Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

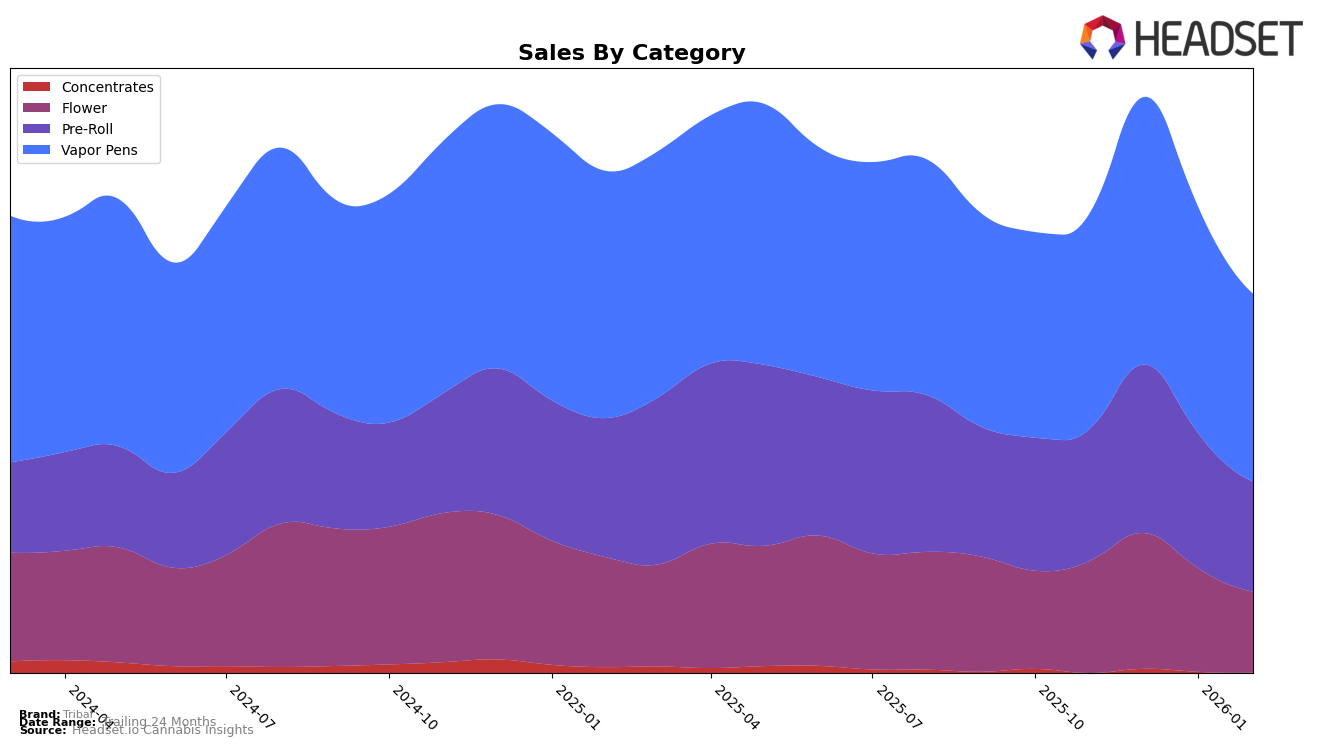

Tribal's performance across various categories and provinces showcases a mix of stability and challenges. In Alberta, the brand's ranking in the Flower category has seen a decline, dropping from 32nd in November 2025 to 46th by February 2026, indicating a downward trend in this category. However, their performance in the Pre-Roll category has been more stable, maintaining a consistent position around the mid-teens despite a slight dip in sales. Meanwhile, in the Vapor Pens category, Tribal has remained competitive, showing a slight fluctuation but maintaining a strong presence within the top 20. This suggests a robust consumer base for their vapor pen products in Alberta.

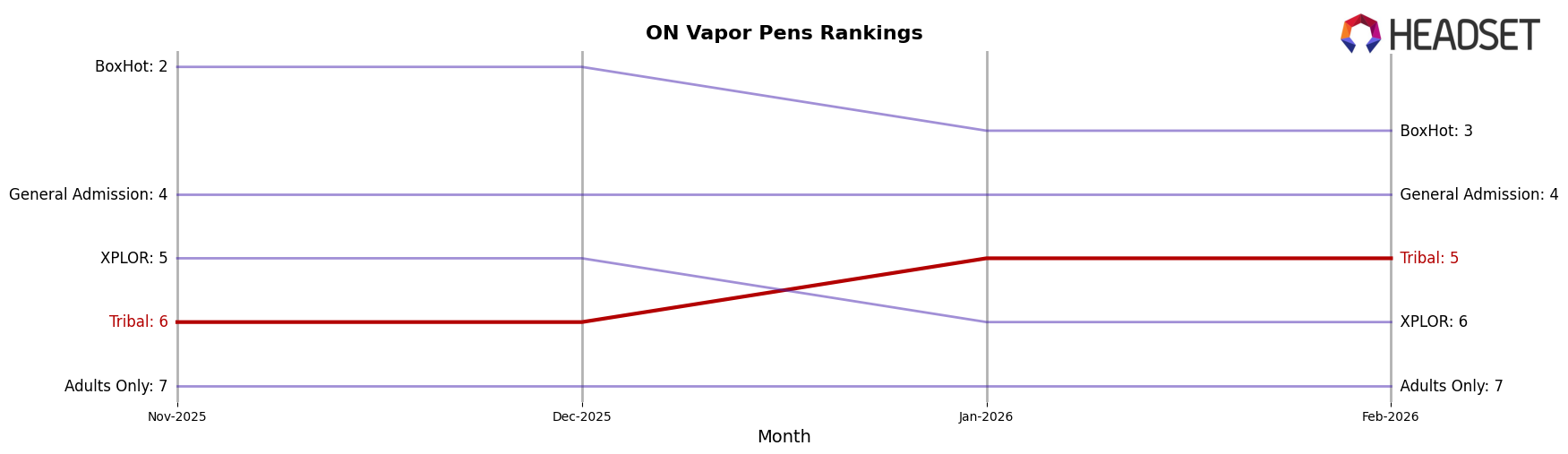

In British Columbia, Tribal's Flower category rankings have also experienced a slight decline, moving from 24th to 31st over the same period. This indicates potential challenges in maintaining market share within this segment. Interestingly, their Vapor Pens category has shown more stability, consistently holding a position around 15th place, which could imply a steady demand for these products. In Ontario, Tribal's performance in the Vapor Pens category is notably strong, consistently ranking within the top 6, highlighting a significant market presence. However, it's worth noting that Tribal did not appear in the top 30 for Concentrates in November 2025, which could suggest an area for potential growth or improvement.

Competitive Landscape

In the competitive landscape of vapor pens in Ontario, Tribal has shown a promising upward trajectory in recent months. From November 2025 to February 2026, Tribal improved its rank from 6th to 5th, indicating a positive shift in its market position. This advancement is particularly notable when compared to its competitors. For instance, General Admission maintained a steady 4th position throughout the same period, while BoxHot consistently held a higher rank at 2nd and 3rd, suggesting a strong market presence. Meanwhile, XPLOR experienced a decline, dropping from 5th to 6th, which could have contributed to Tribal's rise. Despite Adults Only maintaining a stable 7th position, Tribal's ability to climb the ranks highlights its growing appeal and potential to capture more market share in the Ontario vapor pen category.

Notable Products

In February 2026, Cuban Linx Pre-Roll (1g) maintained its top position among Tribal products, showing consistent performance as the leading product in the Pre-Roll category with sales reaching 14,321 units. Cuban Linx Live Resin Cartridge (1g) held steady in second place in the Vapor Pens category, despite a slight decline in sales compared to previous months. Bubble Up Pre-Roll (1g) remained consistently in third place, maintaining its rank from November 2025 through February 2026. Notably, Neon Sunshine Pre-Roll (1g) improved its position to fourth place, climbing from fifth in January 2026. Cuban Linx (3.5g) experienced a drop in ranking to fifth place in the Flower category, reflecting a downward trend from its second-place position in November 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.