Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

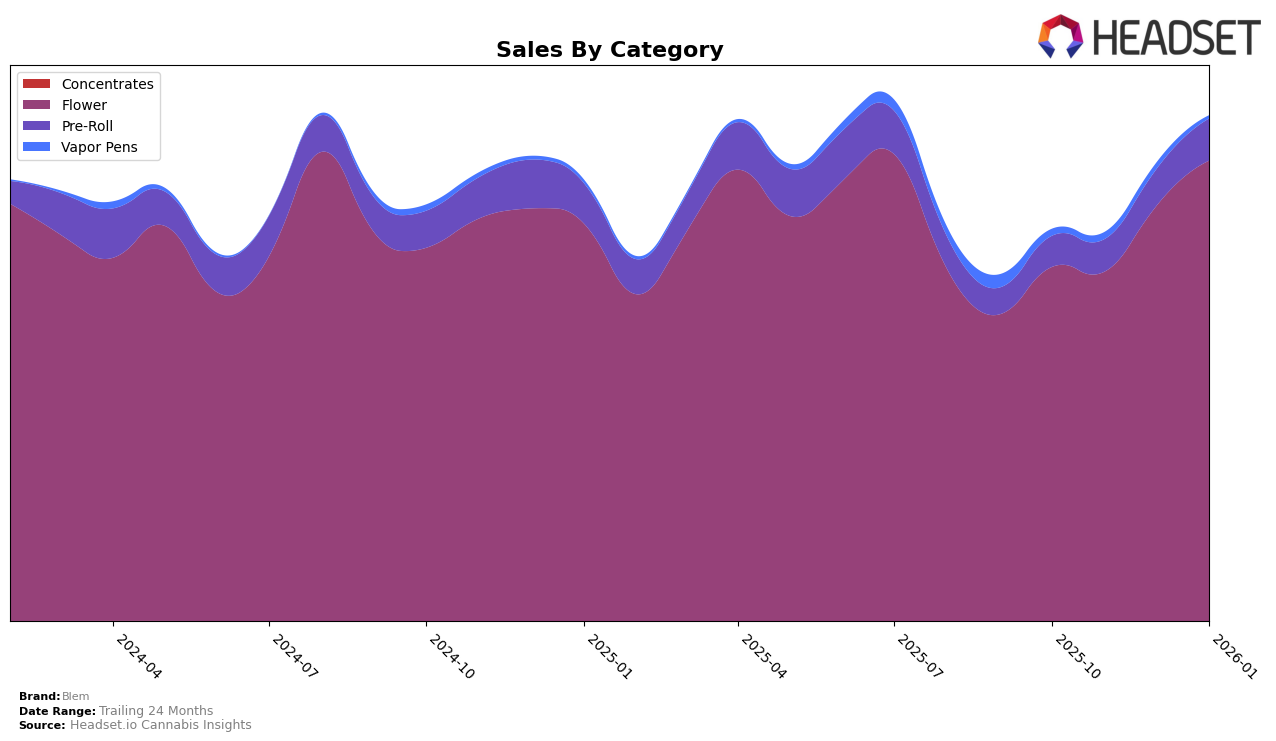

Blem has demonstrated notable upward momentum in the California market, particularly within the Flower category. Over a span of four months, Blem has climbed from the 8th position in October 2025 to 5th by January 2026. This steady improvement indicates a growing consumer preference for Blem's Flower products. While the specific sales figures for each month are available, it's worth noting that January 2026 saw a significant increase from previous months, highlighting a positive trend in consumer demand. The consistent rise in rankings suggests that Blem is successfully capturing market share from competitors in this segment.

In contrast, Blem's performance in the Pre-Roll category within California has been less impressive, although it is showing signs of improvement. Initially not within the top 30 brands, Blem's Pre-Roll products have moved from the 58th position in October 2025 to the 42nd position by January 2026. This upward trajectory, while slower compared to their Flower category, indicates potential for growth if the trend continues. The sales figures for January 2026 reflect an increase, suggesting that Blem's efforts in this category are beginning to resonate with consumers. However, the brand still has significant ground to cover to break into the top tiers of the Pre-Roll market.

Competitive Landscape

In the competitive landscape of California's Flower category, Blem has demonstrated a notable upward trajectory in recent months. Starting from the 8th position in October 2025, Blem climbed steadily to secure the 5th spot by January 2026. This ascent is particularly significant when compared to competitors like Claybourne Co., which experienced a slight decline from 5th to 6th place over the same period. Meanwhile, CAM maintained a stronghold on the 3rd position, consistently outperforming Blem in sales. However, Blem's growth in sales, culminating in a substantial increase by January 2026, suggests a strengthening market presence. Additionally, Blem's rise has outpaced Oakfruitland, which fluctuated in rankings but ended behind Blem at 7th place. As Blem continues to gain momentum, its competitive positioning in California's Flower market appears increasingly robust, signaling potential for further growth and market share capture.

Notable Products

In January 2026, Unruly OG (3.5g) maintained its position as the top-selling product for Blem, with sales reaching 12,254 units. Tangie Ting (3.5g) also held steady in second place, showing a consistent performance over the past months. Unruly OG (10g) continued to rank third, with a slight increase in sales compared to previous months. Bomba (3.5g) remained in fourth place, experiencing a minor decrease in sales from December. Notably, Tangie Ting (10g) entered the rankings for the first time, securing the fifth position, indicating a new interest in larger quantity purchases.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.