Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

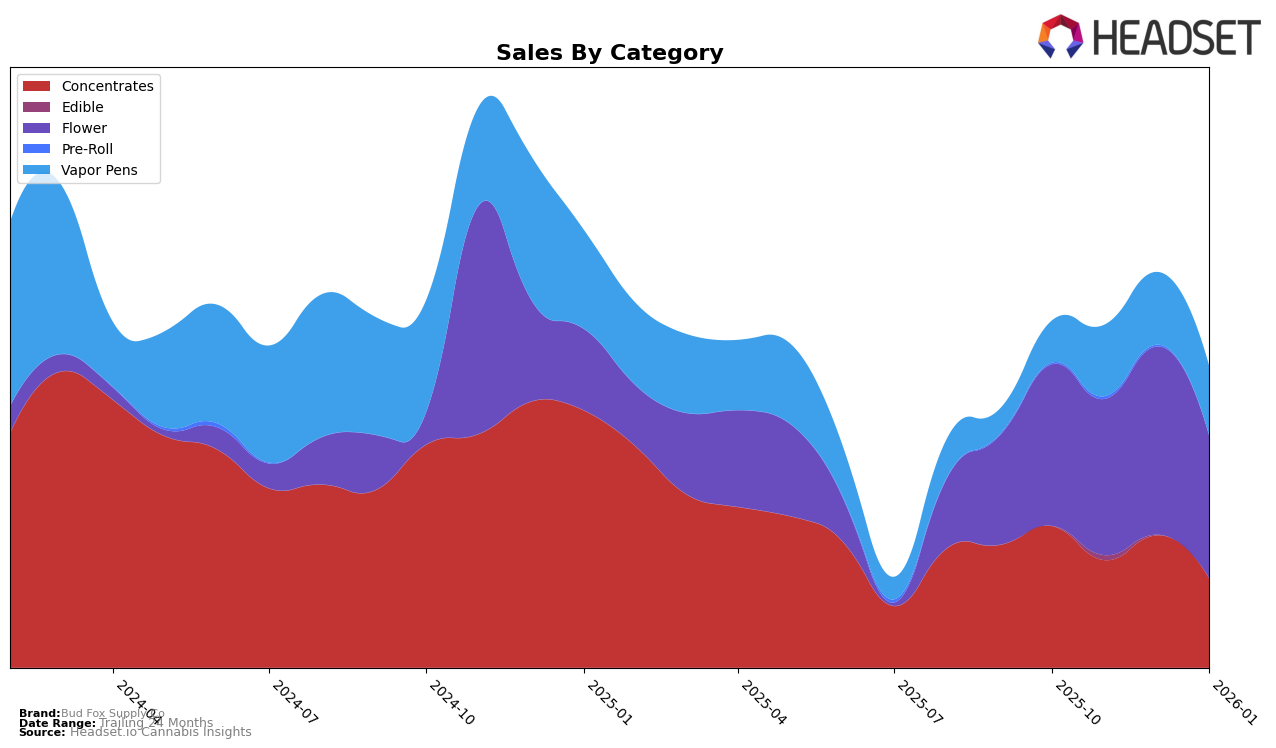

Bud Fox Supply Co has shown a mixed performance across different categories in Colorado. In the Concentrates category, the brand experienced a notable decline in rankings, dropping from 13th in October 2025 to 24th by January 2026. This downward trend might suggest challenges in maintaining market share or increased competition. Despite this, the brand's Flower category saw a slight improvement in December 2025, reaching 34th place, although it was unable to break into the top 30, indicating potential growth opportunities if they can capitalize on this momentum.

In the Vapor Pens category, Bud Fox Supply Co demonstrated a positive trend, moving up from 61st place in October 2025 to 45th by January 2026. This consistent upward movement suggests a growing consumer interest or successful marketing strategies in this segment. However, it's worth noting that the brand's performance in the Flower category remained relatively stagnant, hovering around the 40s without breaking into the top tier. This indicates a need for strategic adjustments to improve their standing in the Flower market. Overall, while Bud Fox Supply Co shows potential in certain areas, there is room for growth and improvement across various categories and states.

Competitive Landscape

In the competitive landscape of the Colorado flower category, Bud Fox Supply Co has experienced fluctuating rankings, reflecting a dynamic market environment. From October 2025 to January 2026, Bud Fox Supply Co's rank oscillated between 34th and 42nd, indicating a relatively stable position amidst fierce competition. Notably, Old Pal demonstrated significant volatility, peaking at 16th in December 2025 before dropping to 36th in January 2026, which suggests a potential opportunity for Bud Fox Supply Co to capture market share during periods of competitor instability. Meanwhile, Vera consistently outperformed Bud Fox Supply Co, maintaining a higher rank throughout the period, which could imply a need for strategic adjustments to enhance competitive positioning. Additionally, Fresh Cannabis showed a downward trend in sales and rank, potentially opening up space for Bud Fox Supply Co to capitalize on shifting consumer preferences. Overall, while Bud Fox Supply Co holds a steady position, the competitive dynamics highlight both challenges and opportunities for growth in the Colorado flower market.

Notable Products

In January 2026, Golden Goat (Bulk) emerged as the top-performing product for Bud Fox Supply Co, reclaiming its number one rank from October 2025 with a notable sales figure of 3,819 units. Flo Limone (Bulk) maintained its second-place position from December 2025, showing a consistent demand. Green Crack (Bulk) slipped to third place after leading in December 2025, indicating a slight drop in its sales momentum. Aloha Limone (Bulk) made its debut in the rankings at fourth place, while Brandywine (Bulk) rounded out the top five, dropping one spot from its December 2025 position. These shifts highlight dynamic changes in customer preferences and market trends within the Flower category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.