Aug-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

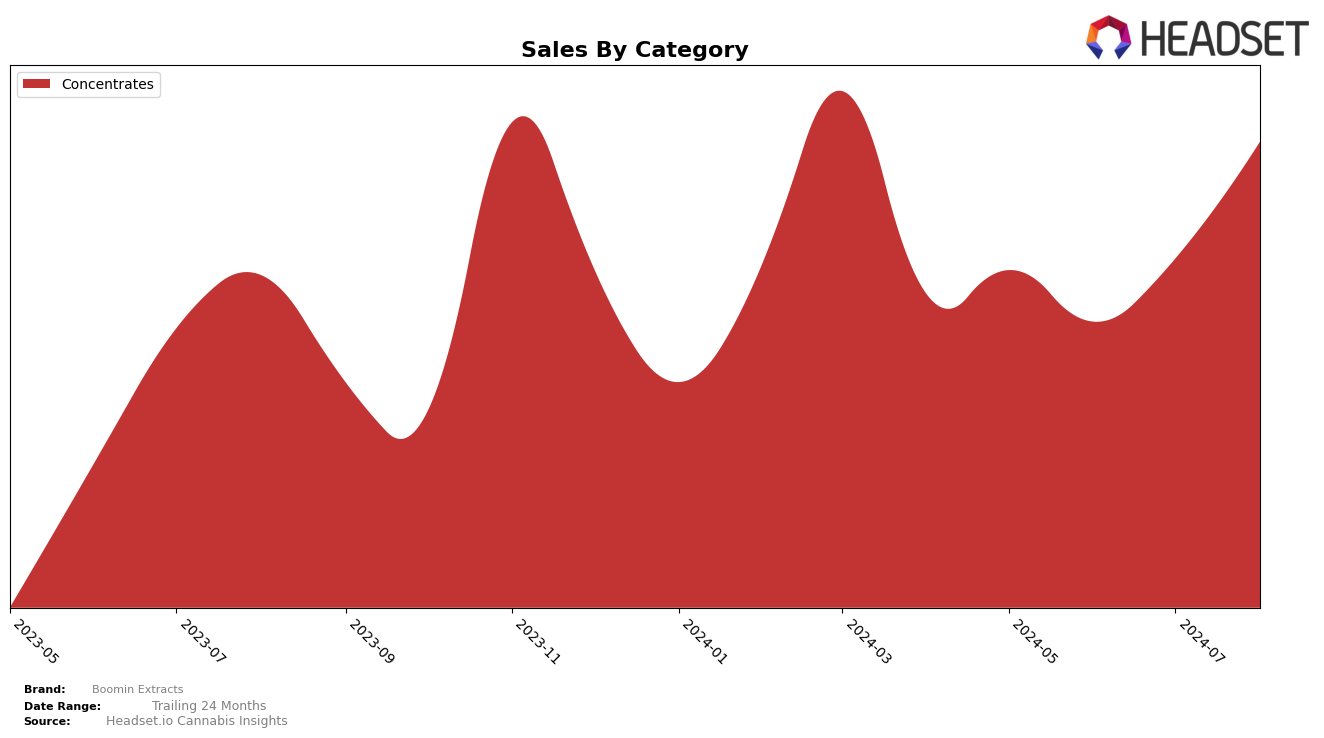

Boomin Extracts has shown a notable performance in the Concentrates category within Oregon. Despite starting May 2024 ranked at 33rd, the brand experienced a positive trajectory, moving up to 31st in July and reaching 27th by August. This upward trend indicates growing consumer interest and market penetration in Oregon, especially notable given their absence from the top 30 rankings in earlier months. The increase in rank is accompanied by a significant jump in sales, with August figures showing a substantial rise from previous months, underscoring the brand's strengthening foothold in the market.

While Boomin Extracts has demonstrated growth in Oregon, the brand's absence from the top 30 in other states and categories suggests a more localized success. This localized performance could indicate either a strategic focus on the Oregon market or challenges in scaling operations and brand recognition beyond this state. The data highlights the importance of regional strategies and market-specific adaptations for cannabis brands aiming to expand their footprint. Observing Boomin Extracts' continued performance in Oregon can provide insights into their potential for broader market success.

Competitive Landscape

In the competitive landscape of Oregon's concentrates market, Boomin Extracts has shown a notable fluctuation in its rank and sales over the past few months. While Boomin Extracts was ranked 33rd in May 2024, it experienced a dip to 36th in June before climbing back to 31st in July and 27th in August. This upward trend in the latter months indicates a potential recovery and growing consumer interest. In comparison, Mana Extracts consistently outperformed Boomin Extracts, maintaining higher ranks and sales, although it dropped out of the top 20 in August. Similarly, Elysium Fields showed a significant improvement, moving from 54th in May to 26th in August, suggesting a strong upward trajectory. Oregon Grown also displayed a competitive edge, although it too fell out of the top 20 in August. Meanwhile, Private Stash maintained a relatively stable position but saw a drop in July before slightly recovering in August. These dynamics highlight the competitive pressures Boomin Extracts faces and underscore the importance of strategic marketing and product differentiation to improve its market position.

Notable Products

In August 2024, Blueberry Pie Batter (2g) from Boomin Extracts emerged as the top-performing product with a notable sales figure of 1000.0 units. Tally Man Batter (2g) secured the second position, showing a consistent high ranking from previous months. Frosted Hog Batter (2g) dropped to third place despite leading in June and July. GMO Batter (2g) maintained a steady presence, ranking fourth in August after a brief absence in July. Cake Crasher Batter (2g) made its debut in the rankings at fifth place, indicating a strong entry into the market.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.