Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

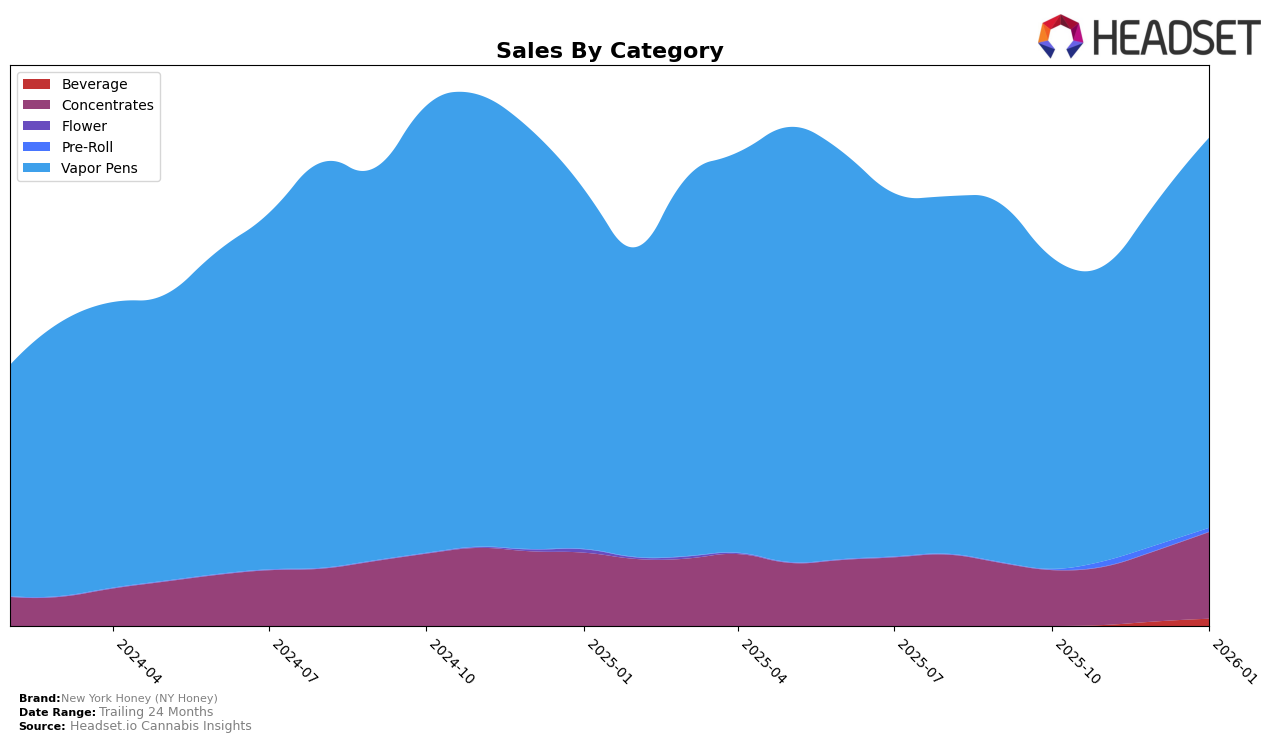

New York Honey (NY Honey) has shown a consistent presence in the New York market, particularly in the Concentrates category. Over the four-month period from October 2025 to January 2026, the brand maintained a steady ranking, hovering between 7th and 9th place. This stability in the top 10 indicates a strong foothold in the Concentrates segment, with sales showing a positive upward trend, culminating in a significant increase by January 2026. The consistent performance in this category highlights their competitive edge and ability to maintain consumer interest over time.

In the Vapor Pens category, New York Honey (NY Honey) experienced more fluctuation in rankings, starting at 20th place in October 2025 and rising to 16th by January 2026. This improvement suggests a growing popularity or possibly effective marketing strategies that have helped the brand climb the ranks. The sales figures for Vapor Pens also reflect a positive trajectory, with a notable increase from November to January, indicating a successful holiday season or product launch. However, the absence of a top 30 ranking in other states or provinces suggests that their influence remains largely concentrated within New York, presenting both a challenge and an opportunity for expansion.

Competitive Landscape

In the competitive landscape of vapor pens in New York, New York Honey (NY Honey) has shown a promising upward trajectory in recent months. Starting from a rank of 20 in October 2025, NY Honey improved to 16 by January 2026, indicating a positive shift in market presence. This advancement is particularly noteworthy when compared to competitors like Jetty Extracts, which fluctuated between ranks 12 and 17, and Mfused, which saw a decline from 8 to 15 over the same period. Meanwhile, Select maintained a relatively stable position in the mid-teens, and Turn improved from outside the top 20 to rank 17. NY Honey's sales figures also reflect this positive trend, with a notable increase from October to January, surpassing competitors like Select and Turn. This consistent growth in both rank and sales suggests that NY Honey is effectively capturing market share and could be poised for continued success in the New York vapor pen category.

Notable Products

In January 2026, New York Honey (NY Honey) saw the Blue Dream Distillate Cartridge (1g) maintain its top spot in the Vapor Pens category with impressive sales of 3010 units, continuing its consistent performance from previous months. The Barry White Distillate Cartridge (1g) also held steady at the second position, reflecting a strong market presence. Golden Ticket Distillate Disposable (1g) climbed back to the third rank from fourth in December 2025, indicating a positive shift in consumer preference. Meanwhile, Strawberry Cough Distillate Cartridge (1g) slipped to fourth place, showing a slight decline in its ranking. Mimosa Distillate Cartridge (1g) entered the rankings at fifth place, showcasing a new contender in the competitive landscape.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.