Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

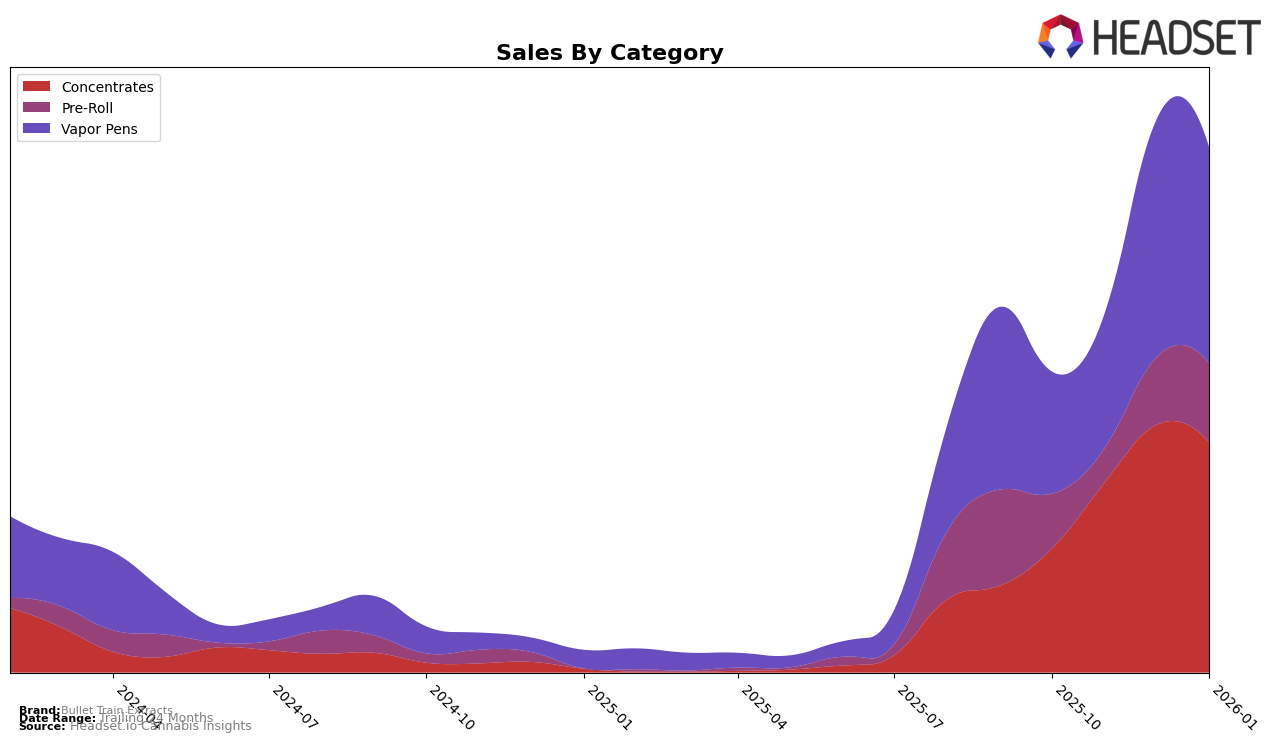

Bullet Train Extracts has shown varied performance across different product categories in Illinois. In the Concentrates category, the brand has consistently ranked outside the top 30, indicating a struggle to maintain a competitive position. This is further evidenced by the rank fluctuations from 33rd in October 2025 to 38th in January 2026. Vapor Pens also saw a decline, dropping from 60th to 71st over the same period, which suggests a decreasing market presence. Interestingly, the Pre-Roll category saw the brand fall out of the top 30 entirely after November 2025, highlighting a significant challenge in gaining traction in this segment.

In contrast, New Jersey presents a more optimistic picture for Bullet Train Extracts. The brand's performance in the Concentrates category has been notably strong, improving from 12th place in October 2025 to an impressive 5th place by January 2026. This upward trend is mirrored in the Vapor Pens category, where the brand climbed from 58th to 31st, indicating a growing consumer preference for their products. The Pre-Roll category also saw positive movement, with the brand advancing from 61st to 47th, suggesting a gradual but steady improvement in market penetration. These trends highlight New Jersey as a key market for Bullet Train Extracts, with significant gains across multiple categories.

Competitive Landscape

In the competitive landscape of concentrates in New Jersey, Bullet Train Extracts has demonstrated a notable upward trajectory in rankings over the past few months. Starting from a rank of 12 in October 2025, Bullet Train Extracts climbed to 6 in November, reached 4 in December, and slightly settled at 5 in January 2026. This positive trend indicates a strong market presence and growing consumer preference. In comparison, Black Label Brand experienced fluctuations, dropping from rank 2 in October to 7 in December before recovering to 3 in January, suggesting some volatility in their market position. Meanwhile, Locals Only Concentrates maintained a relatively stable performance, consistently ranking within the top 5, which underscores their competitive edge. MPX - Melting Point Extracts showed a slight decline from rank 4 in October and November to 6 in January, indicating a potential challenge in maintaining their earlier momentum. Overall, Bullet Train Extracts' rise in rank suggests a successful strategy in capturing market share, despite strong competition from established brands.

Notable Products

In January 2026, High Society Infused Pre-Roll (1g) emerged as the top-performing product for Bullet Train Extracts, climbing from a previous rank of 4 in December 2025 to 1, with sales reaching 1084 units. Lime OG Infused Pre-Roll (1g) followed closely, securing the second position with a notable increase in sales to 973 units, despite not being ranked in the previous two months. Mad Rabbid Live Badder (1g), which had consistently held the top spot in October and November 2025, dropped to third place with sales of 871 units. Baby Yoda Infused Pre-Roll (1g) saw a decline, moving from second place in December 2025 to fourth in January 2026, with sales decreasing to 803 units. Secret Meetings Live Crumble (1g) entered the rankings for the first time, securing fifth place with sales of 721 units.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.