Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

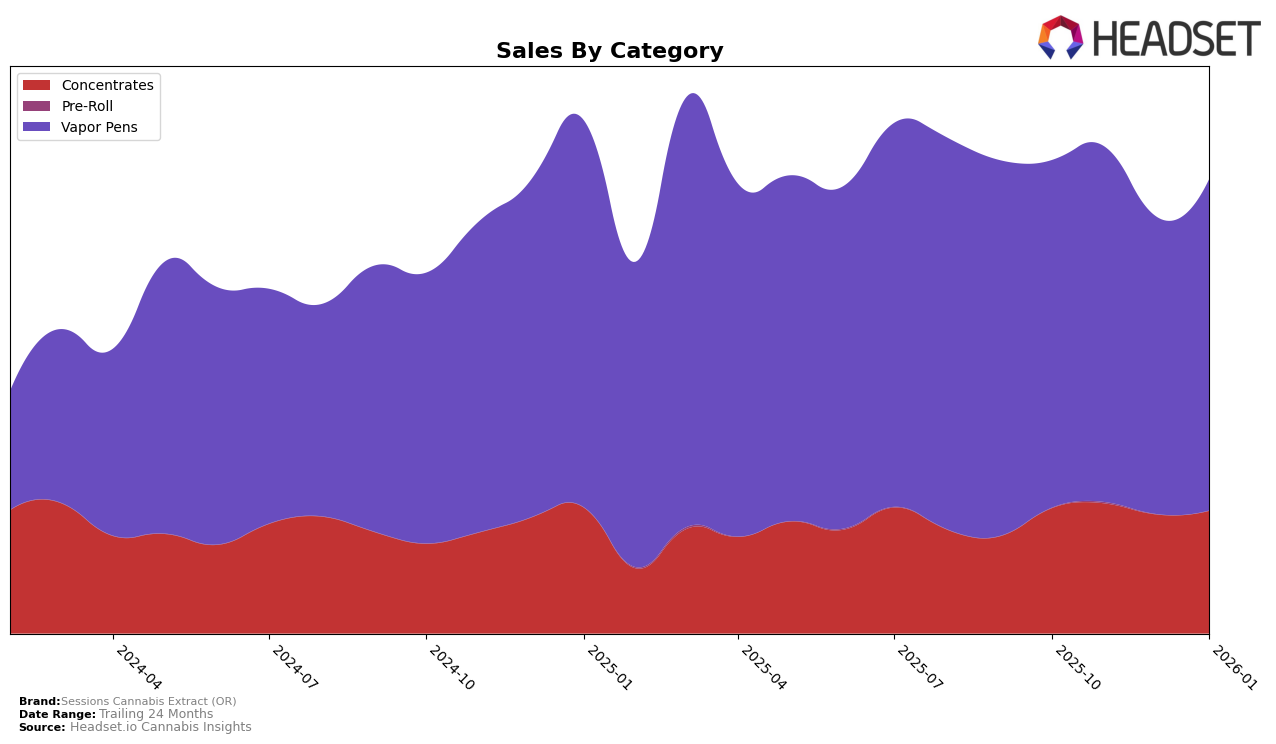

Sessions Cannabis Extract (OR) has shown a consistent performance in the Oregon market, particularly within the Concentrates category. Over the months from October 2025 to January 2026, the brand maintained a steady ranking, fluctuating slightly from 7th to 9th position. This indicates a relatively stable presence in the top 10, which is commendable given the competitive nature of the market. The brand's sales figures reflect a slight dip in December, followed by a recovery in January, suggesting resilience in maintaining consumer interest and market share.

In the Vapor Pens category, Sessions Cannabis Extract (OR) experienced more variability in its rankings within Oregon. The brand held the 13th position in both October and November 2025, dropped to 16th in December, and then climbed back to 14th in January 2026. This fluctuation highlights a more competitive landscape in the Vapor Pens category, where maintaining a position in the top 15 is notable. The sales trajectory mirrors this movement, with a noticeable decrease in December followed by a rebound in January, indicating potential seasonality or shifts in consumer preferences during these months. The absence of a ranking in the top 30 in any state or province outside of Oregon suggests that the brand's reach might be currently limited geographically, presenting both a challenge and an opportunity for future expansion.

Competitive Landscape

In the competitive landscape of Vapor Pens in Oregon, Sessions Cannabis Extract (OR) has experienced fluctuations in its market position over the past few months. Starting at rank 13 in October 2025, Sessions saw a dip to rank 16 by December 2025, before slightly recovering to rank 14 in January 2026. This volatility is notable when compared to competitors such as Verdant Leaf Farms, which maintained a relatively stable position, peaking at rank 13 in December 2025. Meanwhile, Higher Cultures consistently outperformed Sessions, holding a steady rank around 11 and 12 throughout the period. Gem Carts also showed a positive trend, climbing from rank 16 in October 2025 to 13 by January 2026, indicating a competitive pressure on Sessions. Despite these challenges, Sessions Cannabis Extract (OR) demonstrated resilience with a notable sales rebound in January 2026, suggesting potential for regaining its competitive edge in the Oregon Vapor Pens market.

Notable Products

In January 2026, Sessions Cannabis Extract (OR) saw Juke Box Hero Cured Resin (1g) leading the sales charts as the top-performing product, with sales reaching 1155 units. Following closely, Forbidden Cookies Cured Resin (1g) and Lemon Drizzle Cured Resin Disposable (1g) secured the second and third spots, respectively. Vapor pens were notably popular, with Peaches Peaches Cured Resin Cartridge (1g) and Jam Session Cured Resin Disposable (1g) rounding out the top five. Compared to previous months, these products have shown a significant rise in rankings, indicating a shift in consumer preference towards cured resin products. This upward trend in sales for concentrates and vapor pens suggests a growing demand for these categories.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.