Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

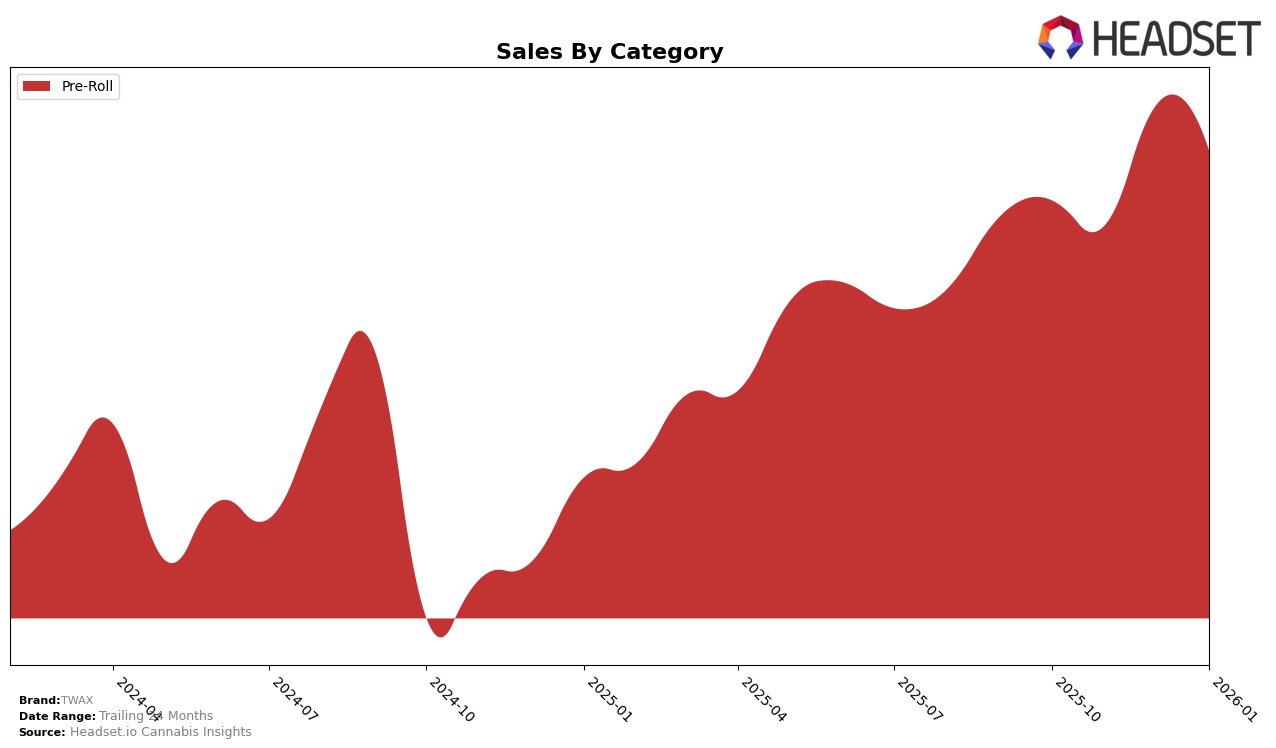

TWAX has shown varied performance across different states and categories, with notable movements in the Colorado Pre-Roll market. The brand has experienced a positive trajectory, advancing from 11th place in October 2025 to 6th place by January 2026, reflecting a steady increase in sales figures during this period. This upward movement is indicative of growing consumer preference or effective market strategies in Colorado. Conversely, in Missouri, TWAX has faced challenges, slipping from 25th place in October 2025 to outside the top 30 by December 2025 and further declining in January 2026. This decline suggests potential market saturation or increased competition affecting the brand's visibility and sales in the state.

In New Jersey, TWAX has demonstrated resilience and growth, moving from 27th place in October 2025 to 18th place by December 2025, though slightly dropping to 20th in January 2026. This fluctuation indicates a competitive but promising market environment for TWAX as it gains traction. However, in Nevada, TWAX's performance has been less robust, as it did not rank in the top 30 for December and January, highlighting potential areas for improvement or strategic adjustment. This mixed performance across states underscores the dynamic nature of the cannabis market and the importance of tailored strategies to address regional preferences and competition.

Competitive Landscape

In the competitive landscape of the Pre-Roll category in Colorado, TWAX has shown a notable upward trajectory in rankings from October 2025 to January 2026. Initially ranked 11th in October, TWAX climbed to 6th place by January, indicating a strong upward momentum in the market. This rise is significant, especially when compared to competitors like Bloom County, which experienced a decline from 4th to 7th place over the same period. Meanwhile, Seed & Strain Cannabis Co. maintained a steady position in the top 4, suggesting a robust market presence. TWAX's sales growth aligns with its improved ranking, contrasting with the sales decline seen by Bonsai Cultivation, which remained consistently at 5th place. This dynamic shift highlights TWAX's potential to capture more market share and suggests a positive trend for future performance in Colorado's Pre-Roll sector.

Notable Products

In January 2026, Grapevine Distillate Infused Pre-Roll (1g) maintained its top position in the TWAX product lineup with sales of 6,184 units. Lemon Haze Distillate Infused Pre-Roll (1g) consistently held the second rank, showing stable performance across the months. Banana Cream Distillate Infused Pre-Roll (1g) rose to the third spot, improving from its fourth position in December 2025. Strawberry Banana Distillate Infused Pre-Roll (1g) dropped to fourth place, while Blueberry Distillate Infused Pre-Roll (1g) remained steady at fifth. Overall, the rankings indicate a strong preference for the Grapevine variant, with notable shifts in the middle-tier product rankings over the months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.