Nov-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

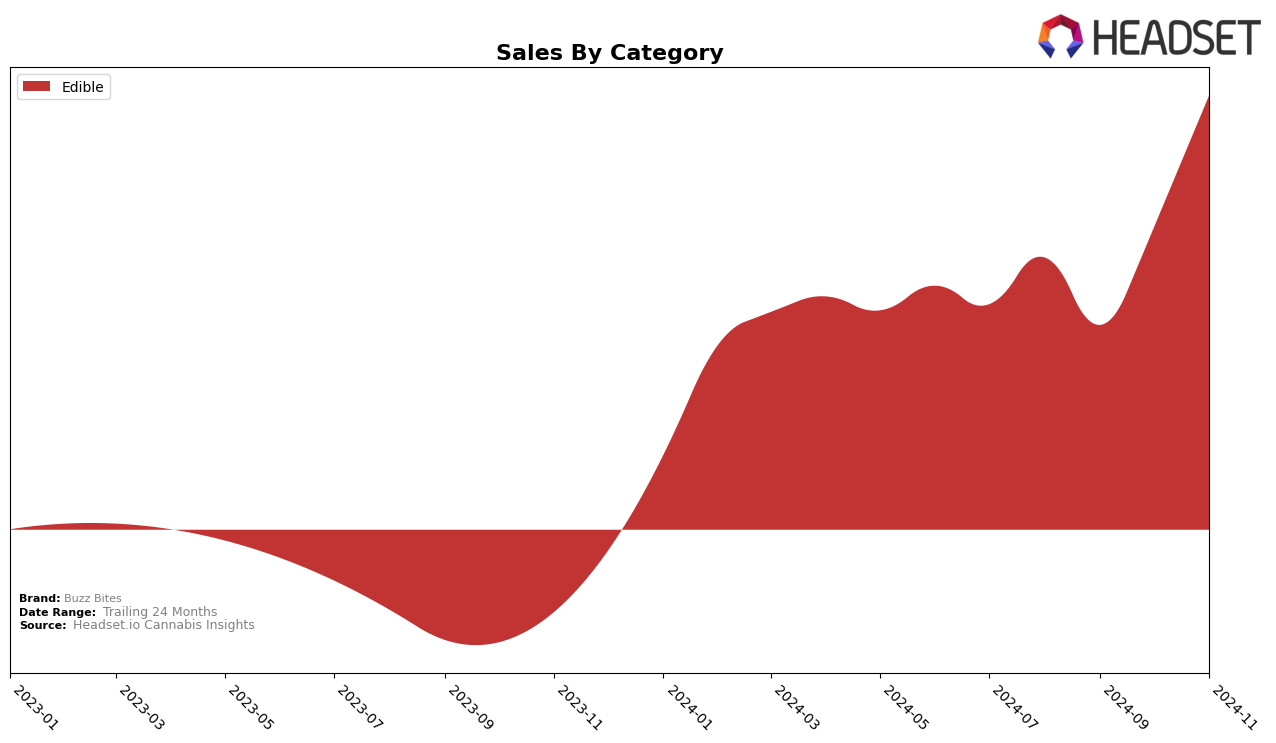

Buzz Bites has shown a noteworthy performance in the Edible category, particularly in Oregon. After not making it into the top 30 brands in September 2024, Buzz Bites made a significant comeback in October, ranking 31st, and continued its upward trajectory by securing the 29th position in November. This positive trend indicates a strong recovery and growth in consumer interest and sales, which is further supported by the increase in sales figures from October to November. Such a rebound highlights the brand's potential to maintain or even improve its market position in the coming months.

While Buzz Bites has demonstrated promising growth in Oregon, its absence from the top 30 rankings in September could be seen as a setback, suggesting potential challenges in maintaining consistent market presence. However, the brand's ability to re-enter the rankings and improve its position by November is a testament to its resilience and adaptability. This fluctuation in rankings might reflect strategic changes or market dynamics that have influenced consumer preferences. Observing these trends can provide valuable insights into the brand's performance and its competitive stance within the Edible category in Oregon.

Competitive Landscape

In the competitive landscape of edible cannabis products in Oregon, Buzz Bites has shown a notable upward trend in its market position from August to November 2024. Initially ranked 36th in August, Buzz Bites was not in the top 20 in September, but made a significant leap to 31st in October and further improved to 29th in November. This positive trajectory suggests a growing consumer interest and potential increase in market penetration. In contrast, Concrete Jungle experienced fluctuating ranks, with a notable absence from the top 20 in September, indicating potential volatility in their sales performance. Meanwhile, Pacific Wave and Retreats maintained relatively stable positions, though Pacific Wave saw a decline from 19th in August to 27th in November, suggesting a potential loss in market share. Yamba Junk showed some improvement, moving from 31st in August to 27th in October, before dropping back to 30th in November. These dynamics highlight Buzz Bites' potential to capitalize on its upward momentum and gain a stronger foothold in the Oregon edible market.

Notable Products

In November 2024, the top-performing product from Buzz Bites was Strawberry Watermelon Gummies 10-Pack (100mg), maintaining its number one rank for four consecutive months with a sales figure of 1159 units. Blue Razz Gummies 10-Pack (100mg) held the second position, showing a significant leap in sales from October to November. Soothe - CBD/THC 1:1 Sour Apple Gummies 10-Pack (100mg CBD, 100mg THC) climbed to the third rank, up from fifth in October, indicating a growing consumer preference. Calm- Blue Raspberry Infused Gummies 10-Pack (100mg) dropped two spots to fourth, despite strong sales in the previous month. CBD/THC 1:1 Peach Mango Gummies 10-Pack (100mg CBD, 100mg THC) rounded out the top five, showing a consistent presence in the rankings since August.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.