Aug-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

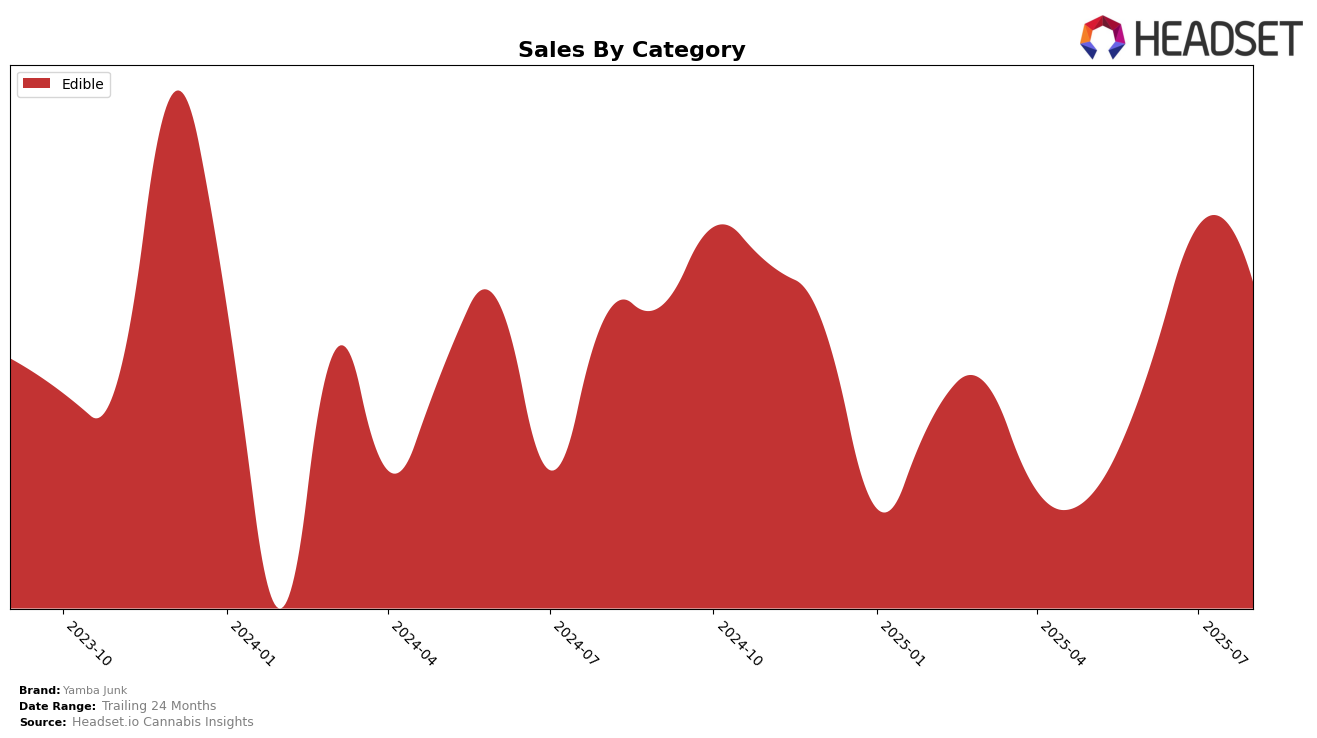

Yamba Junk has demonstrated a notable trajectory in the Oregon edibles market over the summer months of 2025. Starting from a rank of 37 in May, the brand showed a consistent upward movement, climbing to rank 30 by July and maintaining that position in August. This consistent rise into the top 30 indicates a strengthening presence in the Oregon edibles category, a noteworthy feat considering the competitive landscape. The brand's sales figures reflect this upward trend, with a peak in July followed by a slight dip in August, suggesting potential seasonal factors or market saturation influencing consumer demand.

Despite these gains in Oregon, Yamba Junk's absence from the top 30 rankings in other states and categories during the same period highlights areas for potential growth or strategic realignment. The brand's focus on the edibles category in Oregon may indicate a targeted strategy, yet it also suggests opportunities for expansion into other product categories or geographical markets. Understanding the dynamics in Oregon could provide insights into replicating success in other regions, but the lack of presence elsewhere suggests that there are challenges or competitive barriers that Yamba Junk might need to address to broaden its market footprint.

Competitive Landscape

In the Oregon edible market, Yamba Junk has shown a notable upward trend in rankings from May to August 2025, moving from 37th to 30th place. This improvement in rank is indicative of a positive trajectory in sales performance, even as competitors like Tasty's (OR) and Pacific Wave experienced a decline in their rankings, with Tasty's dropping from 24th to 29th and Pacific Wave fluctuating between 26th and 32nd. Yamba Junk's consistent rise contrasts with the volatility seen in Cascade Valley Cannabis and Crown B Alchemy, both of which failed to maintain a steady presence in the top 30. This suggests that Yamba Junk is successfully capturing market share from its competitors, positioning itself as a growing player in the Oregon edibles scene.

Notable Products

In August 2025, the top-performing product from Yamba Junk was Strawberry Blueberry Floss Cotton Candy (100mg), maintaining its first-place rank with sales of 428 units. Peach Mango Floss Cotton Candy (100mg) climbed to the second position, showing a significant improvement from the third rank in the previous two months, with notable sales figures of 407 units. Lemon x Lime Floss Cotton Candy (100mg) entered the rankings at third place, having not been ranked in June or July, with 317 units sold. Peach Mango Sugadoobs (100mg) made its debut in the rankings at fourth place. Meanwhile, Green Apple Watermelon Sugardoobs (100mg) dropped to fifth place, after being unranked in July, indicating a decrease in its sales momentum.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.