Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

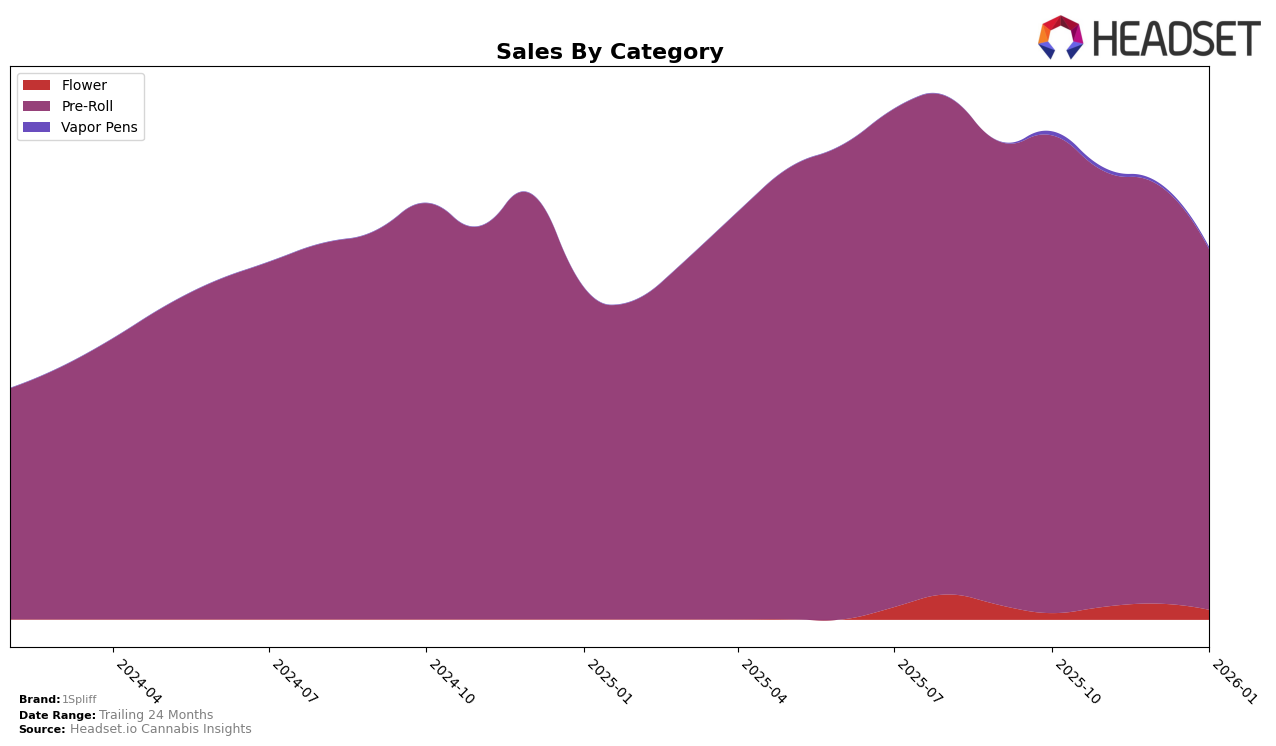

In the pre-roll category, 1Spliff's performance varied significantly across different regions. In Alberta, the brand experienced a slight decline in rankings, moving from 21st place in October 2025 to 24th by January 2026. This downward trend coincided with a notable decrease in sales, which dropped from approximately 371,135 CAD in October to 278,798 CAD in January. The brand's fluctuating position in Alberta suggests challenges in maintaining a strong foothold in this competitive market. Conversely, in Ontario, 1Spliff maintained a relatively stable presence, consistently ranking within the top 20. Despite a gradual decline in sales from October to January, the brand's ability to remain in the top rankings indicates a resilient market presence in Ontario.

While 1Spliff managed to stay within the top 30 in both Alberta and Ontario, the brand's varying performance highlights the diverse market dynamics in these regions. The decline in Alberta could be attributed to increased competition or shifting consumer preferences, whereas the steadier performance in Ontario suggests a loyal customer base or effective marketing strategies. It's noteworthy that in both markets, 1Spliff did not fall out of the top 30, which speaks to its established brand recognition. However, the contrasting trajectories in sales and rankings between these two provinces provide valuable insights into regional challenges and opportunities for growth.

Competitive Landscape

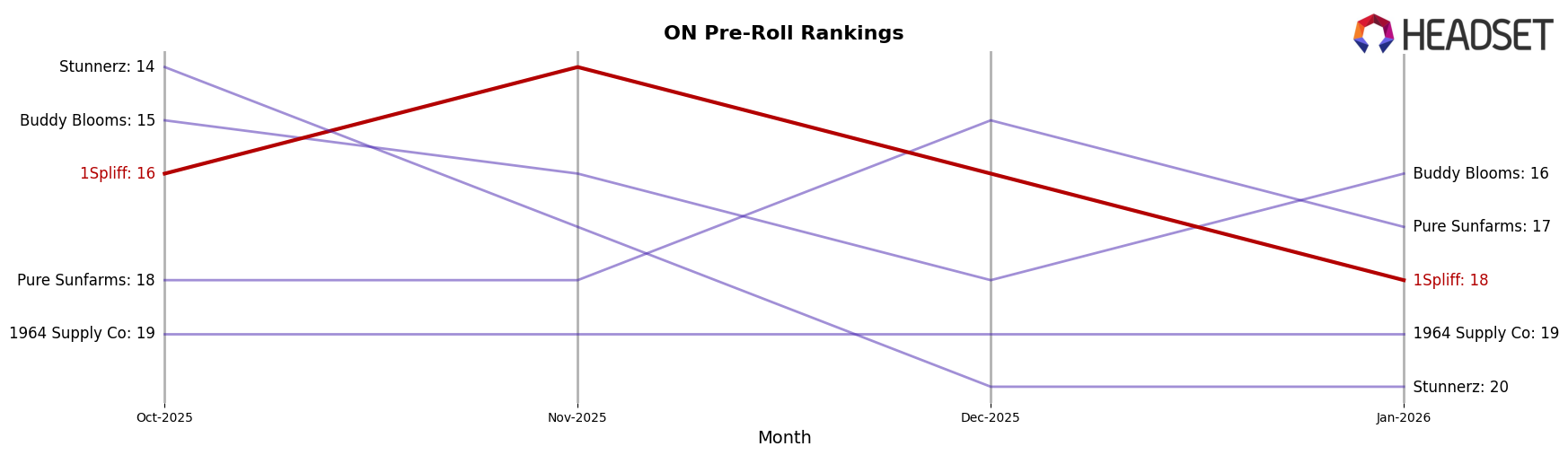

In the competitive landscape of the Pre-Roll category in Ontario, 1Spliff has demonstrated a fluctuating performance in recent months, impacting its rank and sales trajectory. Starting from October 2025, 1Spliff held the 16th position, improving to 14th in November, before slipping back to 16th in December and further to 18th in January 2026. This volatility is mirrored in its sales, which saw a decline from November to January. In comparison, Buddy Blooms maintained a relatively stable presence, consistently ranking between 15th and 16th, while Pure Sunfarms showed a slight improvement in December, reaching 15th place. Meanwhile, Stunnerz experienced a notable drop, falling from 14th in October to 20th by January. These shifts highlight the dynamic nature of the market, where 1Spliff faces both opportunities and challenges in maintaining its competitive edge amidst fluctuating consumer preferences and rival brand performances.

```

Notable Products

In January 2026, the top-performing product for 1Spliff was Cannon Pre-Roll (1g) in the Pre-Roll category, maintaining its first-place rank consistently from October 2025. Hawaiian Snowcone Pre-Roll 10-Pack (3.5g) held steady in the second position, despite a decrease in sales to 5993 units. Pink Lemonade Pre-Roll 7-Pack (3.5g) also retained its third place, though it experienced a notable drop in sales figures. Grape Escape Pre-Roll 7-Pack (3.5g) moved up to fourth place from fifth in the previous month, showing a slight sales decline. Hawaiian Snowcone Pre-Roll 7-Pack (3.5g) slipped to fifth place, indicating a downward trend in sales since October 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.