Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

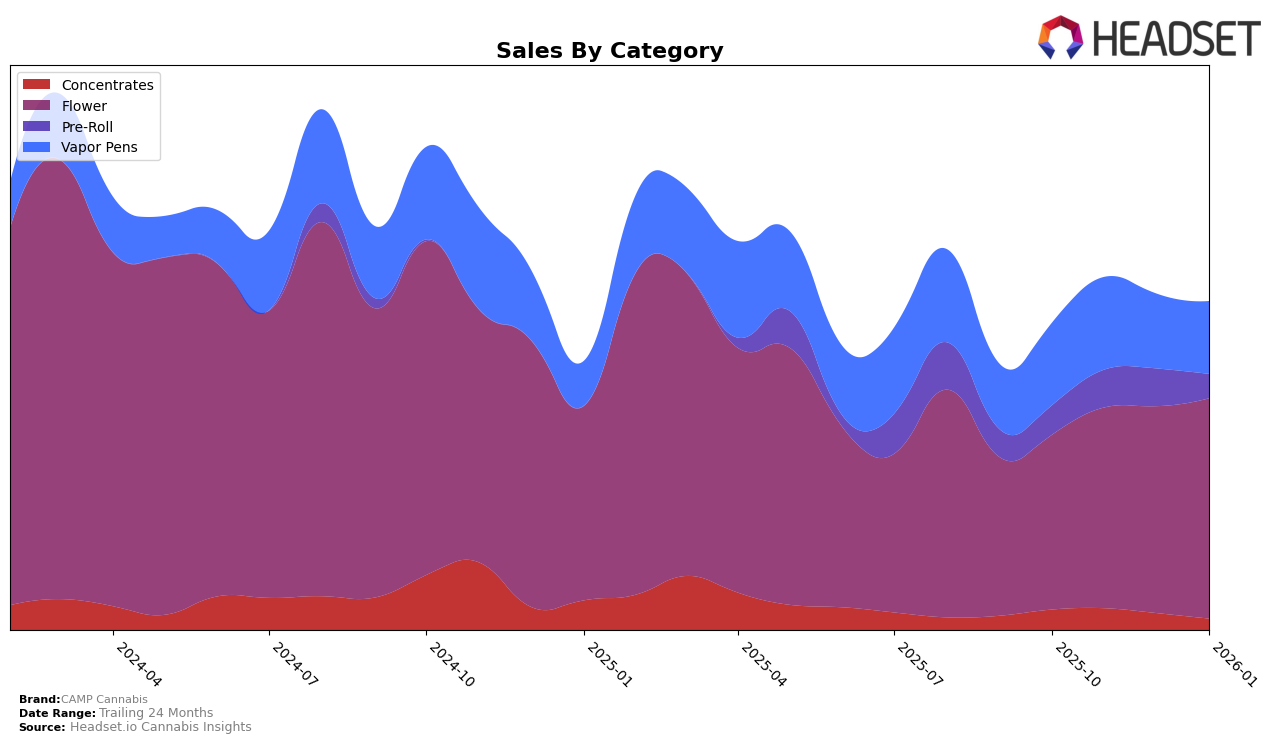

In the state of Missouri, CAMP Cannabis has shown varied performance across different product categories. Concentrates, for instance, saw a declining trend in rankings from 28th in October 2025 to 36th by January 2026, indicating potential challenges in maintaining market share. This drop in ranking coincides with a noticeable decrease in sales, suggesting that the brand might need to re-evaluate its strategy in this category. On the other hand, the Flower category has seen a positive trajectory, consistently improving from 34th to 30th over the same period. This upward movement in rankings highlights a strengthening position in a highly competitive market segment, reflecting positively on the brand's efforts to capture consumer interest.

The Pre-Roll category, however, presents a mixed picture. While there was an improvement in ranking from 49th to 42nd between October and November 2025, the brand did not maintain this momentum, slipping back to 46th by January 2026. This fluctuation might indicate volatility in consumer preferences or competitive pressures within the state. Meanwhile, Vapor Pens have experienced a slight recovery, moving from 44th in December 2025 to 40th in January 2026, after a dip in sales. Although not in the top 30, this category still shows potential for growth if the brand can capitalize on its recent positive momentum. Overall, CAMP Cannabis's performance in Missouri reflects both opportunities and challenges across its product offerings.

Competitive Landscape

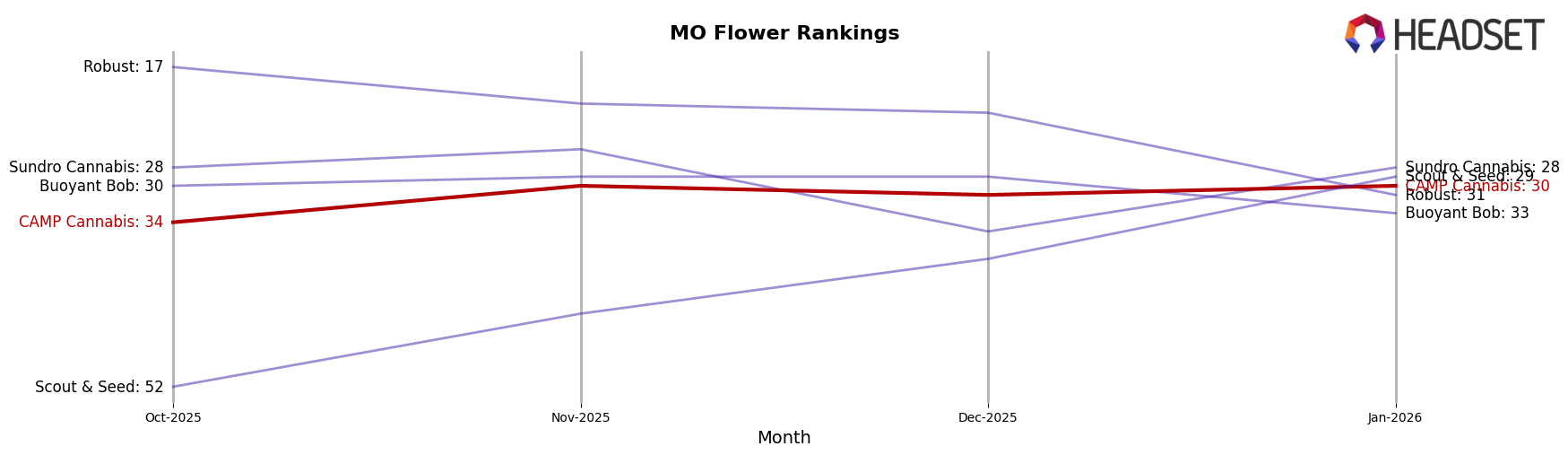

In the competitive landscape of the Missouri flower category, CAMP Cannabis has shown a promising upward trend from October 2025 to January 2026. Initially ranked 34th in October 2025, CAMP Cannabis improved its position to 30th by January 2026, indicating a positive trajectory in market presence. This improvement is notable when compared to competitors like Robust, which saw a decline from 17th to 31st over the same period, and Buoyant Bob, which remained relatively stable but lower in rank. Meanwhile, Sundro Cannabis experienced fluctuations, ending slightly above CAMP Cannabis at 28th in January 2026. Interestingly, Scout & Seed made a significant leap from 52nd to 29th, surpassing CAMP Cannabis in the final month. These dynamics suggest that while CAMP Cannabis is gaining ground, the competitive environment remains fluid, with potential for further shifts in rankings and market share.

Notable Products

In January 2026, the top-performing product for CAMP Cannabis was California #10 (3.5g) in the Flower category, maintaining its leading position from December 2025 with sales of 3,448 units. Sugar High (3.5g) followed closely, securing the second rank, showing a slight drop from its top position in November 2025. Sugar High (Bulk) emerged as a new entrant, achieving the third rank with notable sales. Spec Ops (3.5g) re-entered the rankings, taking the fourth position, indicating a resurgence in popularity. Butterscotch Sunshine (3.5g) rounded out the top five, experiencing a consistent decline from its second-place ranking in November 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.