Sep-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

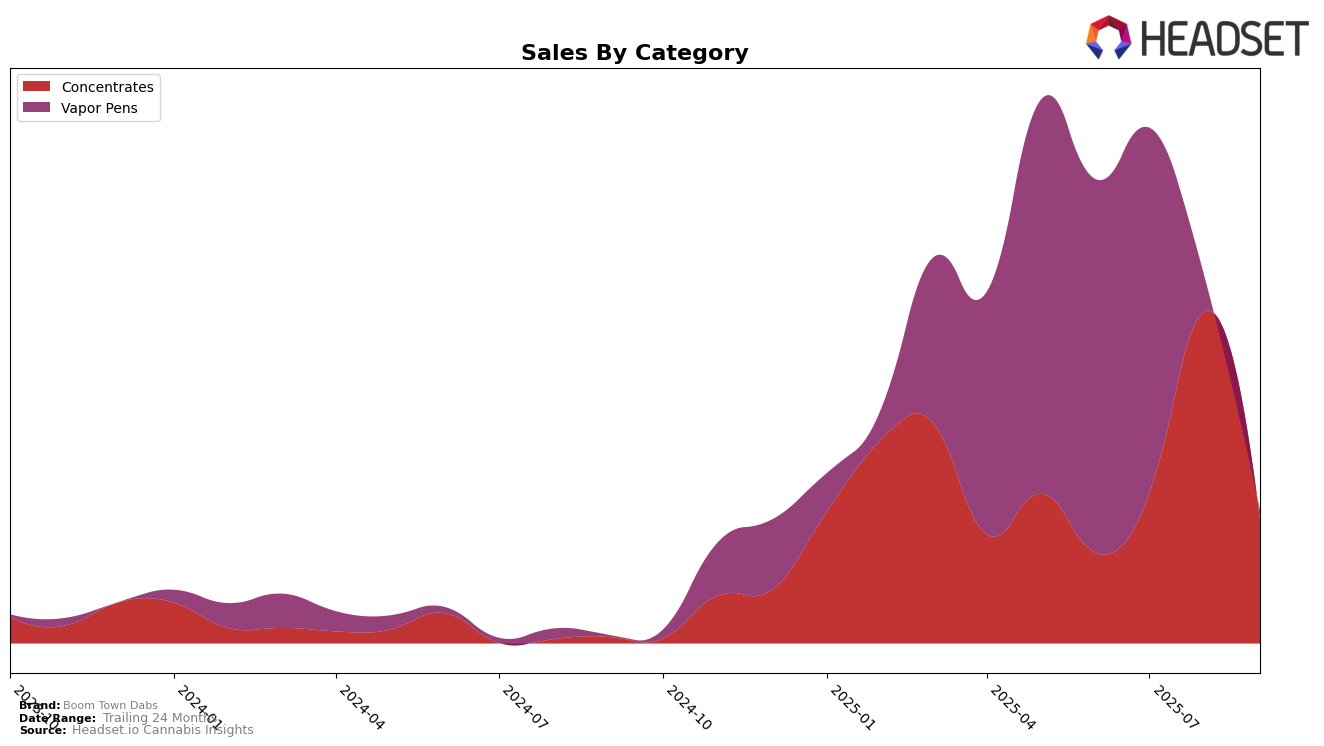

Boom Town Dabs has shown notable performance fluctuations across various categories and states. In the Nevada market, the brand has experienced significant movement in the Concentrates category. Starting from a 9th position in June 2025, Boom Town Dabs climbed to an impressive 2nd position by August before slipping back to 7th in September. This indicates a strong competitive presence but also highlights potential volatility or seasonal demand changes. The brand's sales in this category peaked in August, suggesting a period of heightened consumer interest or successful marketing strategies during this time.

Conversely, Boom Town Dabs' performance in the Vapor Pens category in Nevada shows a different trend. The brand started at 16th in June and slightly dropped to 17th in July, eventually falling out of the top 30 by August and September. This decline suggests challenges in maintaining market share or possibly increased competition within the category. The absence of a ranking in the latter months could be seen as a negative indicator, pointing to the brand's need to reassess its strategy in this segment. Despite this, the brand's overall sales figures in other categories could provide a buffer while they navigate these fluctuations.

Competitive Landscape

In the Nevada concentrates market, Boom Town Dabs has experienced significant fluctuations in its ranking over the past few months, reflecting a dynamic competitive landscape. Notably, Boom Town Dabs surged to the second position in August 2025, indicating a strong performance that month, before dropping back to seventh in September. This volatility suggests that while Boom Town Dabs can achieve high sales, maintaining that momentum is challenging amidst strong competition. For instance, City Trees consistently held a higher rank than Boom Town Dabs in June and July, although their sales have been on a downward trend. Meanwhile, Locals Only Concentrates showed resilience by regaining its fifth position in September, potentially indicating a stable customer base. Additionally, Hippies made a notable leap from outside the top 20 in July to eighth in September, suggesting emerging competition. These insights highlight the need for Boom Town Dabs to strategize effectively to capitalize on its peak performances and navigate the competitive pressures in Nevada's concentrates market.

Notable Products

In September 2025, the top-performing product from Boom Town Dabs was Point Break Live Resin Batter (1g), which secured the number one rank in the Concentrates category with sales reaching 1168 units. Black Velvet Live Resin Batter (1g) maintained its second position from August, with sales slightly decreasing to 926 units. Gello Live Resin Batter (1g) also held its third position consistently, although its sales dropped to 856 units. Member Berry Live Resin Badder (1g) experienced a notable drop from first place in August to fourth in September. Old School Lemons Live Resin Batter (1g) rounded out the top five, newly entering the rankings this month.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.