Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

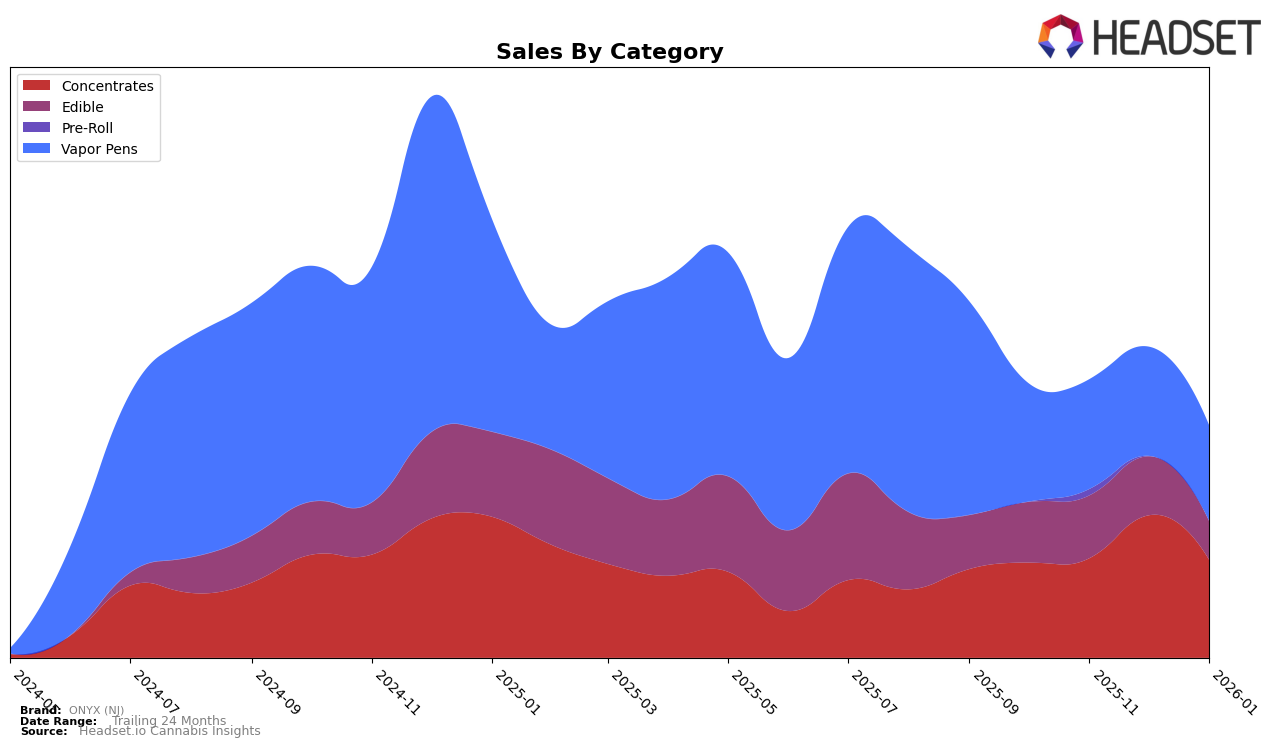

ONYX (NJ) has demonstrated a stable performance in the Concentrates category in New Jersey, maintaining a consistent rank of 7th in October and November 2025, slightly improving to 6th in December 2025, before settling back to 7th in January 2026. This indicates a solid presence in the market, with the brand managing to hold its ground amidst competitive pressures. The sales figures for December 2025 were notably higher, suggesting a seasonal spike or successful promotional efforts during the holiday season, as sales rose significantly compared to other months.

In contrast, ONYX (NJ)'s performance in the Edible category in New Jersey shows a downward trajectory, slipping from 26th in October and November 2025 to 29th in December 2025, and further down to 35th by January 2026. This decline could be indicative of increasing competition or a shift in consumer preferences. Similarly, in the Vapor Pens category, the brand was ranked 27th in October 2025 but saw a gradual decline to 34th by December and January 2026, highlighting potential challenges in maintaining market share in this segment. The absence of ONYX (NJ) in the top 30 in January 2026 for Edibles suggests a need for strategic adjustments to regain competitive footing.

Competitive Landscape

In the competitive landscape of the New Jersey concentrates market, ONYX (NJ) has maintained a relatively stable position, ranking consistently at 7th place from October 2025 to January 2026, except for a brief rise to 6th in December 2025. This period saw a notable sales spike for ONYX (NJ) in December, suggesting a successful campaign or product launch. However, competitors like MPX - Melting Point Extracts and Bullet Train Extracts have shown stronger performances, with Bullet Train Extracts climbing from 12th to 5th place by January 2026, indicating a significant upward trajectory in sales. Meanwhile, Superflux and Pyramid Pens experienced fluctuations, with Pyramid Pens dropping out of the top 10 in December before recovering. These dynamics highlight the competitive pressure ONYX (NJ) faces, emphasizing the importance of strategic marketing and product differentiation to enhance its market position and sales growth.

Notable Products

In January 2026, the top-performing product for ONYX (NJ) was the Black Lotus Live Resin Liquid Diamond Cartridge (1g) in the Vapor Pens category, securing the number one rank with sales of 304 units. The Cherry Cola Full Spectrum Gummies 10-Pack (100mg) in the Edible category moved up to the second position, showcasing a significant shift from its fifth place in December 2025. The Black Lotus Shatter (1g), also in the Concentrates category, entered the rankings at third place, indicating a strong market entry. Yikez Cold Cure Live Rosin (1g) followed closely in fourth place, while the Lemon Face Full Spectrum Gummies 10-Pack (100mg) debuted in the fifth position. This reshuffling of ranks from previous months highlights a dynamic shift in consumer preferences and product performance for ONYX (NJ).

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.