Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

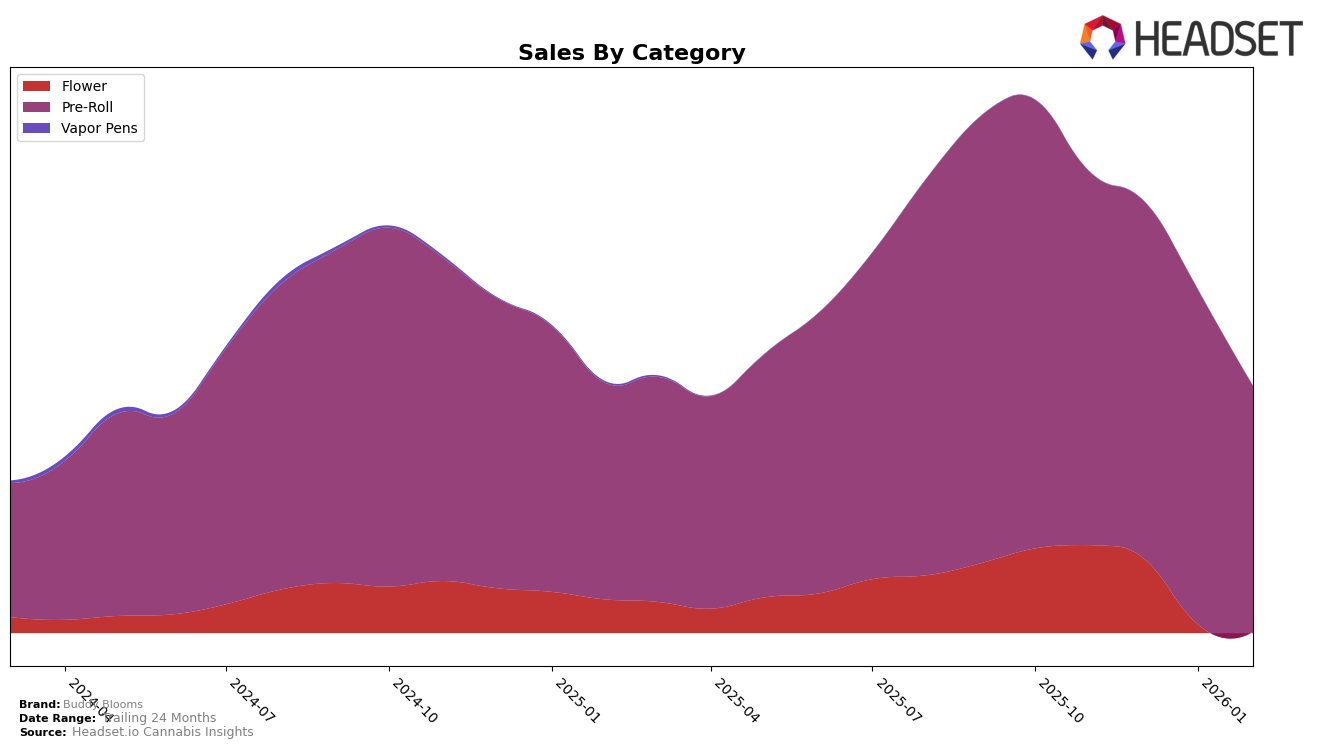

Buddy Blooms has demonstrated varying performance across different product categories and regions. In Ontario, the brand's presence in the Flower category has not been strong enough to break into the top 30 rankings from November 2025 to February 2026. This indicates a potential area for improvement or a shift in consumer preferences that Buddy Blooms may need to address. On the other hand, their Pre-Roll category has shown more consistent performance, maintaining a position within the top 20 over the same period. Notably, while there was a slight dip in rankings from 16th in January 2026 to 20th in February 2026, the category still represents a significant area of strength for the brand in Ontario.

Sales trends for Buddy Blooms in Ontario reveal a decline in the Pre-Roll category, with sales figures dropping from November 2025 through February 2026. This downward trend suggests that while the brand remains competitive in terms of ranking, there is a need to address the declining sales volume to sustain its market position. The absence of Buddy Blooms from the top 30 in the Flower category during these months could be viewed as a challenge, emphasizing the importance of market strategy adjustments to capture a larger share. The data suggests that Buddy Blooms should focus on leveraging their existing strengths in the Pre-Roll category while exploring potential growth opportunities in other product segments.

Competitive Landscape

In the competitive landscape of the Pre-Roll category in Ontario, Buddy Blooms has experienced fluctuations in its market position over recent months. Starting at rank 16 in November 2025, Buddy Blooms saw a dip to rank 18 in December, a brief recovery back to rank 16 in January 2026, and then a decline to rank 20 by February. This volatility in rank is mirrored by a downward trend in sales, with a notable decrease from December to February. In comparison, 1964 Supply Co maintained a stable position at rank 19 for three consecutive months before improving slightly to rank 18 in February, despite a consistent decrease in sales. Meanwhile, 3Saints and BoxHot remained outside the top 20, with BoxHot showing some improvement in February. Double J's also showed a steady performance, maintaining a rank around 20. These dynamics suggest that while Buddy Blooms has faced challenges in maintaining its rank, there is an opportunity to strategize and regain market share, particularly as competitors like 1964 Supply Co and Double J's also experience fluctuations in sales.

Notable Products

In February 2026, the top-performing product from Buddy Blooms was the Biggest Buddy Sativa Pre-Roll 2-Pack (2g), maintaining its number one rank with sales of 8,587 units. The Purple Haze Pre-Roll 10-Pack (5g) held steady at the second position, continuing its consistent performance from January. The Sativa Pre-Roll (1g) climbed to the third spot, showing a slight improvement from its previous fifth-place ranking. The Big Buddy - Indica Pre-Roll 2-Pack (2g) dropped to fourth place, marking a decline from its previous third-place ranking. Lastly, the Lil Buddy - Sativa Pre-Roll (0.5g) remained in the fifth position, consistent with its January ranking.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.