Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

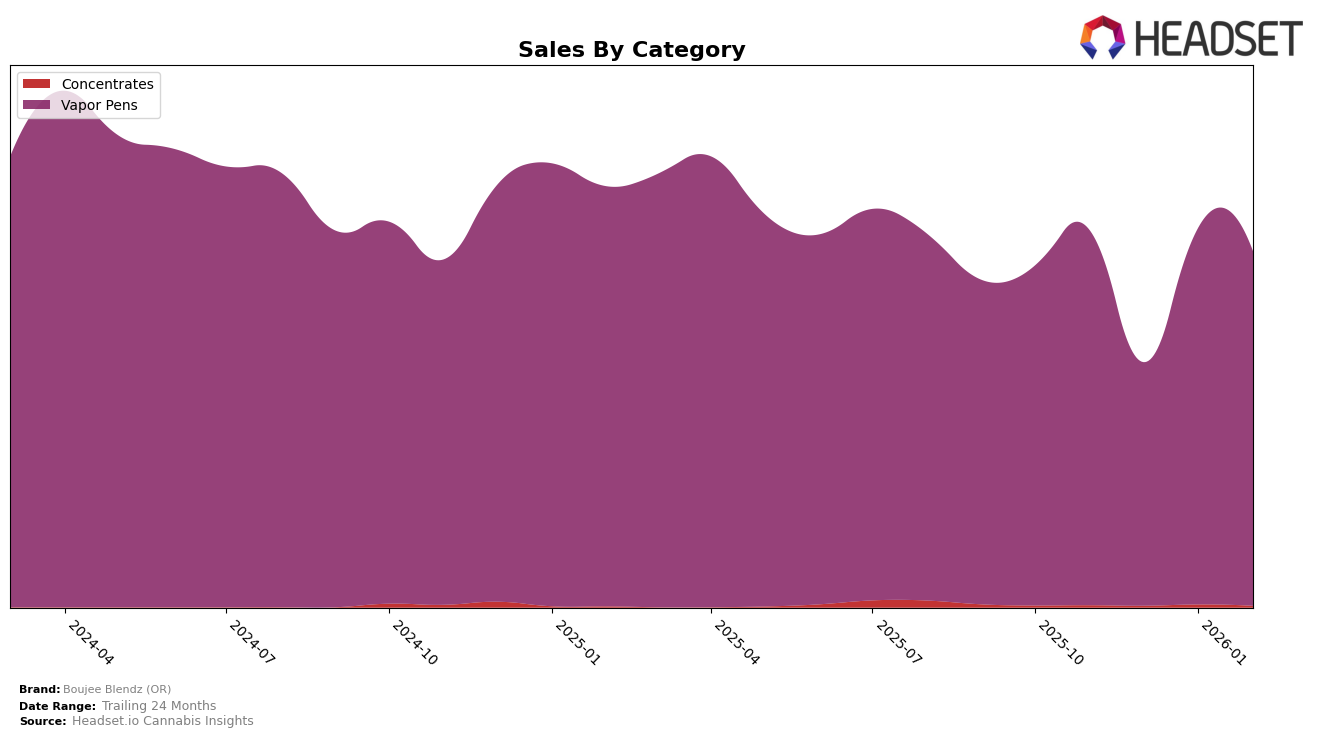

Boujee Blendz has shown a consistent presence in the Oregon market, particularly in the Vapor Pens category. Over the four-month period from November 2025 to February 2026, the brand has maintained its position within the top 30, even improving its rank from 21st in December 2025 to 16th by February 2026. This upward trend is indicative of a strengthening market presence and suggests effective strategies in product offerings or marketing. The brand's sales figures also exhibit a notable recovery from a dip in December, rebounding to a significant level by January 2026, which might reflect a successful holiday season campaign or new product launch.

While Boujee Blendz has managed to sustain its ranking in Oregon, it's important to note that any absence from the top 30 in other states or provinces could signal areas for potential growth or necessary strategic adjustments. The fact that the brand is not listed in the top 30 for other states or categories might indicate either a focus on the Oregon market or challenges in expanding their footprint elsewhere. This presents both a challenge and an opportunity for Boujee Blendz to explore market dynamics outside Oregon, potentially tailoring their approach to meet diverse consumer preferences across different regions.

Competitive Landscape

In the competitive landscape of the Oregon vapor pens market, Boujee Blendz (OR) has experienced fluctuating rankings over the past few months, indicating a dynamic market position. In November 2025, Boujee Blendz (OR) held the 17th rank, but by December, it had dropped out of the top 20, only to recover to 17th in January 2026 and improve slightly to 16th in February. This volatility contrasts with competitors like Bobsled Extracts, which maintained a consistent rank of 18th, and Verdant Leaf Farms, which saw a more stable performance despite a slight dip from 13th to 17th over the same period. Gem Carts and Sessions Cannabis Extract (OR) also demonstrated more stable rankings, with Gem Carts consistently around the 14th position and Sessions Cannabis Extract (OR) fluctuating between 13th and 16th. This suggests that while Boujee Blendz (OR) has the potential to climb in rankings, it faces stiff competition from brands with more stable market positions.

Notable Products

In February 2026, the top-performing product for Boujee Blendz (OR) was the Red Raspberry Liquid Diamonds Cartridge (1g) in the Vapor Pens category, maintaining its number one rank from January with sales of 5222. The Blueberry Live Diamonds Cartridge (1g) also held steady at the second position, showing a consistent performance from the previous month. The Banana Smoothie Live Resin Liquid Diamonds Cartridge (1g) climbed to third place from fifth in January, indicating a notable improvement in its ranking. Meanwhile, the Tutti Frutti Live Resin Liquid Diamonds Cartridge (1g) dropped one spot to fourth place, and the Mango Liquid Diamonds Flavored Distillate Cartridge (1g) rounded out the top five, maintaining its position from the previous month. This month saw minimal shifts in rankings, with the top products largely holding their positions or experiencing slight changes.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.