Apr-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

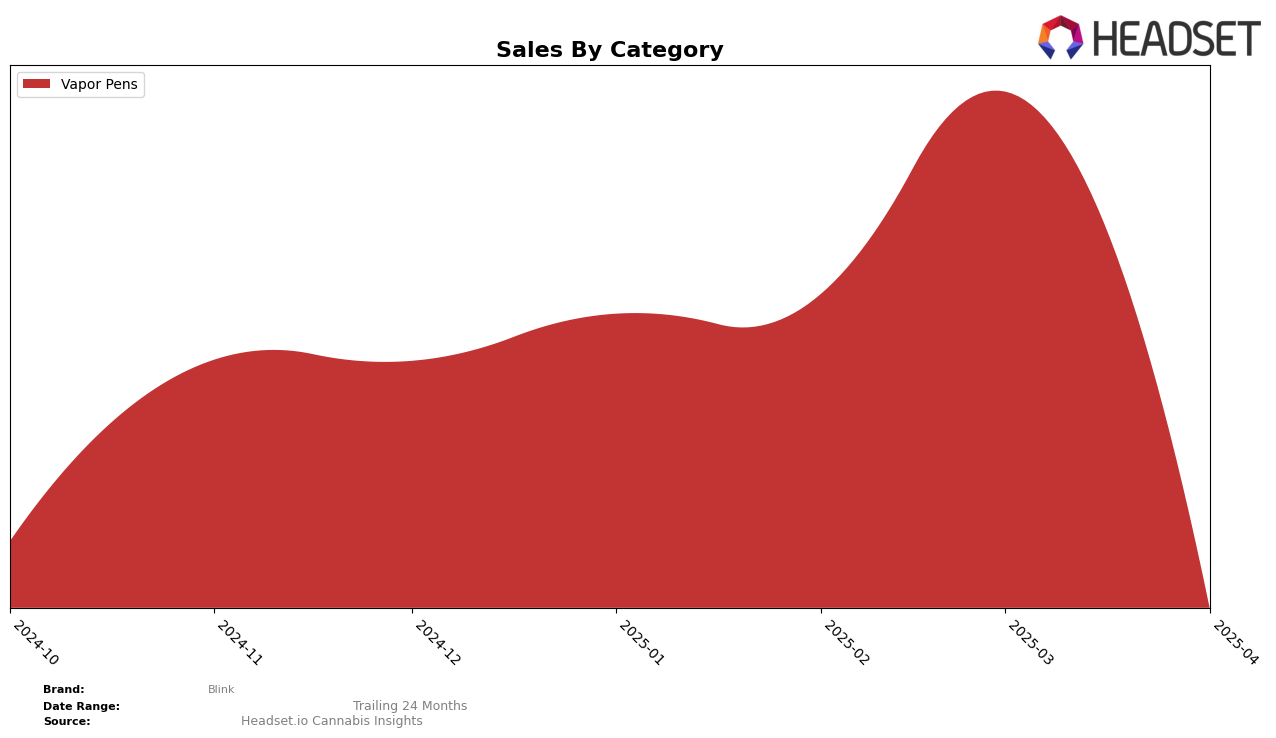

In Maryland, Blink has shown varied performance across the Vapor Pens category. Starting the year at rank 21 in January, the brand saw a slight improvement to rank 20 in both February and March, suggesting a steady presence in the market. However, April witnessed a notable decline, with Blink slipping to rank 30, indicating a possible challenge in maintaining its competitive edge. Despite this drop, the brand managed to increase its sales from January to March, peaking in March before a significant decrease in April. This fluctuation highlights the competitive nature of the Maryland market and suggests that Blink needs to strategize to regain its earlier momentum.

When examining Blink's performance across other states and categories, it becomes evident that their presence is not equally strong everywhere. The absence of Blink from the top 30 rankings in certain states and categories could be seen as a missed opportunity for growth and market penetration. This disparity in performance underscores the importance of targeted strategies tailored to specific regional markets and consumer preferences. While Blink has shown potential in the Vapor Pens category within Maryland, expanding its influence and improving rankings in other regions could be crucial for sustaining long-term success.

Competitive Landscape

In the Maryland Vapor Pens category, Blink experienced a notable fluctuation in its competitive standing from January to April 2025. Initially ranked 21st in January, Blink improved to 20th place in both February and March, indicating a positive trend in market position. However, by April, Blink's rank slipped to 30th, suggesting a significant competitive pressure. This decline coincided with a sharp decrease in sales, highlighting potential challenges in maintaining market share. In contrast, 1937 and Organic Remedies showed more stable rankings, with 1937 consistently outperforming Blink in sales despite its fluctuating rank. Meanwhile, Black Label Brand and Sunnies by SunMed also demonstrated varying ranks, yet their sales figures suggest they are formidable competitors. This competitive landscape underscores the need for Blink to strategize effectively to regain and sustain its market position.

Notable Products

In April 2025, the top-performing product for Blink was Goat Piss Sauce Disposable (1g) in the Vapor Pens category, securing the number one rank with sales of 445 units. Fruity Pebbles OG x Sour Dub Sauce Disposable (1g) maintained a strong presence, ranking second after a slight drop from its previous first-place positions in January and February. Rolled Ice Cream Sauce Disposable (1g) entered the top five for the first time, achieving the third rank. Electric Berry Bliss Sauce Disposable (1g) and Gandhari Kush Sauce Disposable (1g) followed in fourth and fifth place, respectively, both new entries for April. Notably, Fruity Pebbles OG x Sour Dub Sauce Disposable (1g) saw a consistent decrease in rank from February to April, suggesting a shift in consumer preference within the Vapor Pens category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.