Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

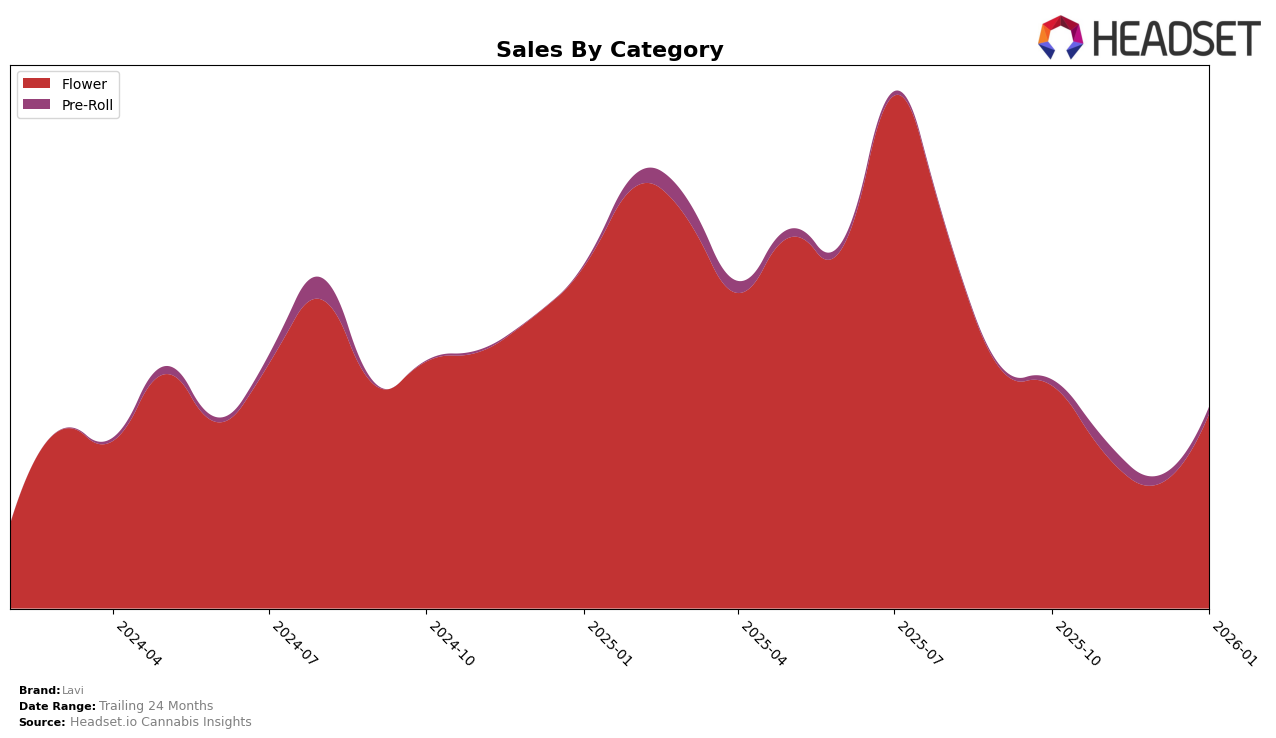

Lavi's performance in the Nevada market reveals interesting trends across different product categories. In the Flower category, Lavi experienced fluctuations in their rankings, starting at the 10th position in October 2025 and dropping to the 20th position by December 2025. However, they managed to climb back up to the 13th position in January 2026. This indicates a potential recovery or strategic adjustment that might have positively impacted their sales trajectory. On the contrary, their Pre-Roll category performance in Nevada shows that they were unable to break into the top 30 in October 2025 but made a significant leap to the 35th position in November. Despite this improvement, they struggled to maintain a consistent upward trend, ending at the 46th position in January 2026.

While Lavi's Flower category showed resilience with a notable sales increase in January 2026, suggesting a strategic pivot or market adaptation, the Pre-Roll category results highlight areas for potential growth. The absence from the top 30 in October and the moderate rankings in subsequent months suggest that Lavi might face stiff competition or challenges in this segment. These movements across categories imply that while Lavi has a solid foothold in the Flower market, there is room for improvement and expansion in Pre-Rolls. Readers interested in a deeper dive into Lavi's strategies and specific sales figures might find additional insights by exploring detailed market reports or competitive analyses.

Competitive Landscape

In the competitive landscape of the Flower category in Nevada, Lavi experienced notable fluctuations in its ranking over the observed months. Starting at 10th place in October 2025, Lavi's rank slipped to 13th in November, further dropping to 20th in December, before recovering slightly to 13th in January 2026. This trajectory suggests a volatile market presence, potentially influenced by the performance of competitors like FloraVega / Welleaf, which saw a similar dip but managed to rebound to 12th place by January. Meanwhile, Summa Cannabis maintained a steadier position, fluctuating slightly but consistently ranking above Lavi in December and January. Solaris emerged as a strong competitor, climbing from 16th in October to 8th in December, before settling at 11th in January, indicating a robust upward trend that could pose a significant challenge to Lavi's market share. The competitive dynamics underscore the importance for Lavi to strategize effectively to regain and sustain its market position amidst these shifting ranks.

Notable Products

In January 2026, Sexual Healing (14g) from Lavi topped the sales chart, achieving the number one rank with impressive sales figures of 1274 units. Headband (14g) secured the second position, showing a slight drop from its previous top rank in December 2025 with 1260 units sold. La Bomba (14g) climbed to third place, marking a significant improvement from its fifth position in November 2025. Orange Beltz (14g) and Lemon Cherry Gelato Popcorn (7g) completed the top five, with Orange Beltz making its debut in the rankings. The notable shifts in rankings highlight a dynamic change in consumer preferences from previous months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.