Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

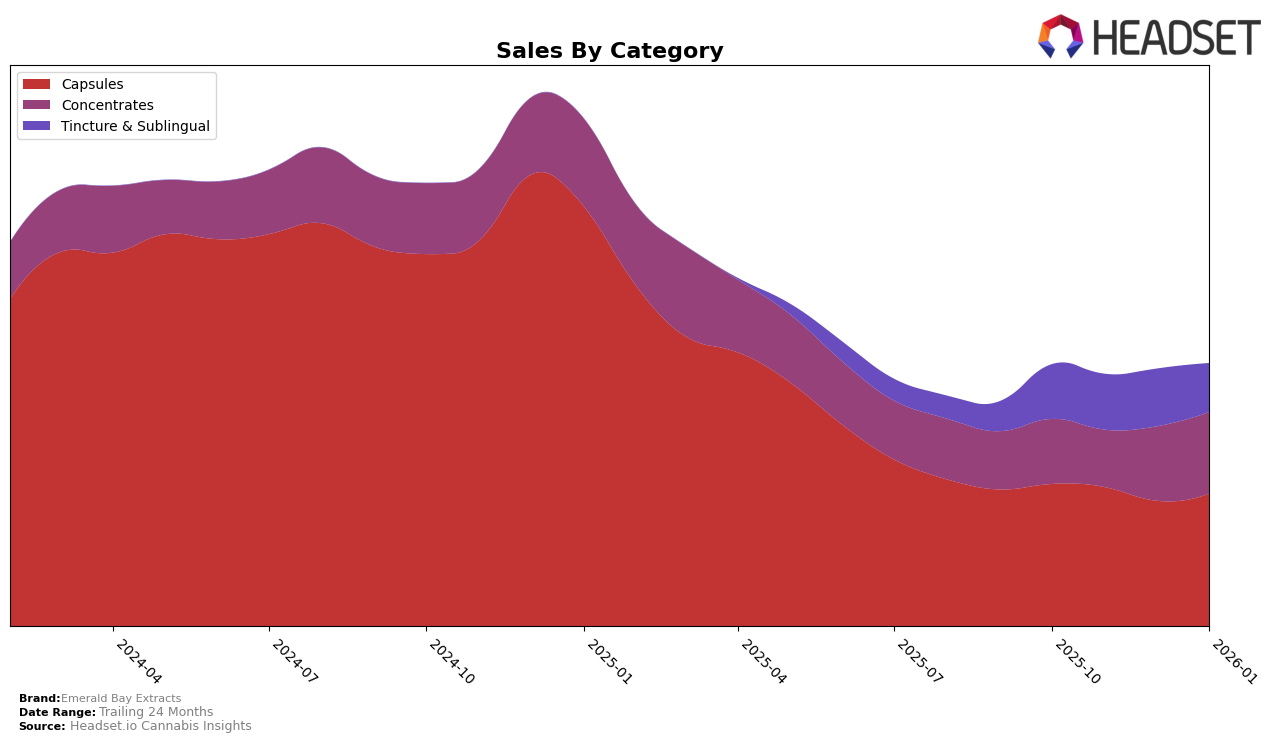

Emerald Bay Extracts has shown consistent performance across several categories in California. In the Capsules category, the brand has maintained a stable position at rank 6 from October 2025 through January 2026. This demonstrates a strong foothold in this segment, even though there was a slight dip in sales from October to December. Meanwhile, in the Concentrates category, Emerald Bay Extracts has made notable progress, climbing from rank 27 in October to 21 by January. This upward trend indicates a growing popularity and acceptance of their products in this category, which could be an area of potential growth for the brand.

Conversely, Emerald Bay Extracts has faced some challenges in the Tincture & Sublingual category within California. The brand's ranking has seen a slight decline from 8 in October to 11 in January, suggesting increased competition or changing consumer preferences in this space. Despite this, the sales figures reveal a peak in November, which might indicate potential for recovery or strategic opportunities to regain higher rankings. The absence of top 30 rankings in any other state or category could be seen as a limitation, highlighting the brand's current focus or market penetration challenges outside of California.

Competitive Landscape

In the competitive landscape of the California cannabis capsules market, Emerald Bay Extracts consistently held the 6th rank from October 2025 to January 2026, indicating a stable position amidst fluctuating sales figures. Despite a slight decline in sales over these months, Emerald Bay Extracts maintained its rank, showcasing resilience against competitors. Notably, Kikoko and Buddies consistently ranked higher, holding the 4th and 5th positions respectively, with Kikoko experiencing a downward sales trend, which could present an opportunity for Emerald Bay Extracts to close the gap. Meanwhile, Dr. Norm's showed significant upward movement in rank, climbing from 12th to 8th, suggesting an emerging threat. Emerald Bay Extracts' consistent rank amidst these dynamics highlights its competitive stability, yet underscores the need for strategic initiatives to enhance sales and potentially improve its market position.

Notable Products

In January 2026, the top-performing product from Emerald Bay Extracts was the Ice Cream Cake RSO Syringe (1g) in the Concentrates category, maintaining its first-place ranking for four consecutive months with sales of 1601 units. The Blue Dream RSO Syringe (1g) also performed strongly, holding the second position after climbing from the fourth spot in November 2025, with sales reaching 1180 units. The new entry, Hashburger RSO Syringe (1g), debuted at third place, showcasing impressive initial sales. Meanwhile, Blue Dream RSO Tablets 40-Pack (1000mg) in the Capsules category dropped to fourth place from its previous consistent second-place ranking in October and November. Super Lemon Haze RSO Syringe (1g) entered the top five for the first time, securing the fifth spot with notable sales improvements.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.