Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

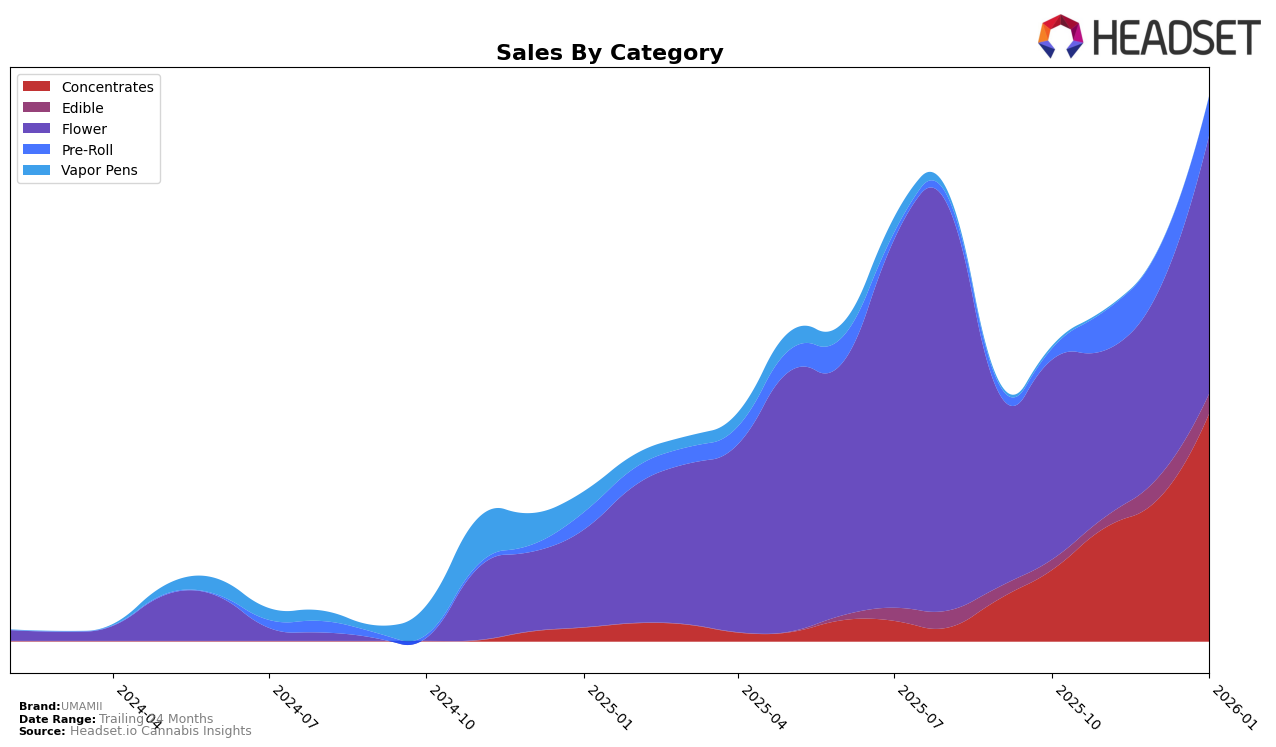

UMAMII has demonstrated notable growth in the New York concentrates category, climbing from 17th place in October 2025 to an impressive 8th place by January 2026. This upward trajectory is reflected in their sales figures, which have significantly increased over the same period. This performance suggests a strong market presence and growing consumer preference for UMAMII's concentrates. In contrast, their performance in the edible category has been less prominent, as they did not appear in the top 30 rankings until January 2026, where they entered at 60th place. This indicates a potential area for growth and increased market penetration for UMAMII in the edibles market.

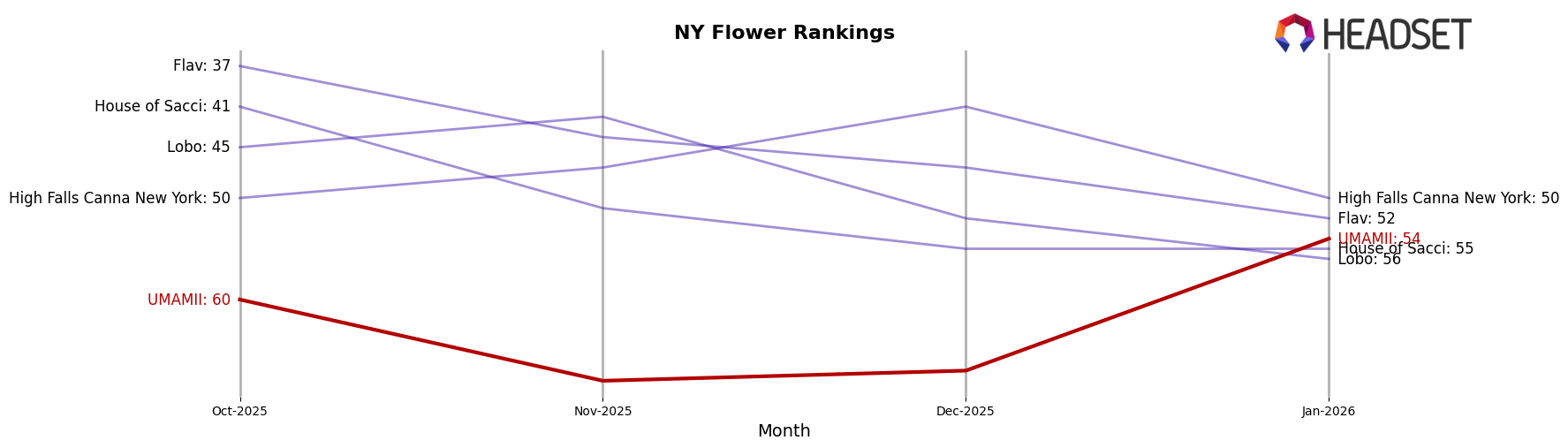

In the flower category, UMAMII has shown a mixed performance in New York. Starting at 60th place in October 2025, they experienced a slight decline in November and December but managed to rebound to 54th place by January 2026. Despite these fluctuations, the brand's sales in this category have seen a notable increase, suggesting that while their ranking may not reflect a dominant market position, there is still a steady demand for their flower products. This pattern of performance across different categories highlights UMAMII's strengths and potential areas for strategic focus as they continue to expand their brand presence.

Competitive Landscape

In the competitive landscape of the Flower category in New York, UMAMII has shown a notable improvement in its rank from December 2025 to January 2026, moving from 67th to 54th position. This upward trend is significant, especially when compared to competitors like Flav, which has seen a consistent decline in rank from 37th in October 2025 to 52nd in January 2026. Similarly, Lobo and House of Sacci have also experienced downward trends, with Lobo dropping from 45th to 56th and House of Sacci remaining stagnant at 55th in January 2026. Meanwhile, High Falls Canna New York saw a fluctuating performance, peaking at 41st in December 2025 but falling back to 50th by January 2026. UMAMII's sales have also increased significantly in January 2026, reflecting a positive reception in the market, which could be attributed to strategic marketing efforts or product innovations. This positions UMAMII as a rising competitor in the New York Flower market, suggesting potential for further growth and market share capture.

Notable Products

In January 2026, UMAMII's top-performing product was Gary Payton x Lemley Cured Resin (1g) in the Concentrates category, climbing from third place in December 2025 to first place with sales reaching 779 units. Cherry Paloma x Georgia Apple Pie Cured Resin (1g) also showed significant improvement, moving up from fifth to second place with 637 units sold. Grape Pie x Animal Cookies Live Rosin (1g) entered the rankings at third place, indicating strong initial performance. GMO (14g) in the Flower category debuted at fourth place, while Papaya Live Rosin (1g) dropped from first in December to fifth in January. The shifts in rankings suggest a growing preference for cured resin products among consumers.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.