Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

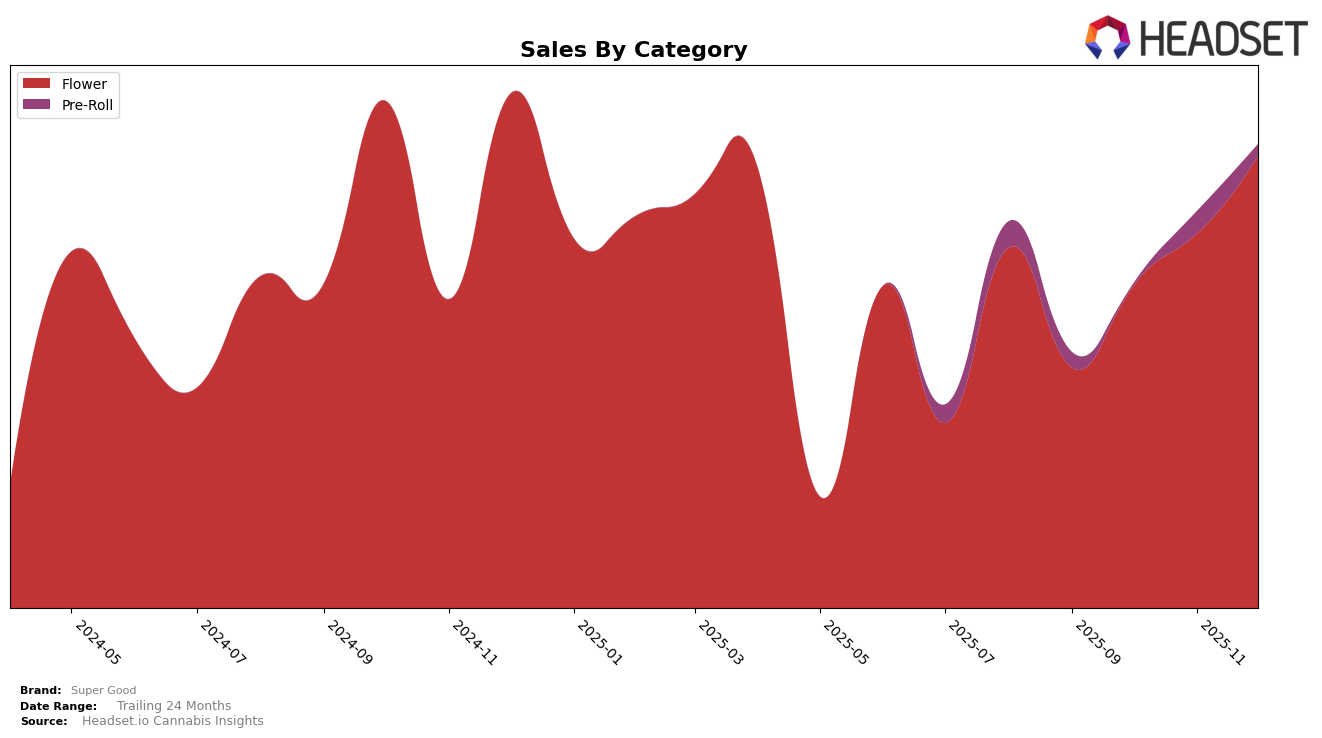

Super Good has shown a notable performance improvement in the Flower category in Nevada over the final months of 2025. Climbing from a rank of 36 in September to 25 by December, the brand has demonstrated consistent upward momentum in the highly competitive Flower market. This upward trend is underscored by a significant increase in sales, which rose from $163,789 in September to $308,241 by December. Such a trajectory suggests that Super Good is effectively capturing consumer interest and expanding its market presence in Nevada's Flower category.

In contrast, Super Good's performance in the Pre-Roll category in Nevada presents a more mixed picture. While the brand achieved a rank of 56 in November, it was absent from the top 30 in both October and December, indicating potential volatility or challenges in maintaining a consistent market position. Despite these fluctuations, there was a positive sales trend from September to November, with sales increasing from $10,491 to $15,183. This suggests that while the brand is making strides in Pre-Rolls, there may be room for improvement in sustaining a stable ranking within this category.

Competitive Landscape

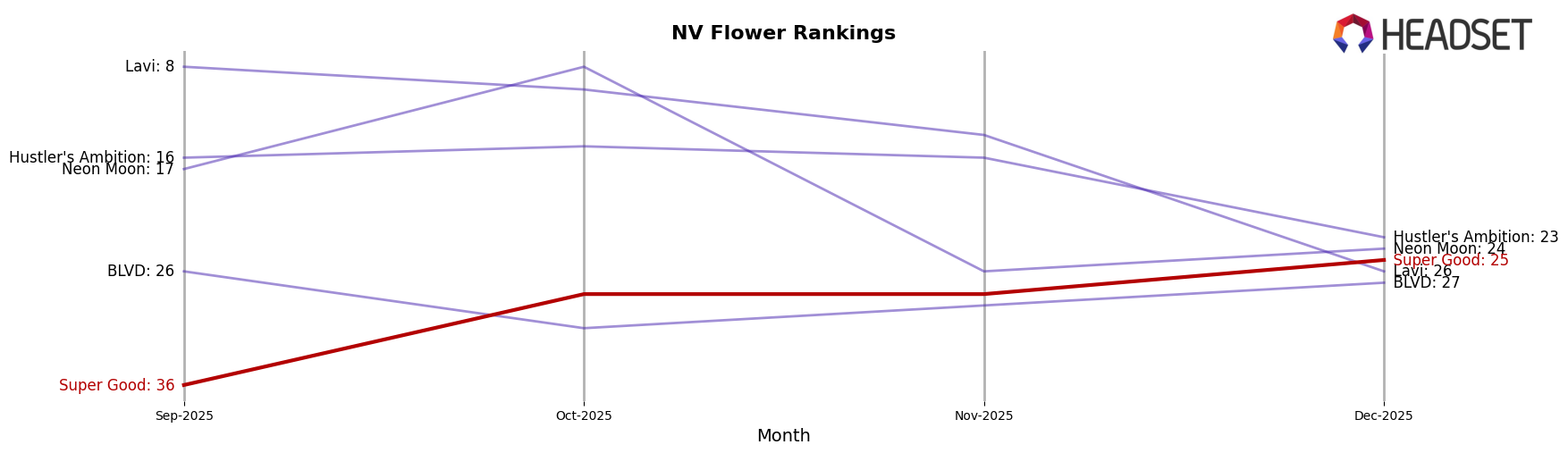

In the competitive landscape of the Nevada flower category, Super Good has demonstrated a promising upward trajectory in brand rank, moving from 36th position in September 2025 to 25th by December 2025. This improvement is indicative of a positive sales trend, as Super Good's sales figures have consistently increased each month. In contrast, Lavi experienced a decline in rank from 8th to 26th over the same period, with a corresponding drop in sales, suggesting potential market share opportunities for Super Good. Similarly, Neon Moon and Hustler's Ambition showed fluctuating ranks, with Neon Moon peaking at 8th in October before slipping to 24th in December, and Hustler's Ambition maintaining a relatively stable yet lower rank. These shifts highlight Super Good's potential to capitalize on the volatility of its competitors and further solidify its position in the Nevada flower market.

Notable Products

In December 2025, OG Diesel (14g) emerged as the top-performing product for Super Good, achieving the number one rank with a notable sales figure of 1323 units. Ruby Red (14g) maintained its position at second place, showing a slight decrease in sales compared to November. Rainbow Ice Pre-Roll (1g) occupied the third spot, slipping from its previous rank in September but maintaining strong sales. A new entrant, 702 Headband (14g), debuted at fourth place, highlighting its growing popularity. Pink Runtz (14g) rounded out the top five, dropping from its second-place ranking in October, indicating a shift in consumer preference.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.