Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

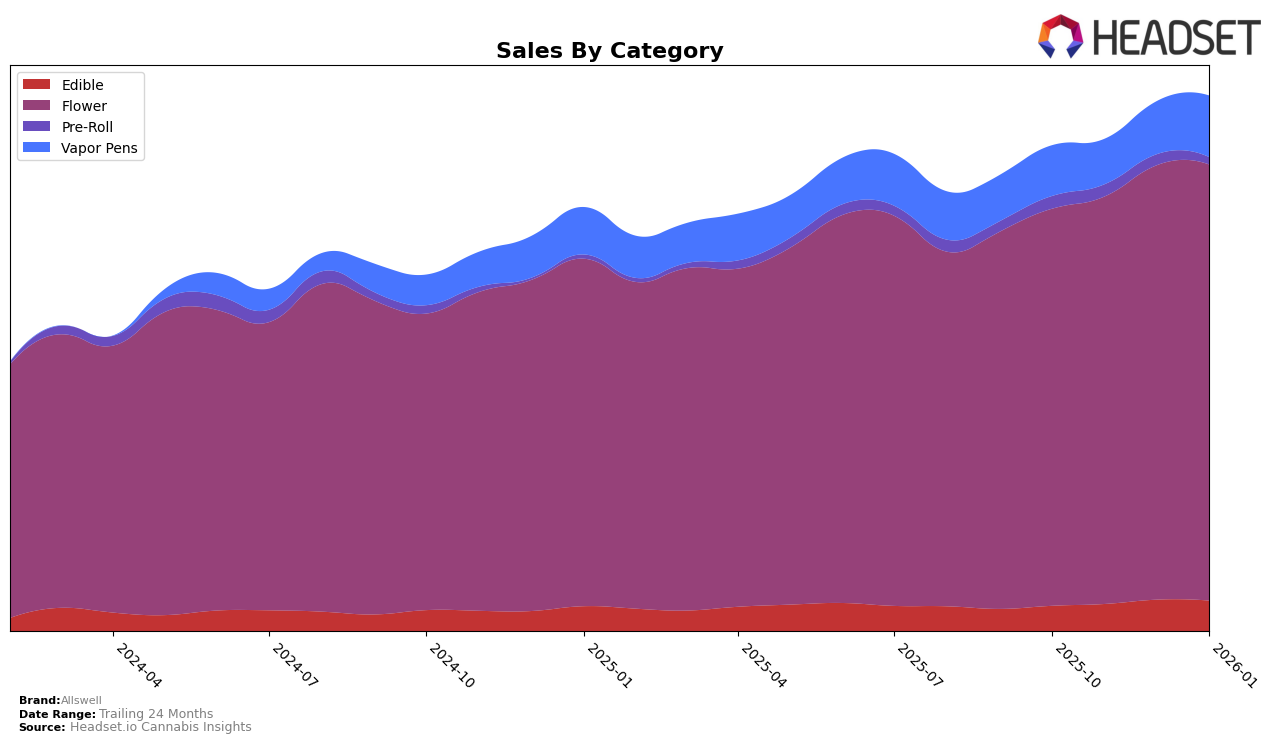

Allswell's performance in California displays notable trends across different product categories. In the Edible category, Allswell showed a gradual improvement in ranking from October 2025 to January 2026, moving from 27th to 25th place. This upward trend indicates a positive reception among consumers, supported by a steady increase in sales during this period. On the contrary, the Pre-Roll category did not see Allswell in the top 30 rankings after November 2025, suggesting a potential area for improvement or a shift in consumer preference away from this product line.

In contrast, Allswell's Flower category maintained a strong and consistent performance, holding steady at the 4th position throughout the months from October 2025 to January 2026. This stability highlights Allswell's strong market presence and consumer loyalty in this category. Additionally, the Vapor Pens category saw a significant improvement in rank, moving from 40th in October 2025 to 37th in January 2026. This positive shift, coupled with increased sales, suggests growing consumer interest and potential for further market penetration in this segment. These insights provide a glimpse into Allswell's strategic positioning and areas of success within the California market.

Competitive Landscape

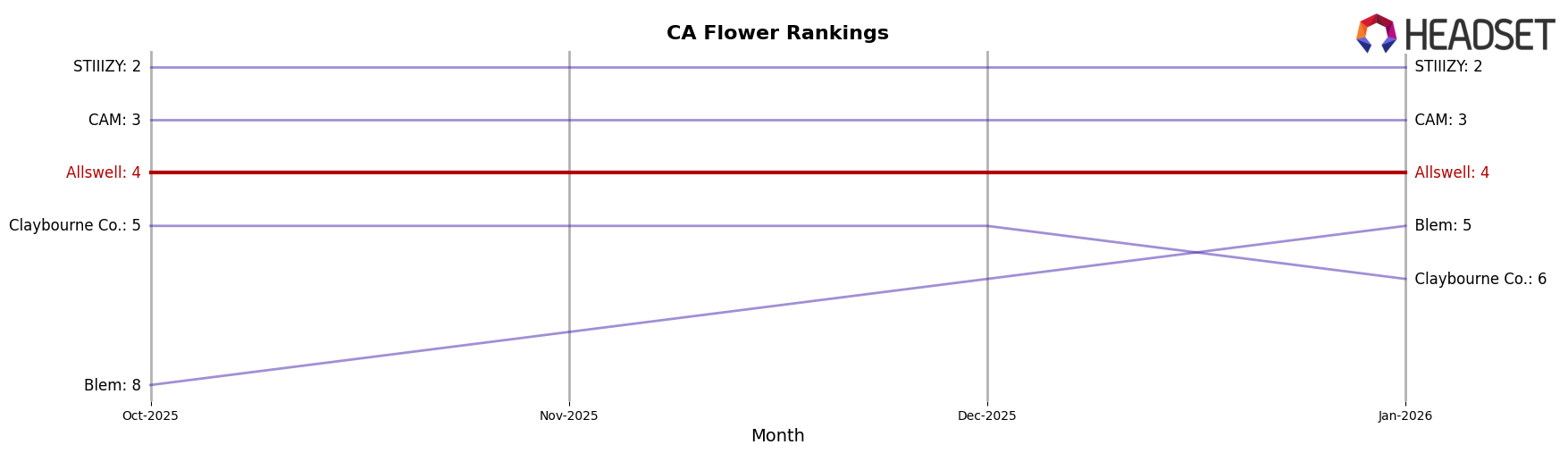

In the competitive landscape of the California flower category, Allswell has maintained a consistent rank at 4th place from October 2025 through January 2026. This stability in ranking suggests a strong market presence, although the brand faces stiff competition from brands like STIIIZY, which consistently holds the 2nd position, and CAM, which remains in 3rd place. Despite these challenges, Allswell's sales have shown a positive trajectory, with a noticeable increase from October to January, indicating a growing consumer base and effective market strategies. Meanwhile, Blem has been climbing the ranks, moving from 8th to 5th place, which could pose a future threat to Allswell's position if the trend continues. Overall, Allswell's steady rank amidst rising competitors highlights its resilience and potential for further growth in the competitive California flower market.

Notable Products

In January 2026, Sweet Berry Dream Gummies 10-Pack (100mg) emerged as the top-performing product for Allswell, climbing from its December rank of 4 to secure the number 1 spot with sales of 6740 units. Sweet Fruit Punch Gummies 10-Pack (100mg) maintained its strong performance, holding steady at rank 2 from the previous month, with sales just slightly lower at 6719 units. Sour Blue Raspberry Gummies 10-Pack (100mg) remained consistent, ranking 3rd as in December, despite a slight dip in sales to 6381 units. Sour Kiwi Strawberry Gummies 10-Pack (100mg) saw a decline, dropping from rank 1 in December to 4 in January, with sales at 6089 units. Notably, Sunset Gelato Smalls (3.5g) entered the rankings for the first time in January, debuting at rank 5.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.