Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

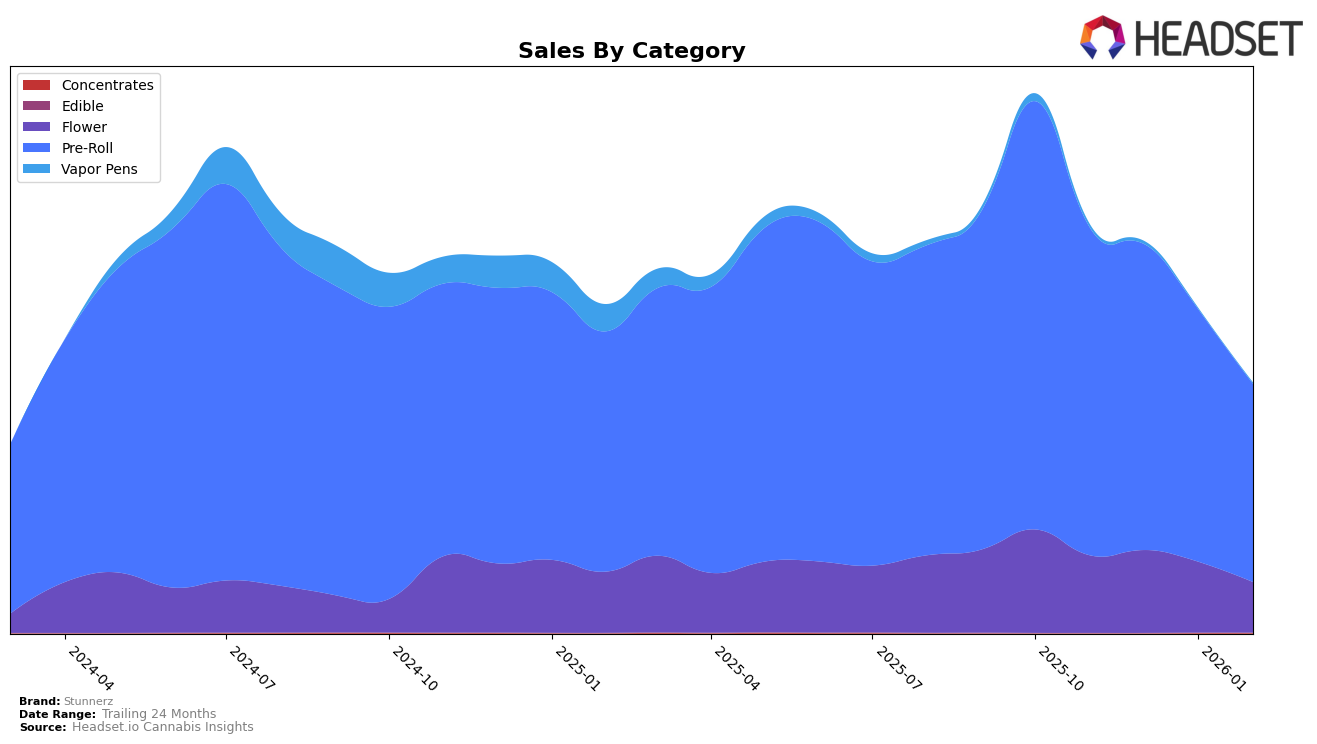

Stunnerz has shown varied performance across different categories and regions, with notable shifts in their rankings. In the Ontario market, their Flower category experienced a decline, as evidenced by their ranking falling from 51st in December 2025 to 59th by February 2026. This downward trend is further highlighted by their absence from the top 30 brands in this category, indicating a potential area for improvement. Despite a slight increase in sales from November to December 2025, the subsequent months saw a decline, suggesting challenges in maintaining market presence.

Conversely, Stunnerz has maintained a stronger foothold in the Pre-Roll category within Ontario. Although their ranking slipped from 17th in November 2025 to 26th by February 2026, they consistently remained within the top 30, showcasing a relatively stable performance. This category's sales trajectory mirrored the rankings, with a noticeable decrease over the months, yet still indicating a solid demand. The ability to stay within the top rankings suggests that while there are competitive pressures, Stunnerz has managed to sustain consumer interest in their Pre-Roll offerings.

Competitive Landscape

In the competitive landscape of the Pre-Roll category in Ontario, Stunnerz has experienced a notable decline in its ranking, dropping from 17th place in November 2025 to 26th place by February 2026. This downward trend in rank is accompanied by a decrease in sales, which have fallen consistently over the same period. In contrast, Pistol and Paris has shown a positive trajectory, improving its rank from 30th in November 2025 to 24th in February 2026, with sales also showing a recovery in February. Meanwhile, The Loud Plug maintained a relatively stable position, hovering around the low 20s in rank, but experienced a sales decline similar to Stunnerz. These shifts suggest that while Stunnerz has been losing ground, competitors like Pistol and Paris are capitalizing on market dynamics to enhance their standing, highlighting the need for Stunnerz to reassess its strategies to regain its competitive edge.

```

Notable Products

In February 2026, the top-performing product for Stunnerz was the Indica Pre-Roll 2-Pack (2g) in the Pre-Roll category, maintaining its consistent rank of 1 since November 2025, although its sales have decreased to 18,339 units. Following closely, the Sativa Pre-Roll 2-Pack (2g) also held its 2nd place position throughout the same period. The Sweet Cherry Blitz Pre-Roll 2-Pack (2g) remained in 3rd place since its introduction in January 2026. The Milled Variety Pack (14g) in the Flower category consistently ranked 4th since December 2025, while the Mango Blitz Pre-Roll 2-Pack (2g) slipped from 3rd in November 2025 to 5th in February 2026. This analysis indicates stable product rankings for Stunnerz, with slight shifts in sales figures over the months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.