Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

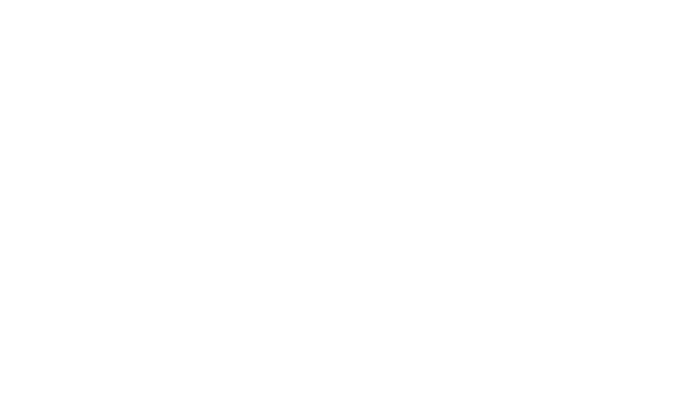

The Growfather's performance in the New Jersey cannabis market has shown notable fluctuations across different product categories. In the Edible category, the brand had a remarkable surge in its rankings, moving from 36th place in December 2025 to 22nd place by January 2026. This upward trajectory indicates a significant increase in consumer interest or potentially successful marketing strategies. However, it's worth noting that the brand was not in the top 30 in November 2025, which could suggest a period of challenges or market adjustments. In contrast, the Flower category saw relatively stable rankings, hovering around the mid-60s, indicating a consistent but not leading presence in that segment.

In the Pre-Roll category, The Growfather maintained a strong presence with a consistent ranking near the top 15 in New Jersey. This consistency suggests a reliable customer base or a well-received product line. Meanwhile, the Vapor Pens category experienced a slight decline in rankings, decreasing from 23rd in October 2025 to 29th in January 2026. Despite this drop, the brand managed to stay within the top 30, which reflects resilience in a competitive market. The sales figures in this category also showed a downward trend, which could be an area for strategic improvement. Overall, The Growfather's performance across these categories highlights areas of strength and potential opportunities for growth.

Competitive Landscape

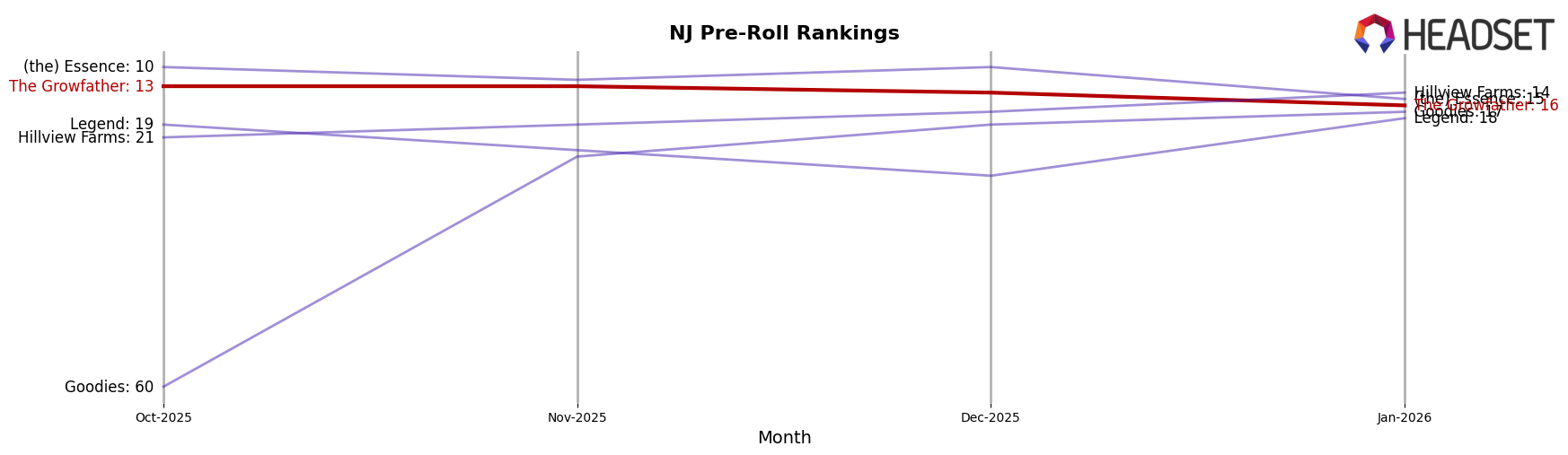

In the competitive landscape of the Pre-Roll category in New Jersey, The Growfather has experienced a slight decline in its ranking from October 2025 to January 2026, moving from 13th to 16th position. This shift is notable as competitors like Goodies and Hillview Farms have shown significant upward momentum. Goodies, for instance, improved its rank dramatically from 60th in October to 17th in January, indicating a strong increase in market presence and sales. Meanwhile, Hillview Farms climbed from 21st to 14th, showcasing a consistent upward trend. On the other hand, Legend and The Essence have shown fluctuations, with Legend ending January at 18th, a recovery from a dip in December, and The Essence dropping to 15th from a stable 10th position in October and December. These dynamics suggest that while The Growfather maintains a strong position, the competitive pressure is increasing, particularly from brands that are rapidly gaining traction in the market.

Notable Products

In January 2026, Sour Diesel Infused Pre-Roll (1.2g) reclaimed its position as the top-performing product for The Growfather, maintaining its rank from October and November 2025, with a sales figure of 1999. White Widow x Strawberry Cough Infused Pre-Roll (1.2g) consistently held the second position from December 2025 onwards. Pineapple Express Infused Pre-Roll (1.2g), previously the best-seller in December, dropped to third place. Super Lemon Cherry Haze Infused Pre-Roll (1.2g) saw a notable rise, securing the fourth spot in January despite missing data for December. Grandaddy Purp Berry Infused Pre-Roll (1.2g) experienced a slight decline, moving from third in November to fifth by January.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.