extracts has shown varied performance across different states and product categories. In the Arizona market, the brand's presence in the Vapor Pens category has been relatively stable, although it did not break into the top 30, with rankings fluctuating between 44th and 49th place from October 2025 to January 2026. This indicates a consistent, albeit modest, market position. In contrast, the brand's performance in the Massachusetts Concentrates category reveals a downward trend, slipping from 32nd to 38th place over the same period, suggesting challenges in maintaining its market share.

In the Maryland market, MPX - Melting Point Extracts has demonstrated notable strength in the Concentrates category, consistently ranking in the top 15, with a peak at 9th place in December 2025. This highlights a strong foothold and potential for further growth. Meanwhile, in New Jersey, the brand's performance in the Concentrates category remains robust, consistently ranking within the top 6, although there's a slight decline from 4th to 6th place by January 2026. However, the brand's presence in the Flower and Pre-Roll categories in New Jersey is less prominent, with rankings not breaking into the top 30 in recent months, indicating potential areas for improvement or strategic reevaluation.

Competitive Landscape

In the competitive landscape of the New Jersey concentrates market, MPX - Melting Point Extracts experienced a slight decline in rank from October 2025 to January 2026, moving from 4th to 6th place. Despite this drop, MPX maintained a strong presence, with sales peaking in December 2025. During this period, Locals Only Concentrates demonstrated notable volatility, briefly surpassing MPX in December before settling at 4th place in January. Meanwhile, Bullet Train Extracts showed a significant upward trend, climbing from 12th in October to 5th in January, indicating a growing competitive threat. ONYX (NJ) and Pyramid Pens remained consistent in their ranks, with ONYX maintaining a steady position close to MPX. This competitive environment suggests that while MPX remains a key player, it faces increasing pressure from both established and emerging brands, necessitating strategic adjustments to maintain its market share.

Notable Products

In January 2026, MPX - Melting Point Extracts saw Purple Milk Live Rosin (1g) leading the sales chart as the top-performing product with a sales figure of 542 units. Gorilla Warfare Live Resin Jam (1g) followed closely in second place. Gorilla Cake Live Rosin Disposable (0.5g) secured the third position, marking its debut in the top three. Tropicana Gushers Cured Resin Jam (1g) came in fourth, while Glitter Bomb Shatter (1g) dropped from third in December 2025 to fifth in January 2026. This shift highlights a dynamic change in consumer preferences, with concentrates maintaining a strong presence in the top rankings.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.