Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

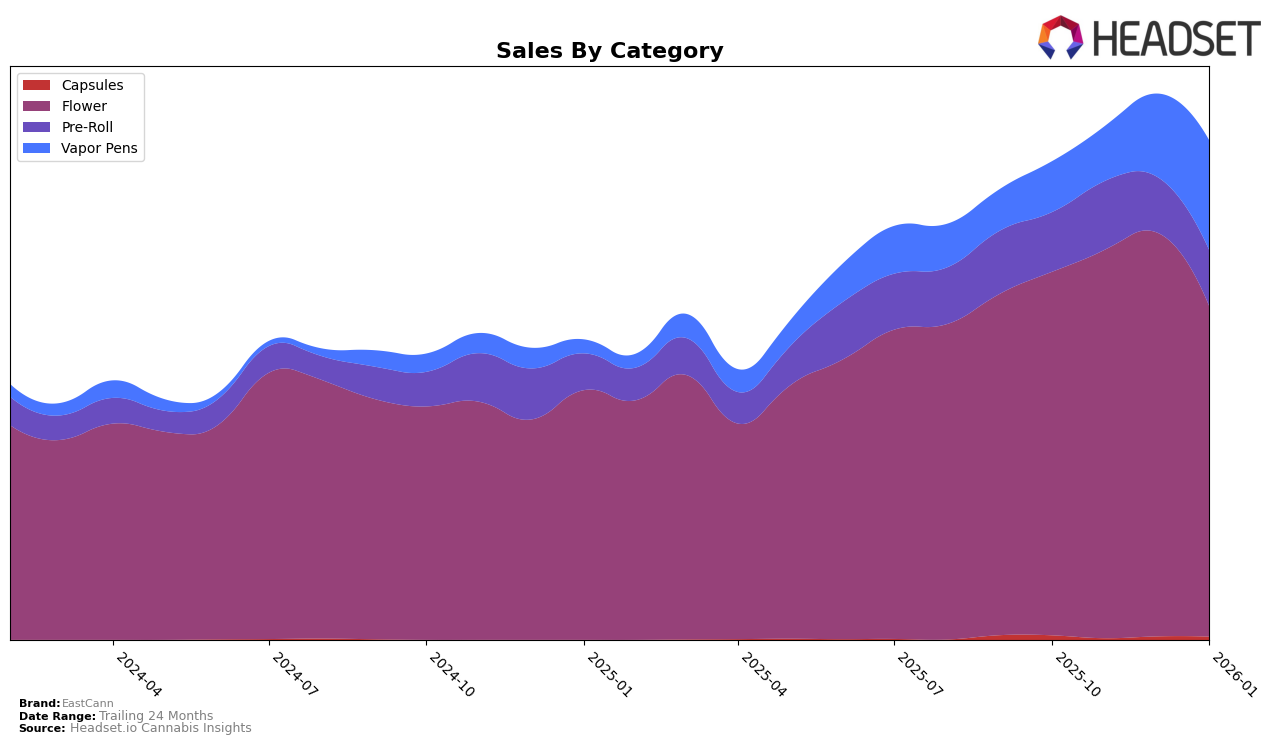

EastCann's performance in the Alberta market for the Flower category has shown noticeable fluctuations. While the brand did not make it to the top 30 in October 2025, it climbed to the 87th position in November, further improving to 63rd in December before slipping back to 84th in January 2026. This indicates a volatile presence in Alberta, as the brand struggles to maintain a consistent top position. Such movements suggest that while EastCann has the potential to capture market attention, sustaining it remains a challenge.

In Ontario, EastCann has maintained a stable presence in the Flower category, consistently ranking around the 25th position from October 2025 to January 2026. However, their performance in the Pre-Roll category has been less stable, with rankings fluctuating between 76th and 89th, indicating potential room for improvement. Notably, EastCann has shown impressive growth in the Vapor Pens category, moving from the 46th position in October to 31st by January 2026. In Saskatchewan, EastCann's Flower category performance has been relatively stable, with a notable peak at 14th in November before settling at 23rd by January. This suggests a strong yet variable presence in these markets, with opportunities to strengthen their standing further.

Competitive Landscape

In the competitive landscape of the Ontario flower category, EastCann has maintained a relatively stable position, ranking 25th in October and November 2025, slightly improving to 24th in December 2025, before returning to 25th in January 2026. Despite this consistency, EastCann faces stiff competition from brands like Tribal, which consistently ranked higher, peaking at 21st in December 2025, and Sixty Seven Sins, which started strong at 22nd in October 2025 but dropped to 27th by January 2026. Meanwhile, BLKMKT and Woody Nelson have not breached the top 20 either, indicating a competitive but not insurmountable market. EastCann's sales figures, while fluctuating, suggest a need for strategic adjustments to climb the ranks, especially considering Tribal's higher sales performance in December 2025. This competitive analysis highlights the importance of leveraging advanced data insights to identify growth opportunities and enhance market positioning.

Notable Products

In January 2026, Velvet Z (1g) maintained its top position in EastCann's product lineup, with sales reaching 3,487 units. Velvet Z (7g) followed closely in second place, consistently holding this rank since December 2025. Mango Sour Cured Resin Cartridge (1g) remained steady at third, despite a decrease in sales compared to December. Chopper's Pick (28g) saw a drop to fourth place, continuing its decline from the top spot it held in October 2025. Notably, Frozen Lemons Live Resin Cartridge (1g) entered the rankings at fifth, marking its first appearance in the dataset.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.