Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

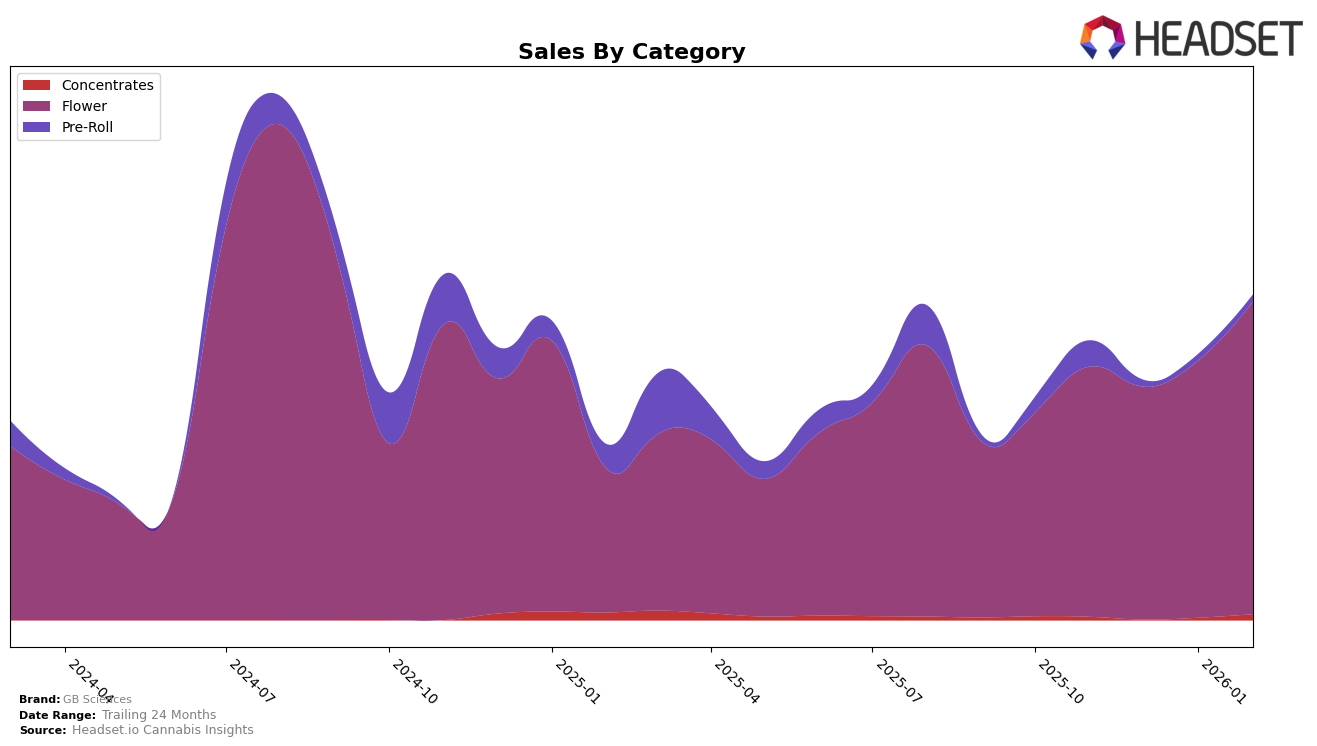

GB Sciences has shown notable movement in the Nevada market, particularly within the Flower category. Over the span from November 2025 to February 2026, the brand's ranking improved significantly from 26th to 21st. This upward trend is indicative of a strong performance, as the brand managed to climb five positions within a few months. Meanwhile, in the Pre-Roll category, GB Sciences did not make it into the top 30, as indicated by their absence from the rankings. This suggests a possible area for improvement or a shift in focus towards categories where they are currently more competitive.

Despite the absence from the top 30 in Pre-Rolls, the overall sales trajectory for GB Sciences in Nevada is positive, particularly highlighted by the increase in Flower sales from December 2025 to February 2026. The Flower category not only saw an increase in ranking but also in sales figures, suggesting a growing consumer preference or effective marketing strategies that resonate well with their target audience. This performance could indicate potential for further growth if similar strategies are applied across other categories or states. However, without further data, it remains to be seen how these trends will evolve in the coming months.

Competitive Landscape

In the Nevada flower category, GB Sciences has shown a promising upward trend in its market position, climbing from a rank of 29 in December 2025 to 21 by February 2026. This improvement in rank is indicative of a positive trajectory in sales, which increased from December to February. In contrast, Polaris MMJ experienced a decline after a peak in December, stabilizing at rank 20 by February. Meanwhile, CAMP (NV) saw a significant drop from rank 8 in November to 23 in February, reflecting a notable decrease in sales. Savvy showed inconsistent rankings, missing from the top 20 in January but rebounding to rank 19 in February. Hustler's Ambition also fluctuated, ending February just one rank below GB Sciences. These dynamics suggest that while GB Sciences is on an upward trajectory, the competitive landscape remains volatile, with several brands experiencing significant shifts in their market positions.

Notable Products

In February 2026, GB Sciences' top-performing product was Jenny Kush (3.5g) in the Flower category, maintaining its first-place ranking for four consecutive months with sales reaching 8,835 units. Jenny Kush (14g), also in the Flower category, held steady at the second position since January 2026. The Jenny Kush Pre-Roll (1g) in the Pre-Roll category remained consistent in third place, reflecting stable demand over the last two months. Jenny Kush Cured Resin Badder (1g) and Jenny Kush Cured Resin Sugar (1g), both in the Concentrates category, secured the fourth and fifth spots, respectively, showing a solid entry into the top rankings since their introduction. Overall, the rankings indicate a strong, consistent performance across different product types for GB Sciences in February 2026.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.