Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

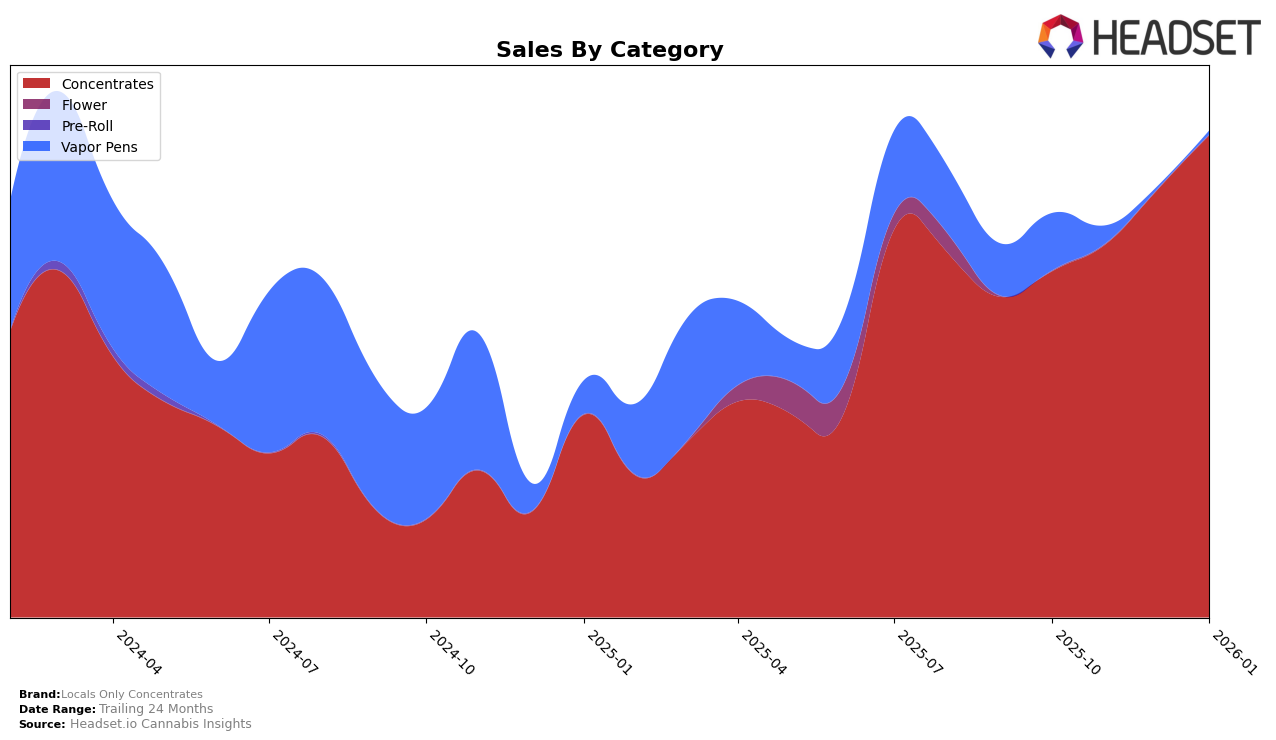

Locals Only Concentrates has demonstrated varying performance across different states and product categories. In New Jersey, the brand has consistently maintained a strong presence in the concentrates category, securing a top-five position over the past four months. Notably, they reached the third position in both October and December 2025, showing resilience and popularity among consumers. Conversely, in California, the brand has not managed to break into the top 30 in the concentrates category, highlighting a potential area for growth or increased market penetration. This disparity between states suggests that while the brand has a solid footing in certain markets, there are opportunities for expansion and increased visibility elsewhere.

In Nevada, Locals Only Concentrates has shown impressive improvement in the concentrates category, jumping from a tenth position in December 2025 to a remarkable second place by January 2026. This upward trajectory indicates a growing consumer preference and possibly successful marketing strategies in the state. However, their performance in the vapor pens category in Nevada tells a different story, as they did not secure a position in the top 30 in recent months, following a decline from the 38th position in October 2025. This mixed performance across categories highlights the brand's strengths in concentrates while suggesting a need to reevaluate their approach in the vapor pens market.

Competitive Landscape

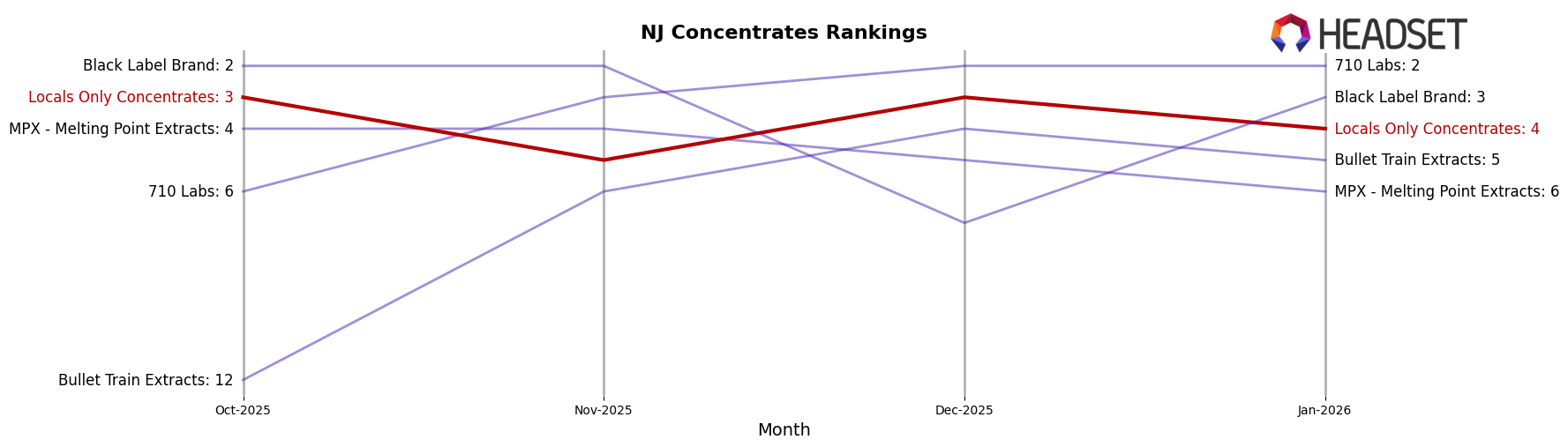

In the competitive landscape of concentrates in New Jersey, Locals Only Concentrates has experienced fluctuations in its ranking over the past few months. Despite a strong start in October 2025 with a third-place ranking, the brand saw a dip to fifth place in November, only to recover to third in December, before settling at fourth in January 2026. This volatility indicates a competitive market environment, with brands like 710 Labs consistently climbing to the top, maintaining a second-place rank from December 2025 to January 2026. Meanwhile, MPX - Melting Point Extracts and Black Label Brand have also shown strong performances, with Black Label Brand notably rebounding to third place in January 2026 after a dip in December. The competitive pressure from these brands suggests that Locals Only Concentrates needs to strategize effectively to maintain and improve its market position amidst these dynamic shifts.

Notable Products

In January 2026, Orange Push Pop Badder (1g) retained its top position as the best-selling product for Locals Only Concentrates, with sales reaching 965 units. J1 Live Wet Diamonds (1g) maintained its consistent performance, securing the second rank for the fourth consecutive month. Diamond Bar Live Wet Badder (1g) emerged as a new entrant in January, capturing the third spot. Meanwhile, Orange Push Pop Live Wet Diamonds (1g) experienced a drop to fourth place, having previously held the top rank in October 2025. Diamond Bar Wet Diamonds (1g) rounded out the top five, showing a decline from its peak position in November 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.